Good people! Attend, and you shall hear the tale: The noble house of Metaplanet, proud and bold, hath declared the issuance of $15 million in ordinary bonds — aye, with every sou earmarked for the acquisition of that capricious digital gold, Bitcoin (BTC)! 💰🪙

Behold! Not for them the trembling knees at mere trifles — though the price of BTC hath tumbled from its lofty $105,000, these lords double their efforts like a gambler losing at cards who insists his luck shall change anon. 🎲

The $15 Million Bitcoin Fandango of Metaplanet

A decree hath been posted: Their bonds, gentlefolk, bear no interest — zero, nothing, rien! (Truly, a tempting offer for the avaricious: a loan where one receives naught in return but hope and holy suspense.) These bonds mature by November 12, each priced at $375,000. The ambition? To fatten their Bitcoin coffers unto 10,000 coins by the close of 2025.

Should every coin and yen be gathered as desired, Metaplanet may pocket 147 BTC at today’s rates. Yesterday, they scooped up 1,241 more Bitcoins (a mere trifle of $126.7 million), and their grand total swelled to 6,796 BTC. One almost expects them to pass out hats and ask the crowd for tips! 🎩

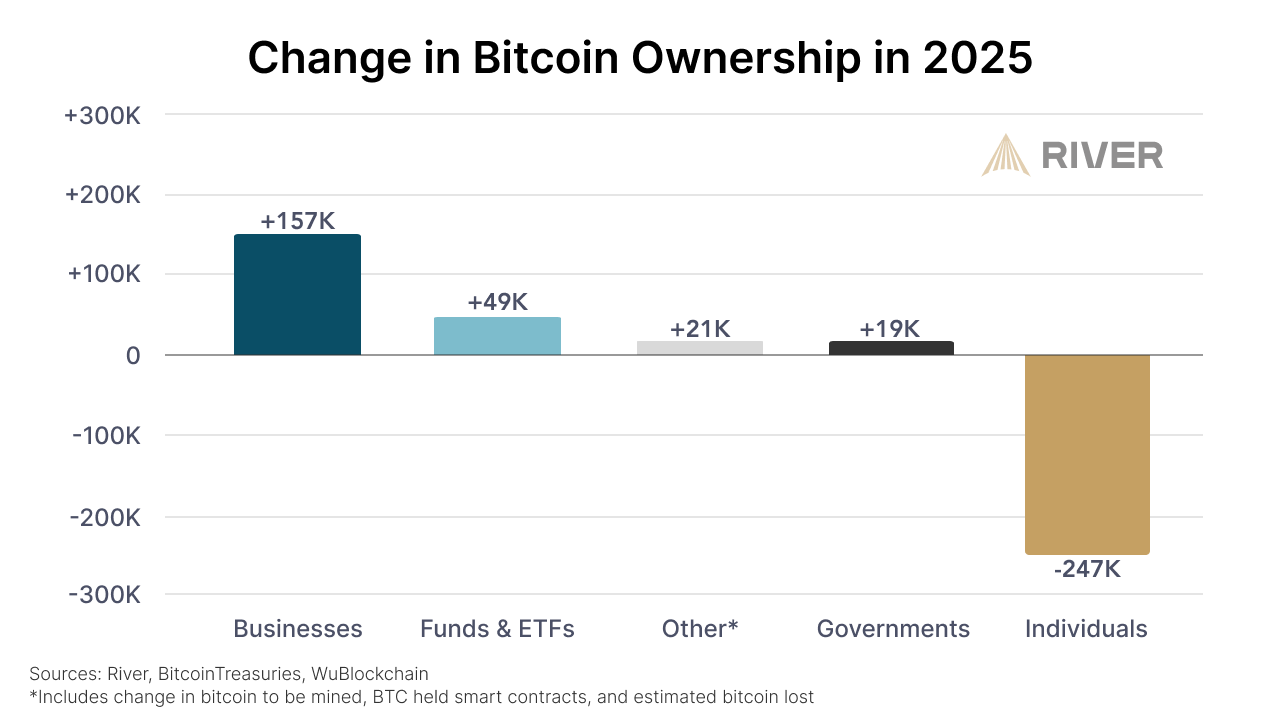

Such a dance aligns with the current mood: ‘Tis the year when sovereigns and institutions snatch Bitcoin from the trembling grasp of mere mortals. River’s wise men whisper: Businesses are now the most ravenous of Bitcoin buyers, gobbling faster than governments and ETFs combined. 🏛️💼

“Businesses are the largest net buyer of bitcoin so far this year, lead by Strategy which makes up 77% of the growth,” reads a scribe’s ill-fated tweet.

The infamous Strategy — once known as MicroStrategy before it acquired a taste for theatrics — leads this parade of excess. On the twelfth of May, they declared the snaring of 13,390 BTC (a paltry $1.34 billion, give or take). Averaging $99,856 per coin, they set a new standard for extravagant purchases (and for unfavorable currency exchange). 🤑

Strategy’s baronial horde now sacks the globe with 568,840 BTC, bought at an average cost of $69,287 per shining token. One wonders if their boardroom meets at Versailles. 🎭

Yet not all are blinded by this shimmering fool’s gold! Peter Schiff, sharp-tongued economist and frequent cloud-shouter, took to X to remind all (and ruin everyone’s fun):

“Your next buy shall likely tip your scales above $70,000,” quoth Schiff, raising a skeptical brow.

He suggests with mock gravitas: Should the price fall (as prices do), Metaplanet & friends could find themselves selling at a loss, the only thing left “real” — other than their regrets. To wager borrowed coin on a market this fickle is much like betting one’s estate on a horse with three legs.

This sober warning echoes even as Bitcoin recently spiked — on the heels of news that the US and China had agreed (for a fleeting moment!) to a brief tariff truce. What celebration! What market froth!

Alas, as soon as the feast began, fortune grew bored: Bitcoin fell from $105,705, swiftly shedding 3.7% of its new wealth and wobbling down to $101,725. Still, soothsayers — ever the optimists — proclaim the rally is only gathering speed, and new all-time highs await, just beyond the next dramatic turn of the stage. 🎭🚀

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-05-13 08:34