It is a truth universally acknowledged—yes, even by those who haven’t the faintest clue what “blockchain” means—that Bitcoin has once again captivated society’s attention. One can barely sip a cup of tepid tea without overhearing the butler discuss “multi-month highs” with Lady Windermere. The “asset,” as the nervous bankers like to call it when they believe no one is listening, soared tantalisingly close to the legendary $100,000 mark. I dare say, one would almost rather invest in NFTs of Wildean epigrams.

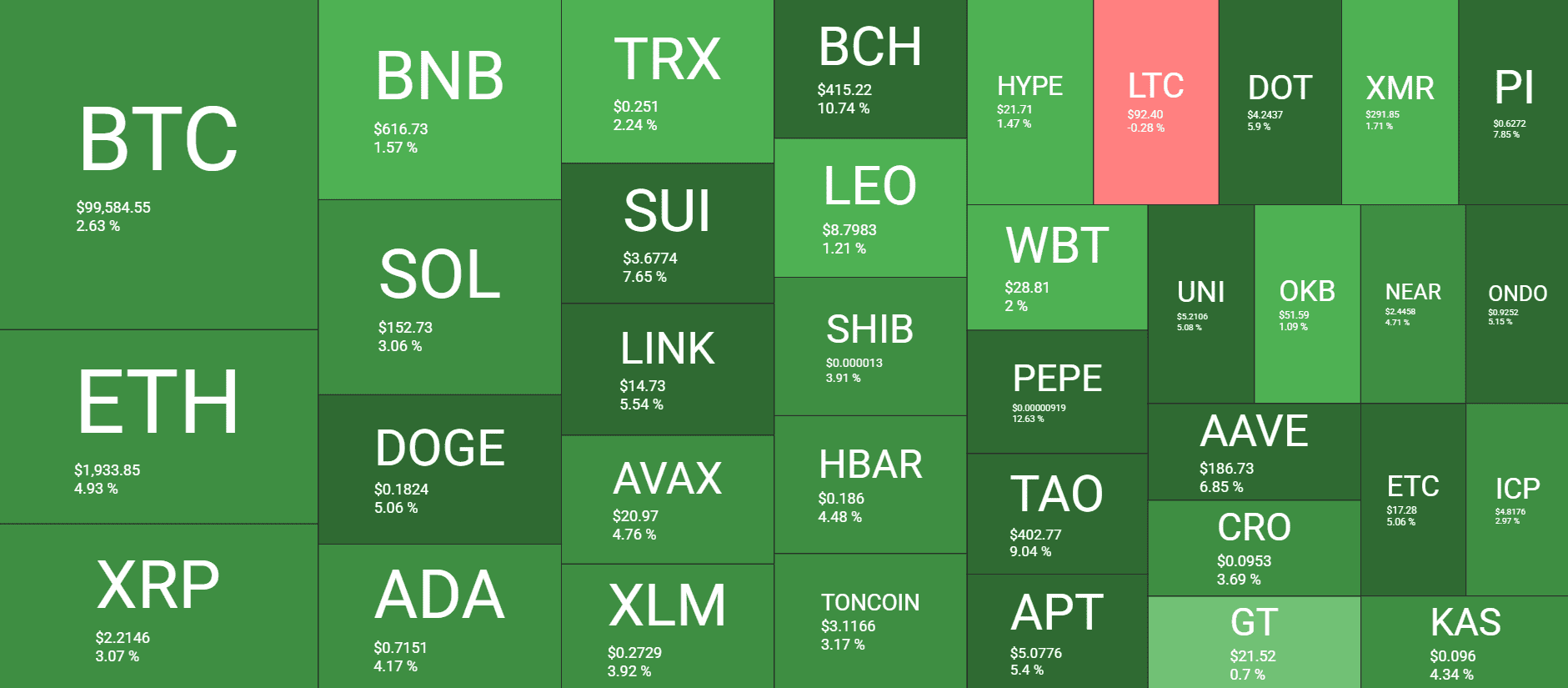

The so-called “altcoins” (which is simply a way for Bitcoin to refer to other cryptocurrencies without befriending them on social media) have also enjoyed a jaunt in the sun. Ethereum, that perennial bridesmaid in the grand digital wedding, has finally danced above $1,900 for the first time in a month—proving, once and for all, that even second-fiddle can be second-fabulous. 💃

BTC and the Spectre of $100,000

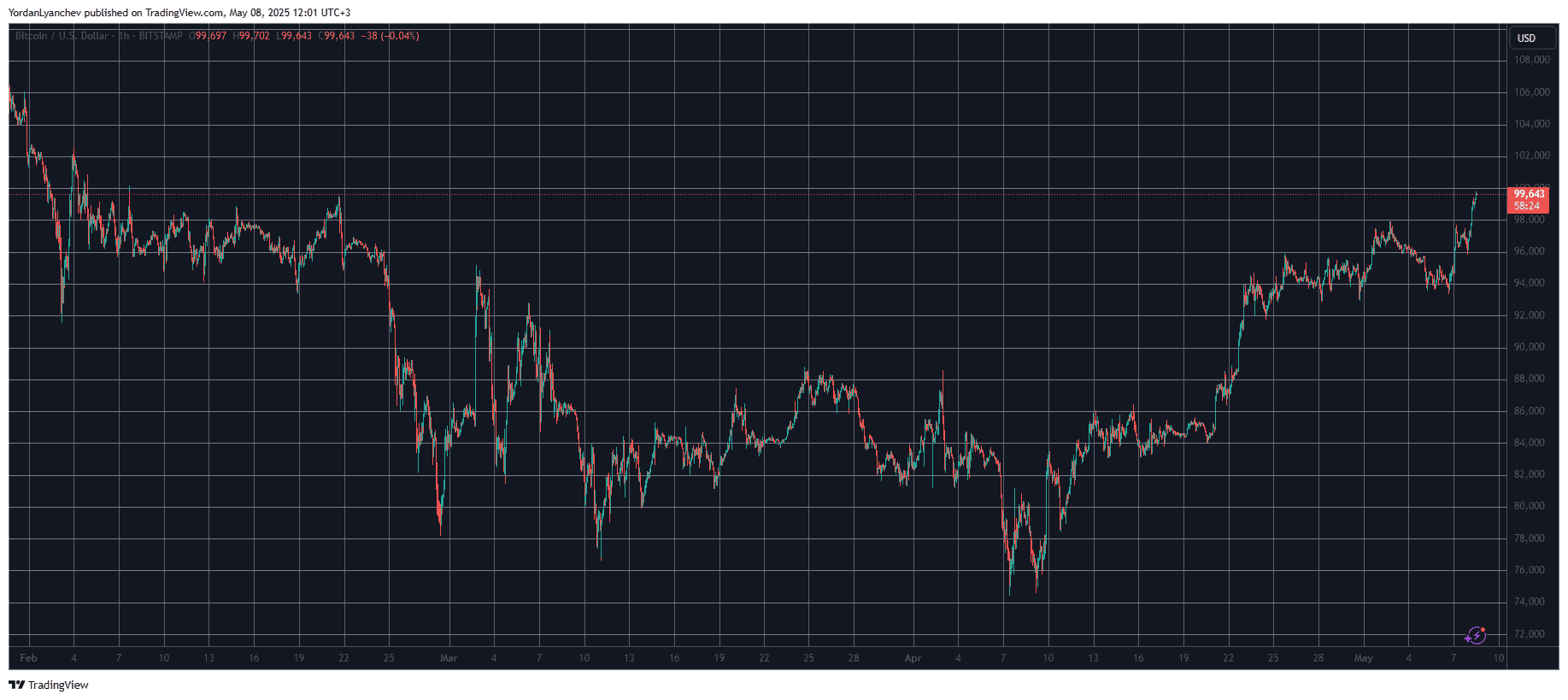

How brief and bittersweet was the reverie when Bitcoin last plummeted to the unfashionable depths below $75,000—one could almost hear the gasps at the country club. With geopolitical tensions climbing higher than the price of a decent Bordeaux, hope sparkled only for those with particularly rosy-tinted monocles.

Yet, like every hero in a penny dreadful, BTC staged a comeback as dramatic as Lord Henry’s exit from a boring soirée—leaping $20,000 after the world (minus a few spoilsports in China) chose mild optimism over abject despair.

Resistance came in the form of mathematical squiggles on charts, naturally, and after being slapped down at $98,000, our plucky protagonist tumbled to $94,000—the sort of plunge that leaves financial analysts clutching their pearls. But let us not underestimate the elasticity of digital hope: BTC rebounded, ascending once more past the $96,000 “support,” which in the world of cryptocurrencies apparently means “I like you today, but tomorrow I may see someone else.”

Despite the Federal Reserve’s positively Wildean indifference to lowering interest rates, whispers from the President on the approaching Trade War talks made the bulls stampede. Now, with naught but a whisker separating Bitcoin from the mythical $100,000, the market cap flaunts itself at $1.98 trillion, while Bitcoin’s “dominance” sits slightly bruised—rather like a peacock who’s realized the duck had better tailfeathers this season.

ETH’s Monthly Masquerade

XRP, SOL, ADA, TRX, AVAX, and XLM have tiptoed up by 2-4%, while DOGE, LINK, and SUI—presumably after a long lunch—bounded ahead by up to 7.5%. Not to be left behind, BCH and PEPE have secured themselves double-digit gains of 11% and 12.5%, respectively. (If only my investments in silk waistcoats yielded such returns.)

To top off the madness, the total crypto market cap ballooned by $100 billion in a mere 24 hours, reaching an utterly decadent $3.2 trillion. One simply cannot find a fainting couch plush enough these days. 🛋️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-05-08 13:03