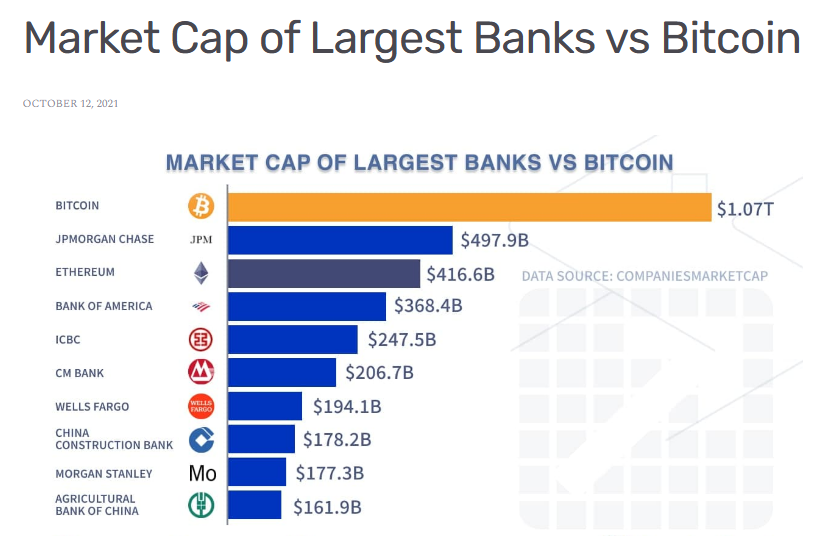

Alright folks, gather round! Picture this: Bitcoin, the digital token that makes your uncle yell at Thanksgiving, is getting close to landing a gig at the government’s dinner table. Morgan Stanley—yes, that Morgan Stanley, the financial suit factory—says Bitcoin is now so big, they’re thinking, “Hey, maybe we should swap some of our dusty gold bars for pixel coins!” They point at Bitcoin’s $1.07 trillion market cap. That’s trillion with a “T” as in “Take my money, please!” or maybe “This can’t possibly go wrong!”

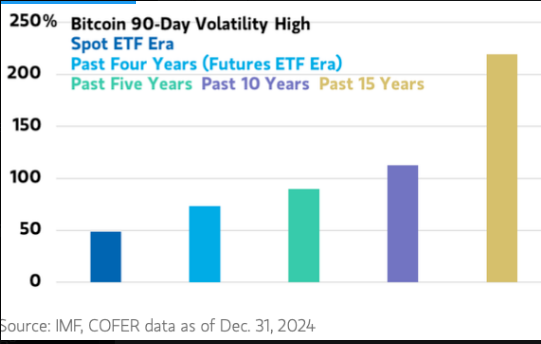

But—hold your crypto horses—there’s a punchline. Bitcoin’s price still bounces more than a kangaroo on a pogo stick. Volatility? You bet, bubbe! When you compare it to the good ol’ dollar, euro, or yen, Bitcoin is still the kid in the candy store after five sodas. Sure, it’s growing, just like my mother’s expectations, but even Morgan Stanley says, “Let’s not hold our breath—it’s still moodier than a teenager with WiFi issues.”

Uncle Sam Wants a Crypto Stash 🍔💰

Which brings us to the main event: US President Donald Trump—never one to miss a pageant—walked onstage in March and said, “Let’s get us some Bitcoin, boys!” That’s right, a brand new executive order for a federal Bitcoin bunker, just like Fort Knox. Only this time, instead of gold bars, there’ll just be a bunch of accountants with USB sticks, nervously watching line graphs.

A Strategic Bitcoin Reserve is now the trendy thing on Capitol Hill. Supporters say it would put the US at the crypto cool kids’ table and maybe, just maybe, help shovel out a bit of that national debt pile. Some optimists even dream it’ll give our dollar a pep talk and a new gym membership.

Morgan Stanley’s math wizards say if Uncle Sam piled up about 12-17% of the total Bitcoin supply, that’d be like the US holding other countries’ currencies in reserve. That’s around $370 billion in Bitcoin—enough to fund a couple Marvel movies or at least one Mars mission with popcorn.

Serious report by @MorganStanley.

-Bitcoin is reserve-sized, but more dramatic than my ex.

-Volatility’s dropping, which would make my therapist happy.

-$370b would put it on par with other currencies.

-Reserve: 12%-17%. Not bad for magic internet money…— Troy Cross (@thetrocro) May 6, 2025

UK and Switzerland: “No Thanks, We’re Good” 🇬🇧🇨🇭

Meanwhile, across the pond, the Brits aren’t biting. The UK’s answer at the FT Digital Asset Summit? “Regulate it? Sure. Hold it ourselves? Maybe after tea with Bigfoot.” Emma Reynolds, the Economic Secretary, basically said, “We’ll take your blockchain, but you can keep your Bitcoin, mate.”

Switzerland? Ah, the land of watches, chocolate, and saying “Nein” politely. The Swiss National Bank President Martin Schlegel says crypto just doesn’t give enough “oomph!” for a real reserve. You want safety, not digital rollercoasters, he says. Unless the rollercoasters are in Zurich and come with fondue.

Bitcoin: Still the Life of the Volatile Party 🎉

So, while Bitcoin fans see a sparkling crypto future, most finance folks say it’s still bumpier than a Mel Brooks chase scene. Even champion Troy Cross agrees: “Yeah, it’s still jittery.” But if those ups and downs ever settle, maybe—just maybe—Bitcoin will get its own seat next to the dollar, the euro, and Mel’s lawyer.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-05-08 01:30