Picture XRP: the perennially misunderstood kid at the cryptocurrency lunch table, now apparently buff enough to draw stares from both institutional investors (dad shoes, briefcase) and retail ones (flip flops, Reddit handle) as we crash into 2025. If you’re one of the three people who enjoys reading the Ripple Q1 2025 XRP Markets Report for the plot, you’re in for a treat—provided you enjoy financial thrillers featuring volume spikes and dystopian drop-offs.

This quarter’s highlight reel? While trading floors turned feverish with spot volume, the XRP Ledger (or XRPL, if you like your abbreviations with extra consonants) spent the quarter napping so hard, even my eldest sister would be jealous.

Spot Volume: The Only Party on the Block, and Everyone’s Invited 🍾

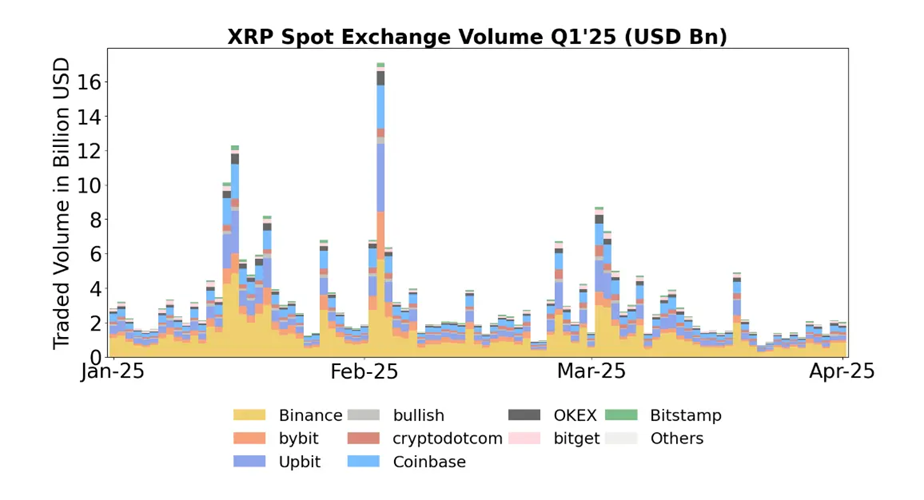

You know you’re living wild when “steady average daily volume” means $3.2 billion, and it spikes so high in late January that you start to wonder if XRP is being traded by caffeinated squirrels on Wall Street. At its apex, over $16 billion shuffled around (“Bring Your Own Whale”), before things slowed down in March—not an uncommon fate for New Year’s resolutions.

Binance hoarded 40% of these numbers, naturally. Upbit took 15%, Coinbase 12%, and I imagine the rest went to whatever platforms let you trade from a houseboat. If you blinked, you missed the part where USD and its clingy cousin, USD stablecoin, sneaked up in fiat pair trades from 25% to 29%. XRP’s price hiked up to $3.40—a number not seen since January 2018 when TikTok didn’t even have a “For You” page.

Somewhere, investment products thought, “Why not us too?” Inflows for XRP-based financial widgets reached $214 million, almost flipping Ethereum off its comfy second-place ledge. Meanwhile, over in the Sad Trombone Section, one analyst pointed out trading volume has dropped 86% in the last six months. So, if you’re riding this particular rollercoaster, seatbelts are not optional.

“XRP volume collapsed from $60 billion in December to under $8 billion now. Retail got flushed out,” said Steph, a crypto analyst—and probably someone who keeps their milk-of-magnesia right next to their Coinbase password.

Yet, despite the day traders’ mass exodus, XRP hung in there—like that cat meme—thanks to such “minor events” as the SEC finally tapping out after years of legal foreplay. And if you think that’s the only bit of institutional love: Franklin Templeton wants an XRP ETF, CME is hacking together XRP futures, and Volatility Shares is flirting with not one, not two, but three XRP ETFs. Move over, Beyoncé, we’ve got more announcements.

On-Chain Activity: Lights On, Nobody Home 💤

Contrast this trading floor energy drink with what’s happening over at the XRPL, where the tumbleweeds have unionized. Transactions collapsed 37% (167.7 million to 105.5 million), while new wallet creations plummeted over 40%, because apparently everyone already has one or decided to just share with their cousin.

Even the XRP set afire as transaction fees shrank by almost a third. The DEX (decentralized exchange) volume eked out a pathetic $832 million, down nearly 17%. That’s probably what you find between your couch cushions if you’re Ripple.

TVL (total value locked), according to DefiLlama, is holding at $80 million, presumably out of spite. Monthly DEX volume, a measly $3.3 million, is less than the budget for a Marvel movie’s craft services. For what’s supposed to be the fourth-biggest crypto, XRPL’s on-chain action is more “high school reunion” than “Coachella.”

And yet, always the optimist, Ripple’s report floats the idea that buying Hidden Road for $1.25 billion might wake the ledger up—a purchase so enormous it feels less like a strategic move and more like drunk shopping at three in the morning.

“Ripple acquired Hidden Road for $1.25B—one of the largest M&A deals in crypto history, driving more institutional use cases for RLUSD and XRPL,” says the report, in a tone I imagine is about as excited as Alexa reading you the weather.

So where does that leave us? Ripple’s Q1 2025: a dazzling stock market rave outside, inner ledger snoozefest inside. The “two-sided picture” they call it—a bit like seeing your kid get straight A’s online, then learning he’s just been napping in class. In crypto, as in life, sometimes you just have to enjoy the show—even if it doesn’t quite make sense.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-05-06 13:39