Today, the august body known as the SEC, heavy with tradition and red tape, decided to postpone Canary Capital’s application for a Litecoin ETF. In their magnanimity, they have opened the floor for public commentary—because of course, nothing soothes the market like a roundabout invitation to bureaucratic debate. The gods of trade responded in kind: Litecoin’s price meekly retreated by 5%—as if trying to slip away unnoticed from the scene of mild humiliation.

One might think the beckoning of public commentary from the Commission is a clue—a whisper of intention behind all those mahogany doors. Yet, consider this: such gestures are frequently but the SEC’s favorite game of chess with time itself. Standard tactics for standard mortals. Nevertheless, traders have the emotional restraint of provincial poets, and the momentary tremble of Litecoin’s price reflected their existential dread.

Will the SEC Reject Canary’s Litecoin ETF (or Just Toy With Hope)?

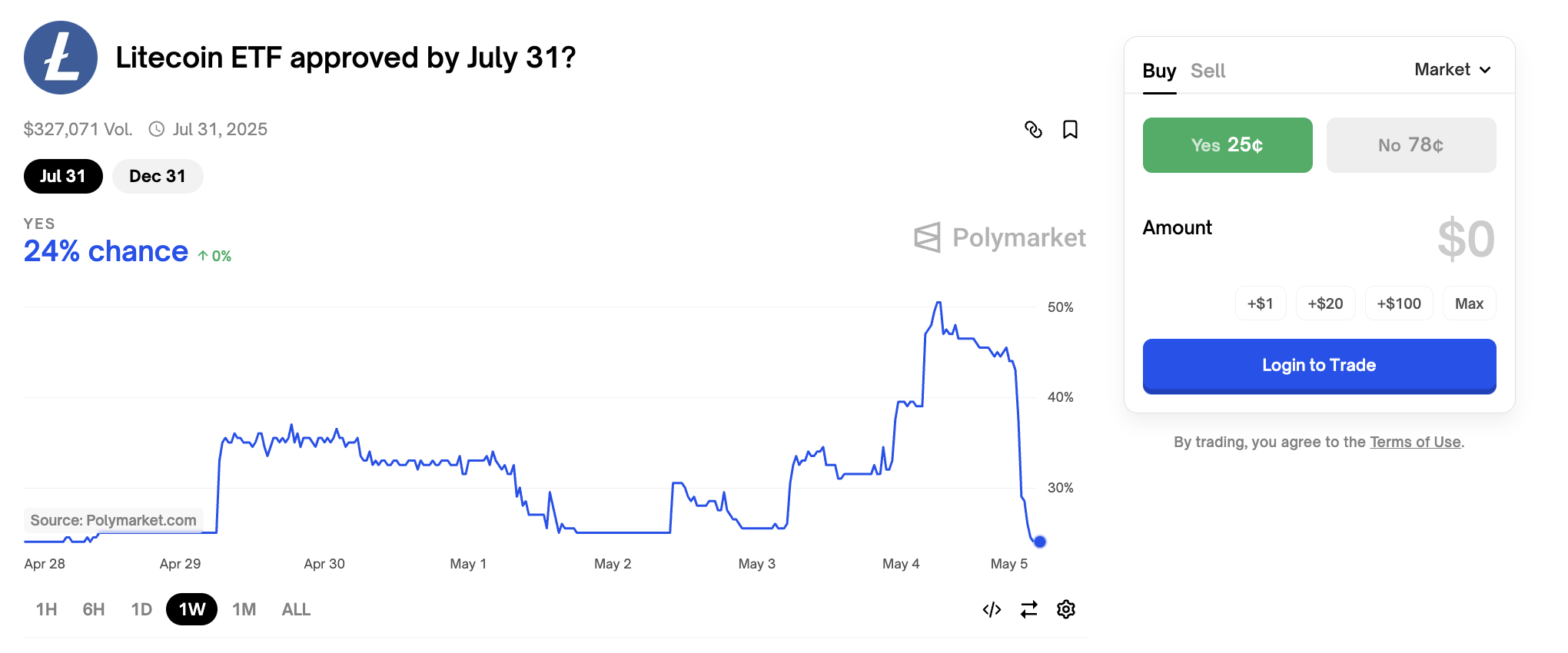

Let us reminisce, just for a moment, on a more optimistic season—not that long ago, analysts genially suggested this Litecoin ETF venture outshone all rival altcoin hopefuls. Polymarket’s odds soared to 85%—spirits buoyed up like paper kites until the ever-vigilant SEC reminded all that gravity was, alas, still in force. Today, another SEC deadline arrived and, naturally, the townsfolk gathered in anticipation, clutching their speculative tickets.

But what did these watchful guardians do? They responded as all true bureaucrats must—with a request for further musings from the public, carefully worded for maximum ambiguity:

“The Commission seeks and encourages interested persons to provide comments on the proposed rule change. The Commission asks that commenters address the sufficiency of [whether] the proposal… is designed to prevent fraudulent and manipulative acts and practices or raises any new or novel concerns not previously contemplated by the Commission,” it whispered dryly, as though reciting Tolstoy at a wedding.

Don’t be fooled by appearances: the seeking of comments does not necessarily spell doom. The SEC’s desk is now overflowing with ETF proposals (it’s practically a fire hazard), and delays have been doled out like bonus rations in a famine.

Recall that public comments were solicited for a Litecoin ETF all the way back in February, and society somehow survived. Yet, optimism is a fragile bloom; the market responded to this latest news with the enthusiasm of a Russian winter.

A swift and unkind fate met Litecoin’s price as the SEC’s gavel fell—down 5% before anyone could finish their evening tea. As for Polymarket’s odds that the ETF would see approval in Q2 2025? They fell in line, demonstrating the kind of sudden reversal that would impress even the most committed duelists. Yet, long-term odds for 2025 remained sturdy, proving that hope, like an old landowner, refuses to vacate.

What of those bullish prophecies, pegging Q2 for the rise of altcoin ETFs? They are now about as reliable as last year’s snow.

Still, a sense of moderation might be found (if one squints). The analyst James Seyffart, who foresaw bureaucratic delay, withheld thoughts on the unpredictability of public comment rounds—perhaps unwilling to wrestle with the gods of irony. Any bold assertion that the SEC intends to slay this or any other altcoin ETF remains as premature as a provincial romance.

Yet, the market, ever the gloomy protagonist, responds with predictable melodrama: traders abandon hope, or at least their short-term positions. The SEC, meanwhile, continues its enduring, some might say existential, waltz with destiny and paperwork. 😂

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-06 03:36