Ah, what a delight it is when the brilliant minds of finance get together to share their insights… and Michael Saylor certainly did not disappoint on his Q1 2025 earnings call. 😏 The man behind the infamous BTC Treasury firm gave investors quite the treat, discussing Q1 financial results, including an oh-so-glamorous review of $MSTR, $STRK, and $STRF. Oh, but wait, there’s more – forward-looking statements that no self-respecting investor should dare miss! 🚨

On May 1, during the earnings call, Saylor made his grand entrance and boldly proclaimed that BTC’s role in expanding institutional interest was “crucial.” Well, thank you, Captain Obvious! 🚢 I mean, who would have guessed? Bitcoin‘s crucial role in finance? Shocking, really. But let’s get back to the real news here. 💼

Saylor, ever the wordsmith, reiterated BTC’s *”unique value proposition.”* His words? “Bitcoin has no counterparty risk.” Wow, just… wow. No company, no country, no creditor, no currency, no competitor. Not even chaos! How reassuring. So, it’s safe to say that Bitcoin isn’t just a cryptocurrency—it’s practically a superhero. 🦸♂️✨

And then, the man with the grand vision predicted that “the First Nation to print their own currency to buy Bitcoin wins.” Yes, folks, it’s a race! Place your bets, because the winner gets… well, a whole lot of digital gold. 🏆

Saylor went on to discuss BTC’s global adoption, which he claims is moving forward “expeditiously.” 🏃♂️ It’s like watching a rocket launch—except with more excitement and fewer actual rockets. As more companies hop on board, Bitcoin becomes “legitimized” and, of course, drives up its price. It’s almost like magic, but with numbers. 💰

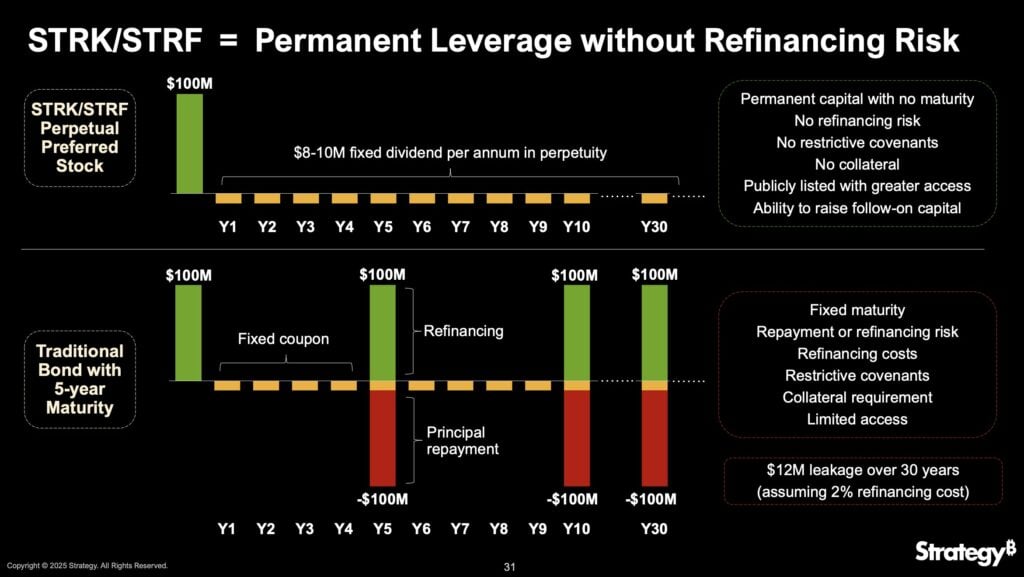

Now, as for Strategy’s oh-so-clever capital market maneuvers, they raised $7.7 billion in Q1 through some rather *interesting* methods like common stock, convertible notes, and, of course, preferred stock IPOs. All to acquire a neat little sum of 61,497 BTC. That’s a lot of Bitcoin. That’s practically a digital treasure chest. 🏴☠️

But the cherry on top? A 13.7% BTC Yield and a $5.8 billion BTC $ Gain year-to-date. For those who aren’t into numbers, that’s basically Saylor saying, “Look, I know how to make money… and I’m really good at it.” 💎💸

Oh, and let’s not forget his celebration of BTC’s adoption by over 70 public companies. It’s like being the cool kid at school. Everyone wants to sit at the Bitcoin table now. 🥳 Meanwhile, Saylor dismisses concerns over BTC’s volatility, claiming that it’s all part of the *long-term* appreciation plan. Volatility? Meh, just a little bump in the road. 🚗💨

But, of course, not everyone’s buying into the hype. Critics have raised concerns about the company’s highly leveraged model. You know, the whole “issuing $2 billion in 0% Convertible Senior Notes due 2030” thing? Yeah, just a minor detail. A tiny $4.2 billion net loss from unrealized fair value losses is totally fine, right? 😂

Despite the skeptics, Saylor remains steadfast in his bullish Bitcoin outlook, posting an AI-generated image to X shortly after the call. And, of course, a tweet with his classic bravado:

Tulip season ends. Bitcoin is forever.

— Michael Saylor (@saylor) May 2, 2025

Well, isn’t that just poetic? 🍂 🌷 But hey, if you’re looking for the next big thing, don’t worry. Saylor’s got your back. Just follow the money… and a little bit of chaos. 😜

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-05-02 16:30