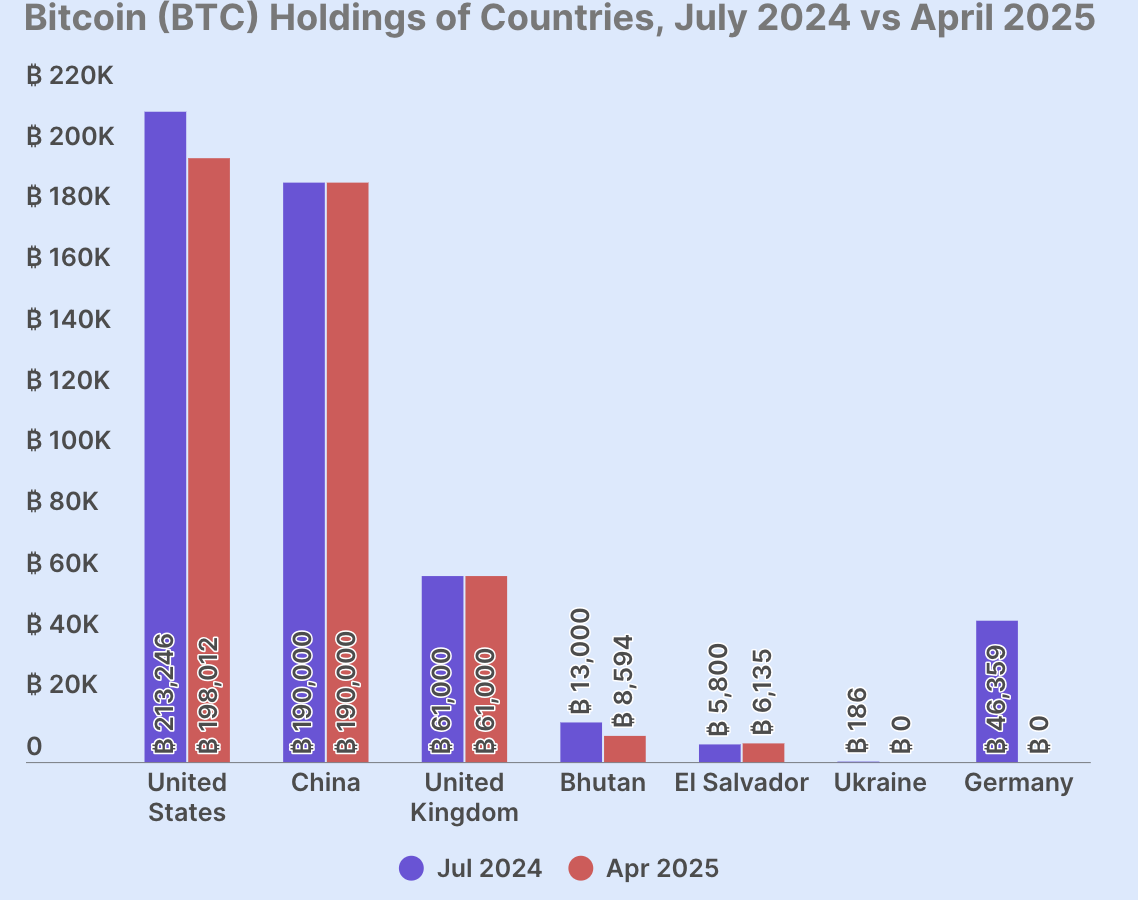

In the dusty ledger of the global Bitcoin story, a new figure has come to light—2.3% of all Bitcoin, piled up in government coffers. That’s 463,741 BTC parked under watchful eyes, down from a grander 529,591 just a season past.

On the surface, that’s a heap of shiny digital gold. But peel back the layers, and you find a story more like a withering vine than a growing tree. Two of the big seven holders have folded their tents and vanished from the scene, while only El Salvador keeps feeding the fire.

Governments: Selling Off or Just Holding Their Breath?

You’d think corporations like MicroStrategy, shouting their Bitcoin holdings from the rooftops, hog the spotlight. But surprise—governments quietly sit among the ten fattest Bitcoin whales, their wallets bulging with confiscated crypto booty.

CoinGecko’s number-crunching didn’t just stop at the surface. Turns out, just five nations keep their Bitcoin piggy banks unlocked.

The United States? The biggest hoarder of government BTC. But don’t get the wrong idea—they’re not out there chasing coins at auctions. Nope. Uncle Sam’s Bitcoin stash mostly arrived via criminal seizures. Joe Biden’s last act in office included selling off some of that digital treasure, sparking Trump’s version of a crypto insurance policy: the Crypto Reserve. Rather than buying, that reserve just wrangles the heap and keeps it from slipping away again.

China’s an enigma wrapped in a digital puzzle. Officially, it eyes crypto like a cat eyes a cucumber—suspicious, aloof, and ready to pounce. It grabbed nearly 200,000 BTC back in 2020 and then went radio silent, making it a giant sleeping giant nobody talks much about.

Across the pond, Britain plays China’s tune, shelving their Bitcoin with a calm patience. Meanwhile, Germany cashed out last year to plug holes in the budget, not because they suddenly woke up anti-crypto. Ukraine followed suit, selling off its Bitcoin veins to fuel a much grimmer battle.

All these government wallets filled up not by buying on exchanges, but by scooping up coins caught in the criminal crosshairs—waiting for the next chapter. Ukraine’s exception took donations from other countries, like passing a tin cup around the neighborhood.

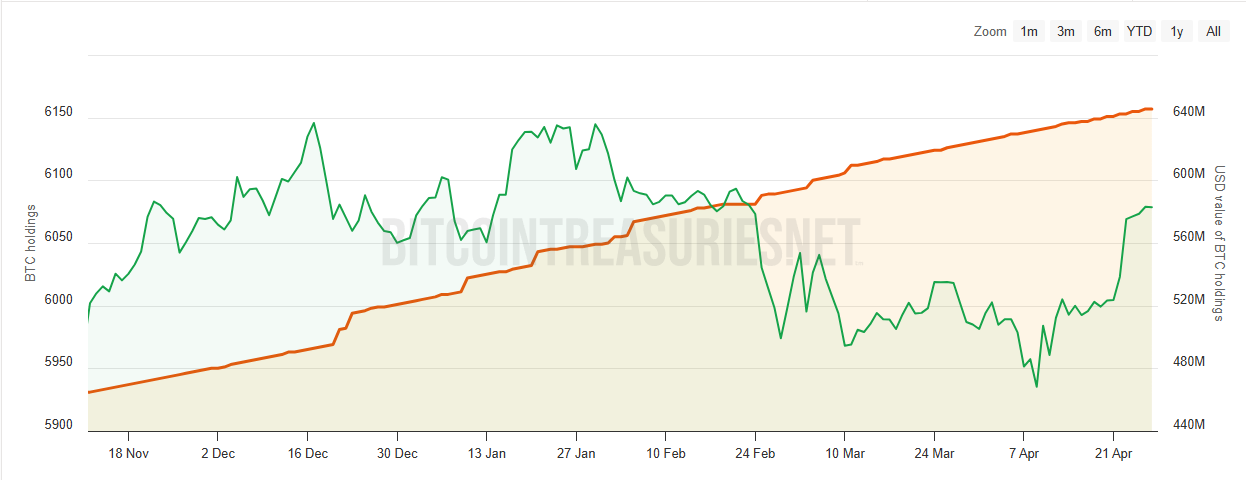

Now, Bhutan’s the wildcard. It’s been mining and selling its Bitcoin stash, a crypto squirrel stashing and nibbling away. That leaves one stubborn dreamer: El Salvador. The tiny nation defies the odds, steadily bulking up on Bitcoin, despite IMF frowns, bank loan conditions, and local grumbles.

So, CoinGecko’s deep dive uncovers a clearing in the bitcoin forest: Governments hold a lot on paper, sure. But their grip is shaky, fading like a sunset. Seven held the treasure last year, now only five still clutch it, the rest letting go. Around the corner, one political sneeze could tip the whole delicate balance.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- What If Spider-Man Was a Pirate?

2025-04-28 19:36