Ah, the digital marvel—Bitcoin—continues its relentless climb, as if mocking the crumbling certainties of a world caught in tariff turmoil and political farce.

Bitcoin Approaches $95K, While Economists and Markets Dance on the Edge of Madness

One cannot help but notice how some bearded sages of economics murmur ominously about President Donald Trump’s whimsical tariff reversals—each a tempest in the teapot, unsettling markets like a maniac throwing stones in a glasshouse. They say the uncertainty he crafts is far more venomous than the tariffs themselves, leaving the world’s financial players stranded in a no-man’s land of bewilderment and existential dread.

Behold the Port of Los Angeles, that great beast of trade, witness to the tides of fortune. Its Chinese cargo has plummeted by a staggering 35% after the imperial decree of a 145% levy cast upon the imports of the world’s second empire. The markets watch with bated breath, unsure whether to jump or retreat, suspended in the eternal limbo of “wait and see.”

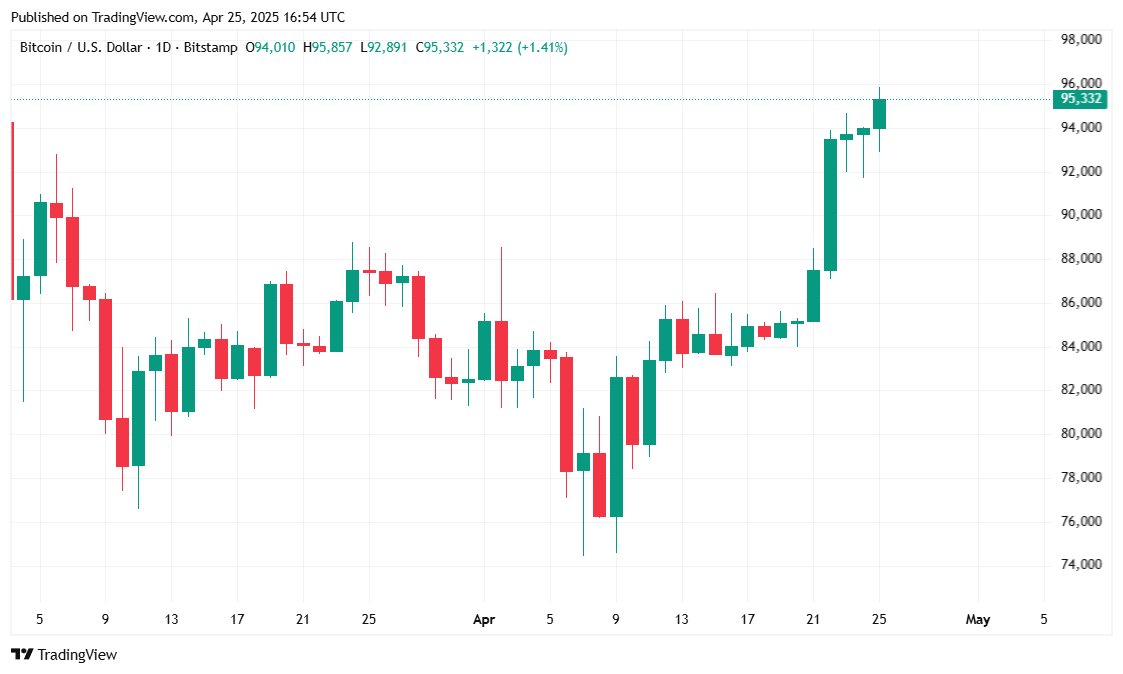

Yet amid this maelstrom, the markets surge upward like a proverbial phoenix scorning the smoke: Bitcoin, that enigmatic specter, basks in its highest glow for two long months. But beware, the future is as murky as a Dostoevskian soul, and Trump—ah, he remains the erratic wildcard in this tragic comedy.

On the March of Market Metrics

In the past 24 hours, the stubborn beast we call Bitcoin scaled to an improbable $95,768.39, only to settle at the still lofty $95,318.24 according to Coin Market Cap’s ledger. Its ascent: a modest 1.92% in a day, yet a near boisterous 12.90% rise over a mere week—like a gambler doubling down as the house burns. Traditional and crypto realms alike find themselves caught in this strange dance of bullish hope amidst tariff tremors. 💸🔥

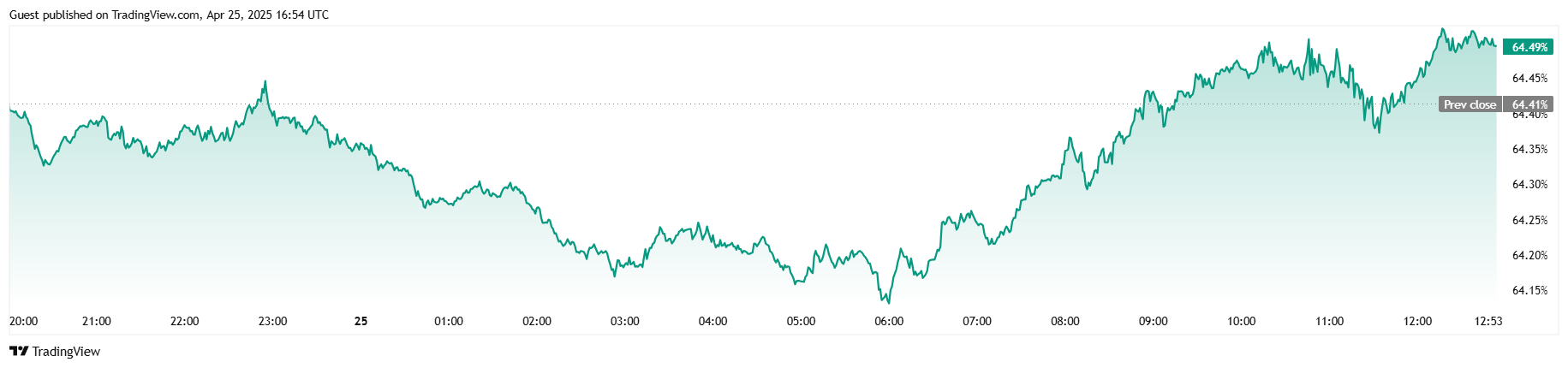

Ah, and the whispers of trade grow louder! A 26.34% surge in 24-hour volume to $40.48 billion reveals a frenzy—some institutional titans and retail adventurers alike, drawn to the siren call of colossal profit. The market cap stands defiant at $1.89 trillion, a 1.91% gain that mocks the uncertainty looming overhead. Meanwhile, Bitcoin’s dominion over the cryptoverse creeps upward to 64.50%, a delicate 0.14% nudge asserting its iron grip on the market’s soul.

Cast your gaze upon the derivatives realm—the shadowy stage of futures betting and whispered wagers. Here, open interest in BTC futures climbed to a dizzying $68.39 billion, a 5.45% surge in just 24 hours; a proof of faith, desperation, or madness—interpret as you will. Liquidations remain low at $2.10 million, with shorts groaning under their losses of $1.32 million. Foolish bears, caught wandering in the snowstorm of Bitcoin’s unexpected strength—Dostoevsky would smile at such tragic inevitability.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

2025-04-25 21:00