STX has decided to make a dramatic entrance today, shooting up nearly 20% in the past 24 hours. It seems the token’s trading volume has also thrown a little party, surging alongside the price. Investors appear to be quite thrilled—or at least curious.

But, hold on to your hats! While the price is off galloping, on-chain data reveals something more sinister: traders seem hell-bent on shorting STX, suggesting they’re not entirely convinced that this recent uptrend will last. How quaint.

STX Soars 20%, but Traders Are Betting on a Plunge—Go Figure!

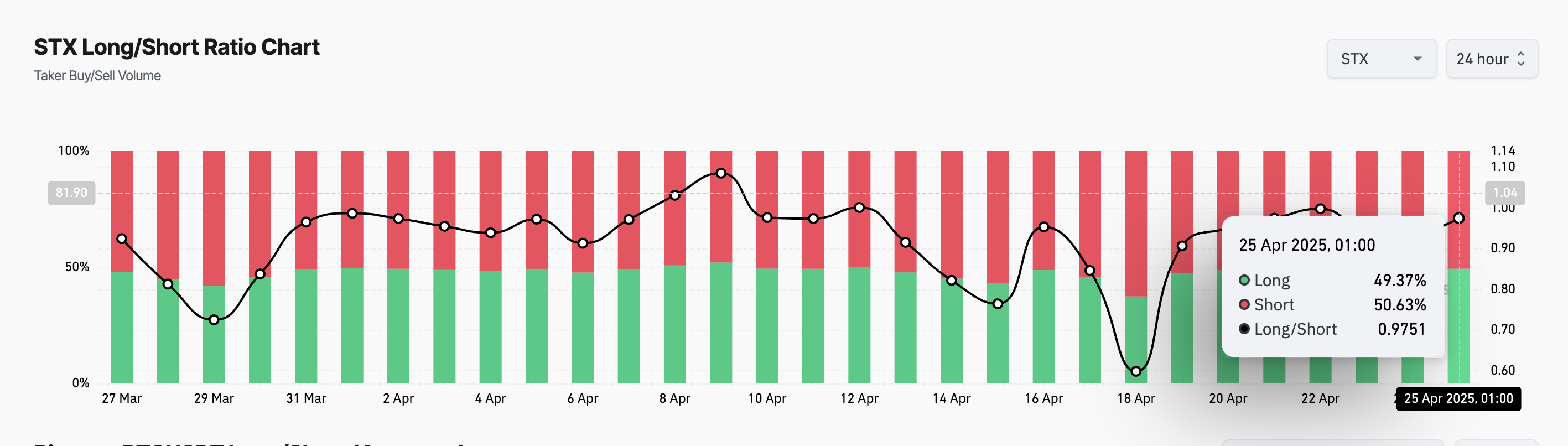

According to the ever-informative Coinglass, the current long/short ratio for STX is hanging around 0.97, which, to the untrained eye, might suggest a preference for short positions. Futures traders, apparently, are not quite as enchanted with this rally as we are.

The long/short ratio is a simple yet elegant measure of how many bulls (those who expect prices to rise) and bears (those expecting the opposite) there are in the market. When the ratio is above one, it’s a sign of bullish confidence. A ratio below one? Well, it suggests a lot of traders think STX’s recent romance with the moon might end in a less-than-charming crash.

So, what’s going on here? It seems the traders are betting against STX’s continued ascent, thinking that this rally might be short-lived. Because, obviously, double-digit gains in a single day are totally sustainable, right?

And let’s not forget the Relative Strength Index (RSI), which, just to be clear, is telling us that STX might be a tad… overcooked. As of the latest count, the RSI is sitting pretty at 74.35, a number that suggests overbought territory. In layman’s terms, STX might be getting a little too big for its britches.

The RSI is a market metric that oscillates between 0 and 100. If it’s above 70, the asset is considered overbought—definitely an invitation for a little price correction. Below 30, however, and it’s a case of ‘buy the dip.’ Pretty straightforward, really.

So, with STX’s RSI reading, we’re looking at a potential slow-down or perhaps even a swift price drop. Don’t get too attached to that 20% jump just yet.

Can STX Defy the Odds and Keep Going?

Once buyers get tired—or, shall we say, bored—of the rally, STX might lose some of its recent allure. In a worst-case scenario, we could see a dip back down to its year-to-date low of $0.47. How’s that for a plot twist?

However, we all know that an RSI above 70 doesn’t always signal an immediate end. Sometimes, bullish momentum can ride high, pushing prices even higher, despite all evidence pointing to a price correction. Such is the whimsical world of cryptocurrency.

If enough buyers keep the party going, STX might manage to break through the $1.07 resistance level, but only time will tell if this rally is the real deal or just a fleeting moment of glory. Stay tuned for the next episode of ‘Crypto Drama: Who Will Win?’

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-04-25 13:01