Ah, the cryptic dance of Bitcoin and her altcoin companions—April 2025 whispers sweet nothings of recovery amidst the cacophony of the market’s chaos.

Divergence, that delightful phenomenon where two once-affectionate metrics suddenly choose to frolic in opposite directions, like star-crossed lovers breaking free from their tragic scripts, often portends a change in momentum—and, dare I say, fortune. Allow me to lead you through five such scandalous signals: three starring Bitcoin, and two featuring its enigmatic entourage.

3 Deliciously Perverse Bitcoin Signals That Say “Rally, Darling!”

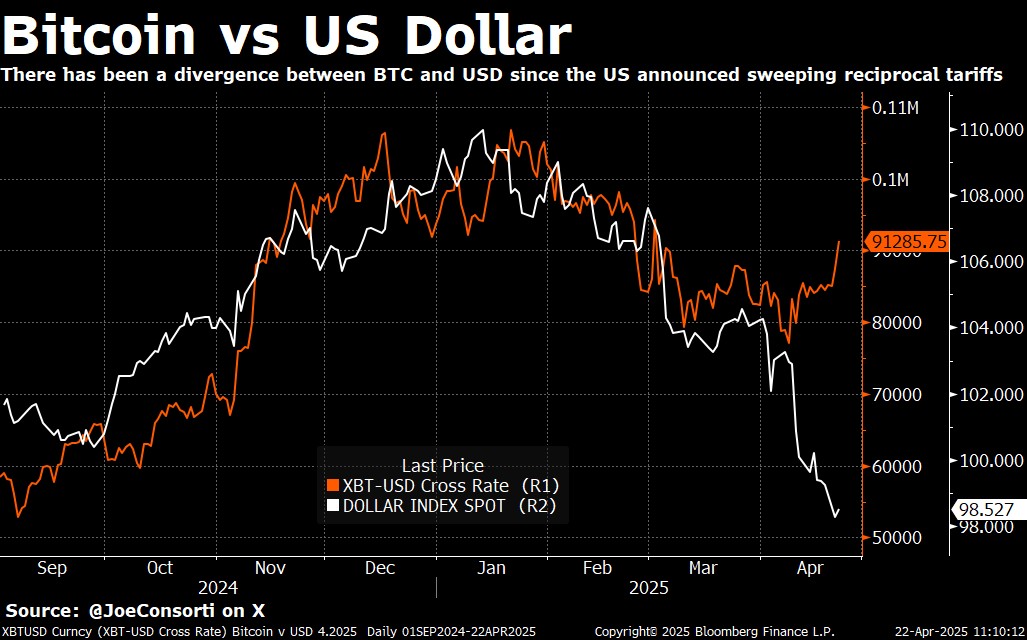

Traditionally, Bitcoin and the US Dollar Index (DXY) maintain the sort of relationship that two jealous socialites have at a gala: when one rises, the other must fall, lest propriety be offended. Yet, from September 2024 to March 2025, these two lovers inexplicably synchronized their steps—how dreadfully gauche.

Enter April, stage left, when the US unveiled a new tariff performance, causing the faithful dance of inverse correlation to resume with gusto.

Joe Consorti, the perceptive head of growth at TheyaBitcoin, observed Bitcoin gracefully shedding its slavish ties to the US dollar. As DXY took a nosedive from 103.5 to 98.5, Bitcoin pirouetted upwards from $75,000 to an ostentatious $91,000—positively theatrical.

One might say investors are seeking refuge in Bitcoin as if it were a phoenix rising from the ash heap of tariff-induced despair. Who knew that economic turmoil could be such a fabulous muse? 🎭

“Bitcoin has been diverging from the US dollar since this grand tariff regime was announced. Amidst this global economic theatrical production, gold and bitcoin are the stars basking in the spotlight,” quipped Mr. Consorti.

But wait! There is more intrigue—Tuur Demeester, advisor to Blockstream and gentleman scholar, noted Bitcoin’s newly minted independence from its erstwhile dance partner, the NASDAQ Index. Once so inseparable, their paths diverged, with Bitcoin strutting confidently in April 2025 while tech stocks stumbled over interest rate jitters.

Though some dour analysts at Ecoinometrics suggest this independence is not necessarily cause for celebration, Tuur wears his rose-coloured spectacles with aplomb.

“Prepare your headlines, dear readers: ‘Bitcoin divergence’ and ‘Bitcoin decoupling’ shall be the buzzwords of 2025,” declared Mr. Demeester with the solemn air of a prophet.

The moral? Bitcoin is no longer the bridesmaid of traditional markets but the radiant bride in its own right.

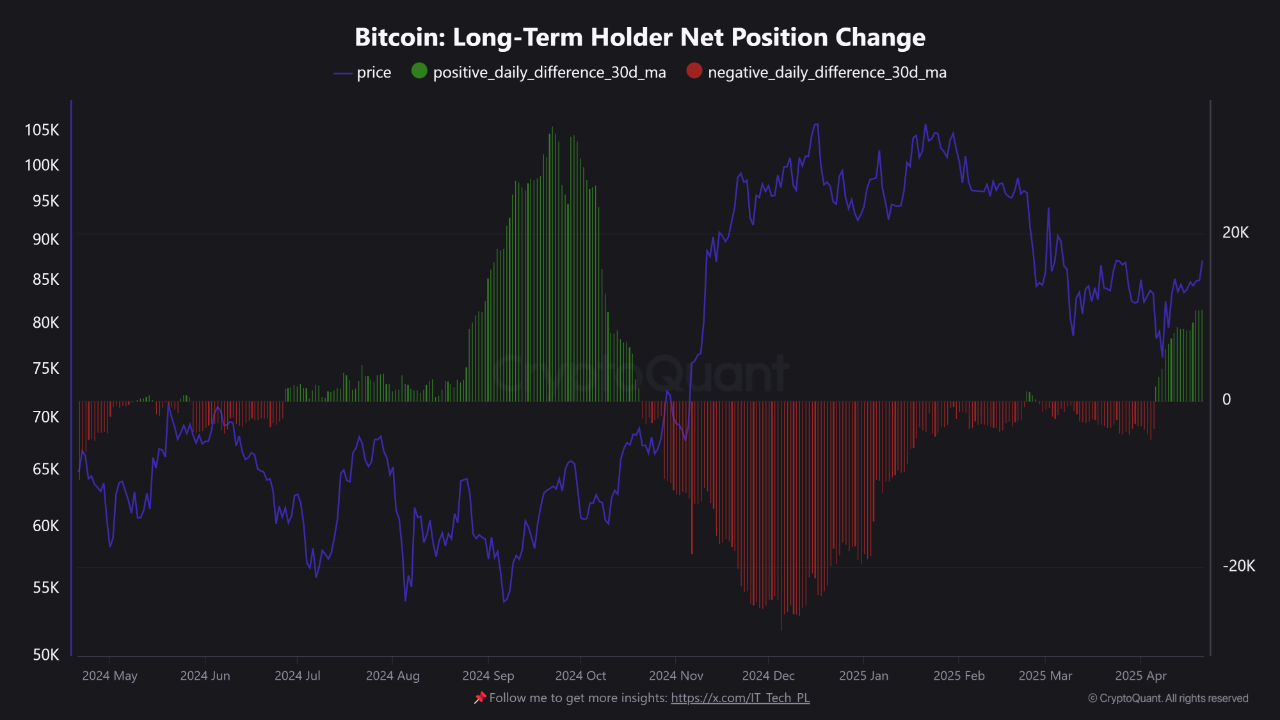

Meanwhile, an unusual tug-of-war ensues in the investor realm. Long-term holders (LTHs), those patient saints who clutch their Bitcoin for over 155 days, have resumed their quiet accumulation whilst short-term holders (STHs) scatter like startled pigeons, selling off in panic.

“Why the fuss? Because when the stoic LTHs accumulate and the jittery STHs capitulate, we witness the tender stirrings of a re-accumulation phase,” mused IT Tech from CryptoQuant, the oracle of behavioral finance.

The Altcoin Awakening: A Comedy of Recoveries

Not to be outdone, altcoins flaunt their own divergences, hinting at a renaissance most delectable.

Jamie Coutts, Realvision’s own crypto consigliere, points us to a curious indicator—the “365-day new lows” metric. Despite altcoin total market cap hitting a sombre note in April, the number of altcoins hitting new yearly lows retreated significantly. It is as if the altcoins have collectively agreed that rock bottom is dreadfully passé.

“Divergence reveals that downside momentum has all but expired,” Jamie proclaimed, as if unveiling a secret elixir.

In plainer English, fewer altcoins tossing themselves into despair means panic is cooling its heels, while the sly upturn in prices suggests buyers are returning, wallets wide open. Could “altcoin season” be blossoming? Time will tell, but the signs are tantalizing indeed.

Another technical jest comes from Merlijn The Trader, who observes a bearish divergence via RSI on the Bitcoin Dominance chart—a cunning hint that Bitcoin’s market share may soon suffer a corrective slap on the wrist.

“The chart sings a bittersweet tune—higher highs, but RSI trailing with lower ones. The altcoin coup is brewing—prepare your popcorn and trade setups,” whispered Merlijn, conspiratorially.

Indeed, April saw the altcoin market cap bounce a delightful 20% from $660 billion to an exuberant $800 billion, leaving one quite convinced that this recovery party is only just beginning.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-04-24 12:45