In an unexpected twist, Bitcoin ETFs continued their incessant inflow streak on Wednesday, scooping up over $900 million in fresh capital. A mere stroll through the crypto wilderness, right?

But here’s the catch: While the ETF demand keeps on roaring like an unstoppable wave, Bitcoin’s open interest has dipped, and its funding rates have done a complete 180—flipping negative. Is the market turning on its heels? Are we seeing the first sign of a shift in the short-term sentiment? Only time will tell…⏳

The ETF Feeding Frenzy: The Bulls Are Winning… Or Are They? 🤔

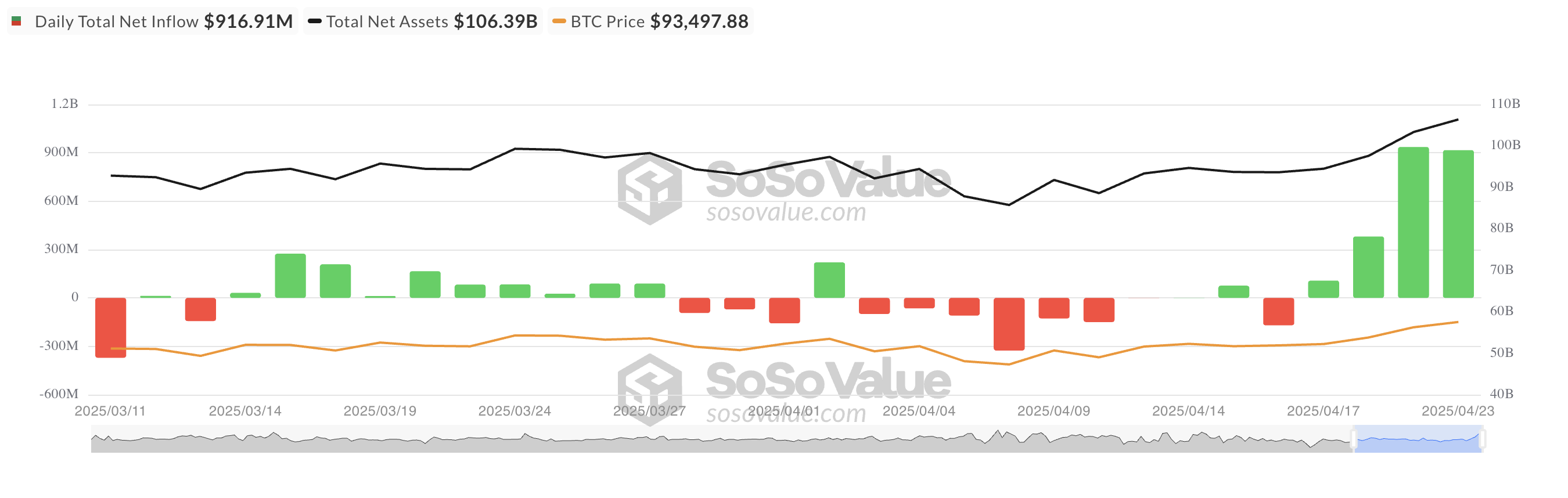

BTC spot ETFs kept their momentum on Wednesday, grabbing yet another $916.91 million in net inflows. A mere four days in a row of continuous inflows—no big deal, right? A clear sign of growing institutional hunger for Bitcoin exposure, particularly as the price makes its valiant (and somewhat shaky) attempt to stay above $90,000.

BlackRock’s ETF IBIT played the role of the heavy hitter on Wednesday, reporting the largest daily inflow of $643.16 million. This brings its cumulative net inflows to a jaw-dropping $40.63 billion. 🤑

And Ark Invest and 21Shares’ ETF ARKB? Oh, they made sure to keep their place at the table with $129.50 million in net inflows. Their total net inflows now stand at $3 billion, which, let’s be honest, is just a nice little chunk of change.

Traders Bolt as Market Sentiment Turns to Mush 🏃♂️💨

The past 24 hours have been a bit of a snooze-fest in the crypto market, with trading activity slumping as the market cap shed a dismal $18 billion. What does this mean for Bitcoin? A modest 1% price dip. Not catastrophic, but certainly not a party either. 🍾

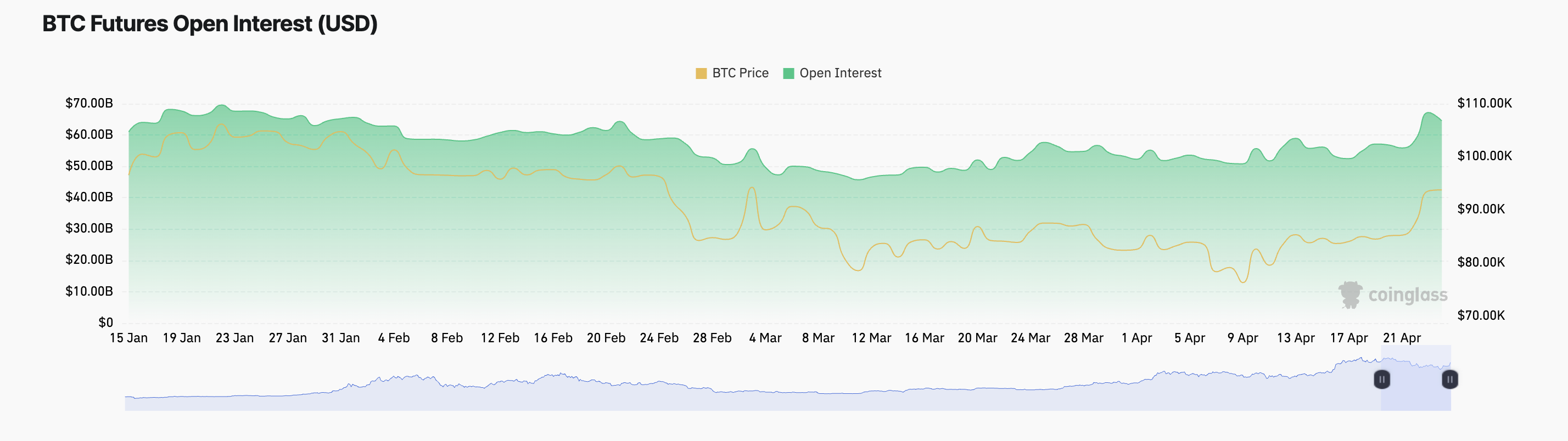

As the momentum stalls, the futures open interest for Bitcoin has been on a downward spiral, plunging by 5% to sit at $64.54 billion. This is the type of behavior that signals traders are packing up and leaving, instead of opening new positions. It’s like a bunch of people realizing the party is over and heading for the exits. 🚪

When both an asset’s price and its open interest nosedive like this, it’s a classic sign that traders are closing out positions faster than you can say “market correction.” Weak conviction? Maybe. Trend reversal? Possibly. We’re all waiting for the plot twist. 🎬

Oh, and did I mention? BTC’s funding rate has once again decided to go negative. Short traders have taken the reins, and now they’re the ones paying to keep their positions open. At the time of writing, it sits at -0.0053%. That’s right, folks—when the funding rate is negative, it’s the shorts that get to dictate the flow. 😈

In layman’s terms: when Bitcoin’s funding rate is negative, the bears are flexing their muscles, and they’re betting against the bulls. Expect some downward pressure on that price… or perhaps a long, drawn-out struggle between hope and despair. 💀

And then there’s the options market, which is flashing some serious warning signs. Today’s high demand for puts in the BTC options market suggests traders are bracing for a decline. According to Deribit, BTC’s put-to-call ratio currently stands at 1.36. More puts than calls? You guessed it—a bearish outlook is in play. ⬇️

In a nutshell, the options market is practically screaming “Downward we go!”—as more put options are being traded than calls. Prepare yourselves, it looks like traders are stacking up their bets on a BTC price decline. Maybe this rollercoaster ride is just getting started? 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-24 10:43