If Ethereum were a character in a Discworld novel, right now it’d be standing at the edge of the Ankh-Morpork market square, scratching its head, wondering whether to buy a suspiciously cheap sausage or run screaming because someone mentioned tariffs. Yes, Ethereum is flirting with a “historic buy zone,” which, in layman’s terms, means it’s dipped below a critical level that makes hopeful investors squeal like Nac Mac Feegle when they spot a bargain.

Meanwhile, the world beyond the blockchain is busy with the usual global theatre where the US and China are having a diplomatic staring contest punctuated by tariff delays—triggering more jittery financial markets than a goblin in a room full of plate glass. President Trump, in his infinite wisdom, decided to hit pause on all tariffs except those on China, which has made everyone collectively clutch their hats and wallets.

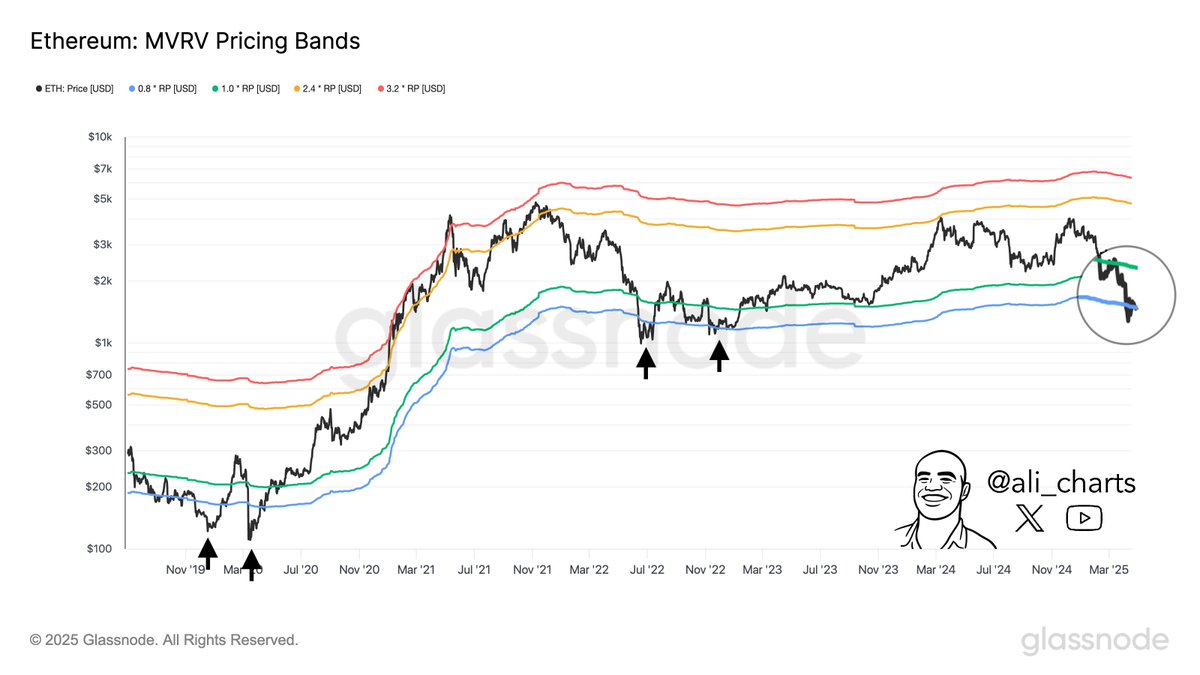

Amid that chaos, Ethereum has huddled into a price zone that crypto sages like Ali Martinez say historically signals “Hey, maybe don’t panic and buy some.” Not just any zone, mind you, but the MVRV Lower Band—imagine it as the financial equivalent of finding a dragon’s hoard marked “For Sale: Slightly Used.” The only question is whether the bulls can muster the courage to charge past resistance or if they’ll end up like a troll stuck under a bridge, waiting for someone brave enough to pay the toll.

The Wallet Whisperer’s Guide to Ethereum’s “Historic Opportunity”

After waving goodbye to the comfy $2,000 support cushion, ETH has taken a dive of about 21%, which on the crypto rollercoaster feels like a polite sneeze. Investors, naturally freaked out by headline drama and trade sagas that sound more like a soap opera than an economic plan, have been fleeing safer ground—turning the market volatility dial all the way up to “What Now?”

Still, some analysts are clutching their abacuses and whispering that this weird dip might just be the calm before the storm, or at least the chance to stack Ethereum at a discount that would make even Ankh-Morpork’s beguiling salesman stop and blink. Ali Martinez—the guy who apparently reads crypto charts in his sleep—reminds us that dipping below that MVRV line usually means it’s time to load up before a rocket takes off. Or a cart crashes dramatically. The market never promises subtlety.

The caveat? While ETH’s position here looks like a green light for patient investors, the path is riddled with tricky little gremlins called “volatility” and “macro uncertainty.” Still, fortune favors the bold—or at least the ones who don’t panic-sell before breakfast.

Ethereum’s Price Dance: Like Watching a Frog Waiting for a Fly

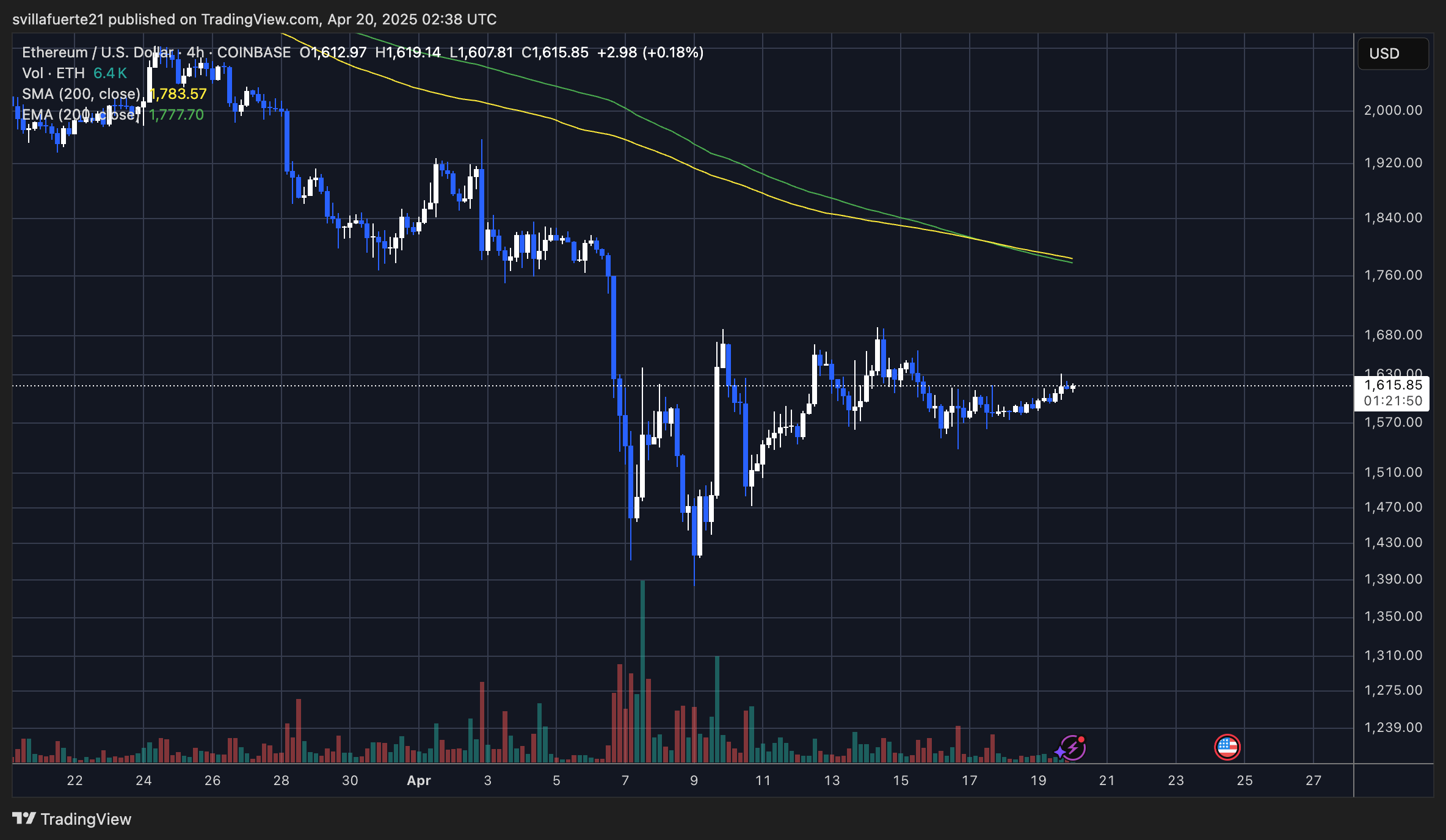

Currently, ETH is playing it cool around $1,610, stuck in a narrow band between $1,550 and $1,630. Think of it as Ethereum doing the financial equivalent of pacing back and forth, hoping someone knocks on the door with either good news or a big check. This indecision is classic buildup—something big’s coming, but whether it’s a party or a witch’s curse remains unknown.

If the bulls manage to persuade Ethereum to leap above $1,700—and eventually smash through the $2,000 “Do Not Pass” sign—then the market might actually start ringing the victory bells. But if it stumbles below $1,550, well, it might have a date with the dreaded $1,500 support floor, which doesn’t sound like a good time unless you enjoy rollercoasters that go straight underground.

So, settle in, grab some popcorn (or something stronger), and enjoy the spectacle. It’s crypto— where technical analysis meets drama and everyone’s just guessing how badly they’ll be entertained.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- Sunday City: Life RolePlay redeem codes and how to use them (November 2025)

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-04-20 12:06