In the grand theater of absurdity, Bitcoin wobbled like a novice ballet dancer right after the Fed’s head honcho, Jerome Powell, cast a dark shadow upon Trump’s tariffs.

BTC Endures the Whirlwind, Because Collapse is So Last Season

Powell took the stage at Chicago’s Economic Club, delivering a gloomy sermon: “The tariff hikes announced so far? Much bigger than anyone dared dream,” he muttered. Apparently, Trump’s tariff tango is choreographed to thrust us into slow growth and inflation’s hungry embrace.

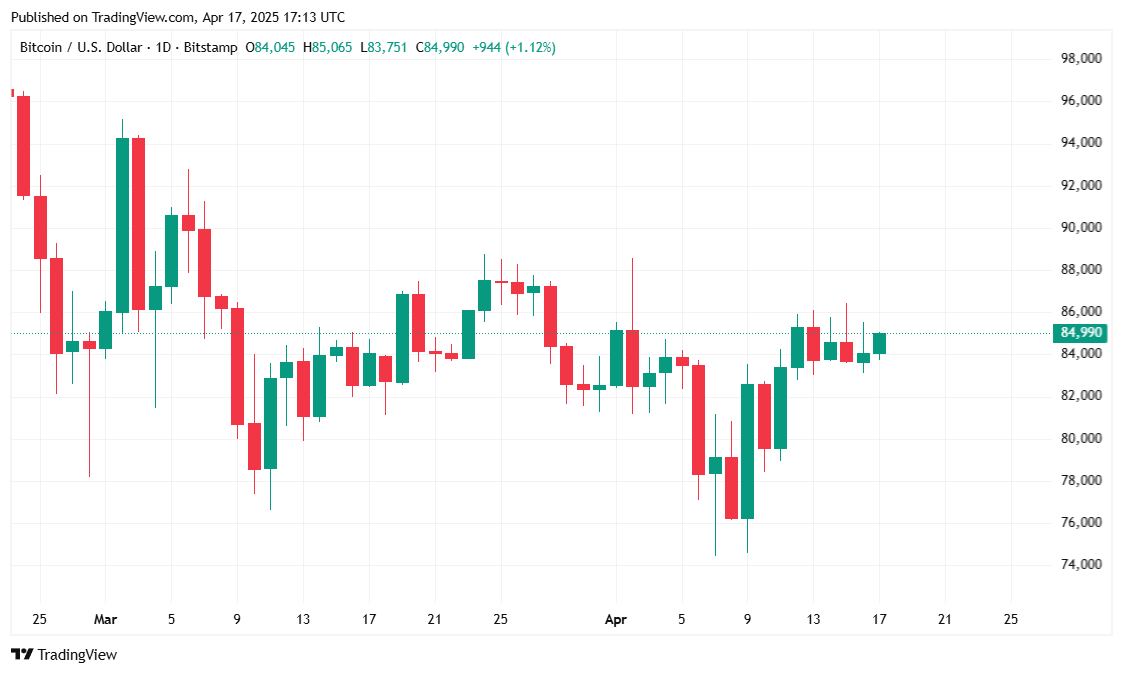

Bitcoin didn’t take this forecast lying down. It faltered, shook, but then shrugged off its slump from $85,300 down to $83,300 like it was nothing more than a pesky mosquito’s bite.

Crypto analyst Dylan Bane, perched like a crow on the wires at Messari, reported, “In thirty minutes post-Powell’s sermon, Bitcoin dipped 2%. Stocks decided to join the pity party—Dow, S&P 500, Nasdaq—plunged 1.5% to 4%, as if to say, ‘We’re all drowning together!’”

Market by the Numbers (Because We Crave Order Amidst Chaos)

Bitcoin currently glides around $84,891.80, a modest climb since yesterday and a robust 7% leap over the week. It tiptoed between $83,314.85 and $85,428.28, gracefully indifferent to the outside turmoil.

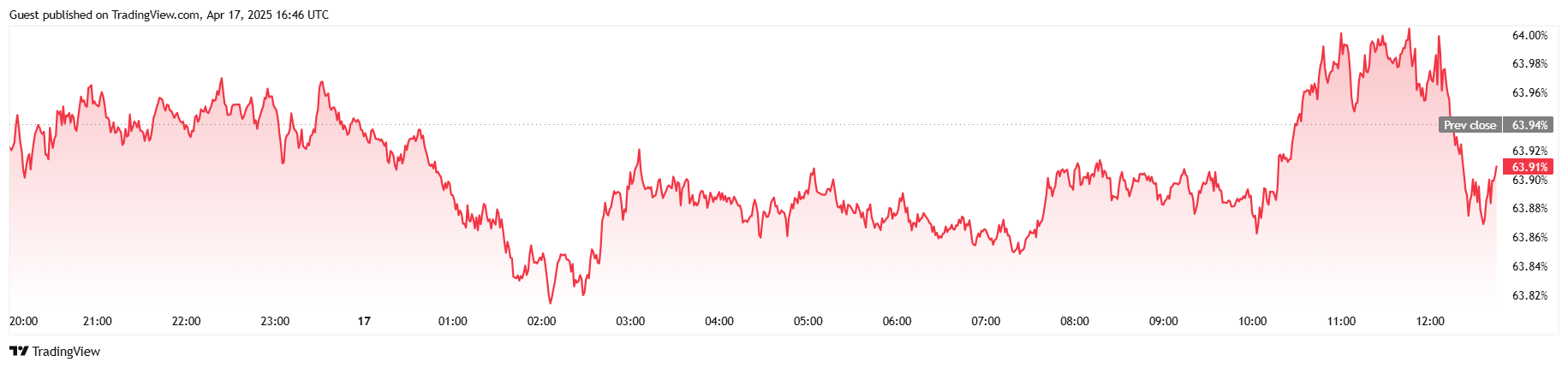

Trading volume, as if on a diet, shrank by 7.13% to $24.59 billion. Market capitalization stands tall at $1.68 trillion, down only a smidge. Bitcoin’s dominance slipped ever so slightly—0.02%—allowing altcoins a moment in the spotlight. Fascinating, isn’t it? The underdogs wag their tails just when the alpha momentarily glances away.

On futures, open interest slipped 0.54%, measuring a cool $54.36 billion. Liquidations hit $3.96 million—mostly annihilating the short sellers who apparently bet on paralysis. Long holders barely noticed, toting just $37,970 in damage, signaling the market’s stubborn optimism and a never-ending squeeze party.

Powell’s Tariff Warning: The Economic Game of Jenga Begins

The Fed’s chairman, with all the cheer of a man announcing a summer plague, warned on tariffs’ dire fate for the economy. “New administration, new headaches,” Powell hummed at Chicago. The dual mandate—taming inflation while nurturing jobs—groans under protectionist weight as if hit by a Russian winter gale.

Behold “stagflation,” that economic riddle wrapped in a mystery, where the economy strolls in place while prices soar, leaving bankers hapless, forced to choose between two woes.

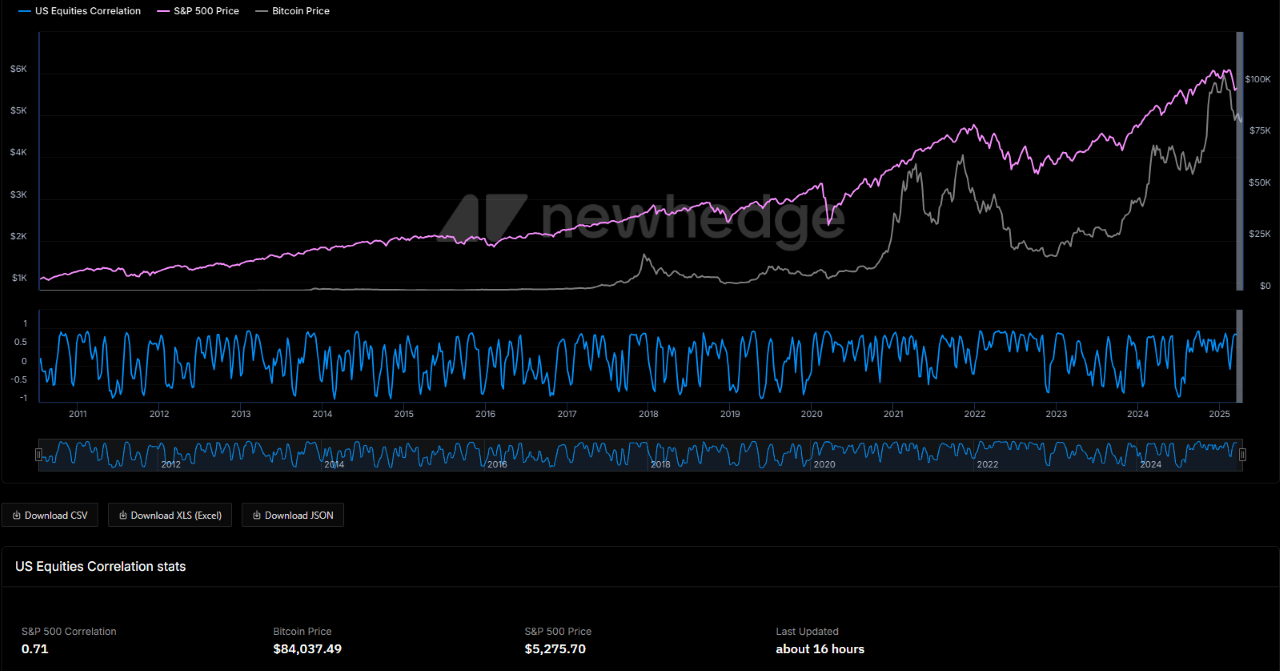

Markets fled at Powell’s prophecy, but Dylan Bane speculates Bitcoin may soon break away, shedding its stock-market shackles, which currently see it dancing on the same string with a 71% correlation.

Bane’s verdict: “Until tariffs and inflation have their way, Bitcoin will cling to equities like a cautious drunk at a bar. Only a tectonic shift in global order—maybe the dollar losing its crown—will uncouple them entirely.”

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- How to find the Roaming Oak Tree in Heartopia

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-04-17 20:57