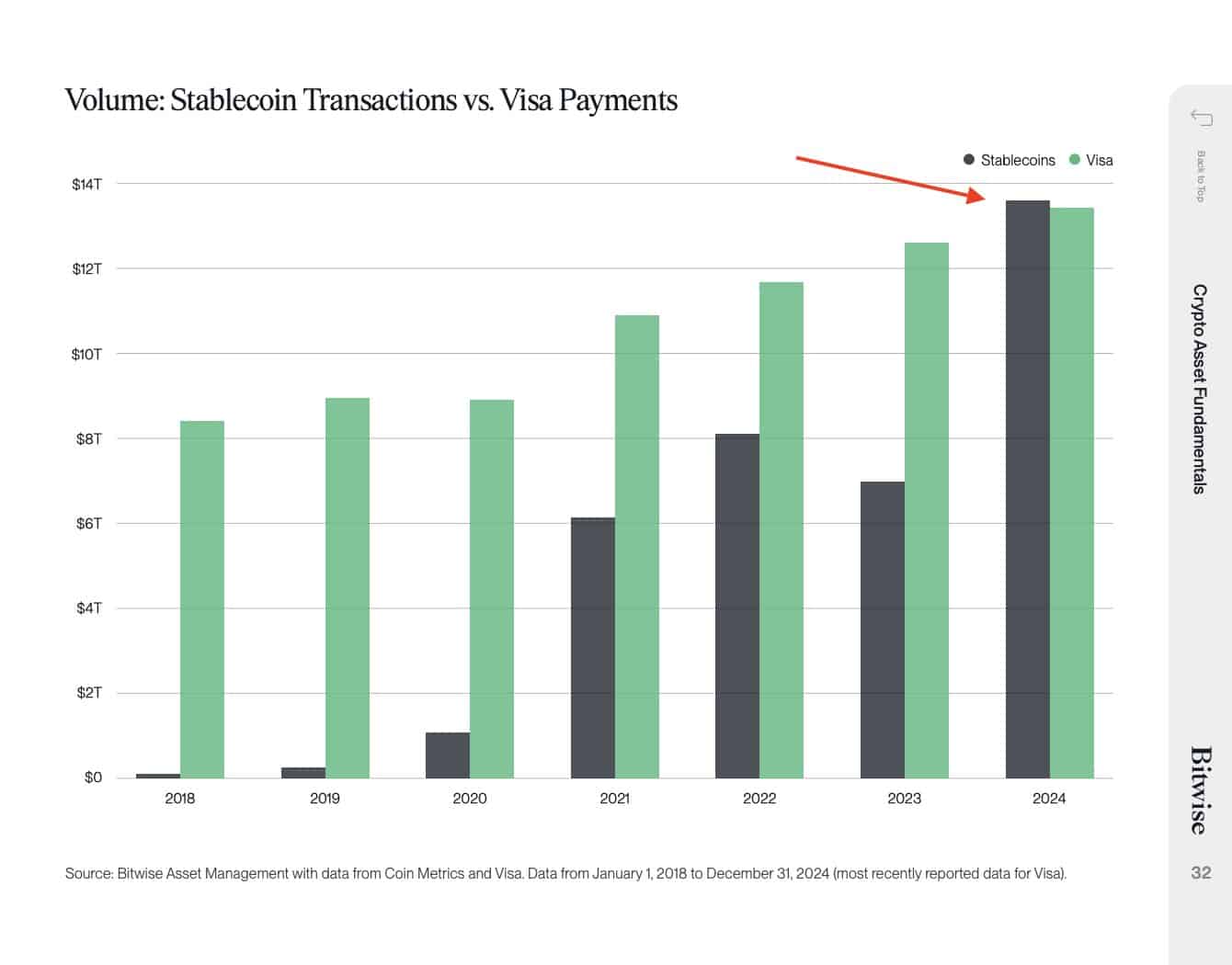

- Oh, look, in 2024, stablecoins did the unthinkable – outpaced Visa in transaction volume.

- Fed Chair casually mentioned that stablecoin legislation was a ‘good idea’. How riveting.

Hold onto your monocles, darlings, because in 2024, stablecoins decided to play hardball and outpaced Visa for the first time in history. According to a fascinating Bitwise report, who could have predicted it, right?

In 2023, Visa was a glutton with its $13 trillion transaction volume. Meanwhile, stablecoins, in their quiet, understated way, managed a modest $7 trillion. Fast-forward to 2024, and voilà, the stablecoin volume doubled, reaching nearly $14 trillion, while Visa had a modest surge above $13 trillion. What a turn of events!

So, what on earth does this mean for crypto?

Well, let’s provide some context, shall we? Stablecoins, the darling of the crypto world, have the most practical use cases, unlike those volatile cryptos that still give people panic attacks. Cross-border payments, once the exclusive domain of old-school financial institutions like Visa, are now ripe for disruption. Yes, stablecoins might just waltz in and steal the show.

In fact, back in February, Bitwise CEO Matt Hougan made a rather bold prediction – stablecoins could seize the $44 trillion cross-border payments market. That’s no small potato, darling.

“Stablecoins are going to dominate the $44 trillion cross-border retail B2B transaction market within the next 5 years.”

It’s like watching a snail pass a cheetah, isn’t it? And, as if that wasn’t enough, PayPal, Fidelity, Stripe, and even Bank of America are all gearing up to hop on the stablecoin bandwagon. Just another sign of mainstream adoption, darling. All aboard the stablecoin express! 🚂💰

Now, unlike those wild, unpredictable cryptocurrencies, stablecoins have this charming little habit of being backed 1:1 by reserve assets. They’re trying to be all sensible, tied to the US dollar or gold. So far, Tether’s USDT and Circle’s USDC are leading the stablecoin parade. Quite adorable, really.

The Bitwise report went on to say that, wouldn’t you know it, there’s some ongoing stablecoin legislation in the works. Two bills in the Senate and House of Representatives could be passed by July. If that happens, expect a veritable flood of adoption. How exciting!

Oh, and let’s not forget that this stablecoin revolution could spill over into DeFi and all other crypto applications. A real crypto renaissance, my dear.

“Growing stablecoin adoption will benefit adjacent sectors, including DeFi and other crypto applications.”

And for a little extra drama, Fed Chair Jerome Powell, ever the party pooper, confirmed that stablecoin legislation was a “good idea.” Well, thank you for that endorsement, Mr. Powell.

As of April, Tether’s USDT is the king of the stablecoin sector with a market cap of $148B, followed by USDC’s $59B. It’s like the game of thrones, but with slightly fewer dragons.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

- What If Spider-Man Was a Pirate?

2025-04-17 14:05