Ah, the start of 2025: a time when Layer-1 blockchain network Solana found itself basking in the glow of meme coins. And not just any meme coins, mind you, but presidentially endorsed, highly volatile assets that made everyone scratch their heads and wonder, “What could possibly go wrong?”

It all kicked off on January 17 when Donald Trump’s TRUMP meme coin made its grand entrance. Suddenly, Solana’s network activity skyrocketed, taking it to heights not seen since the heady days of the 2021 bull cycle. You know, the one where everyone was convinced they could retire before they hit 30. Fun times.

While these chaotic tokens brought Solana a flood of liquidity, users, and yes, even some fleeting fame, the million-dollar question remains: at what cost? And no, we’re not talking about the cost of your soul (or your retirement fund) in this market.

Presidential Memes Hit the Accelerator

Solana’s ability to handle cheap, lightning-fast transactions and a DeFi ecosystem as flexible as a yoga instructor in a wind tunnel made it the perfect breeding ground for meme coins. So when Trump rolled out his TRUMP token, nobody was exactly calling for a press conference.

And what happened next? Oh, just a little thing called “a market frenzy.” Solana’s demand shot through the roof, fueled by developers eager to jump on the meme coin bandwagon and traders who couldn’t resist riding the wave of hype.

Then, in a move that would leave even the most hardened speculators rubbing their eyes, Melania Trump followed suit and launched her own MEME coin just two days later. I mean, why not? If one meme coin is good, surely two is better? The market agreed, and trading volumes exploded. We’re talking numbers like a party balloon on steroids.

For example, MELANIA’s trading volume rocketed 396% within a day, jumping from a mere $1.33 billion to $6.6 billion, according to CoinGecko. Because if there’s one thing we’ve learned, it’s that when memes meet money, things get ridiculous, fast.

To the Moon, Then Back to Earth

By January 24, Solana was processing 832,000 active addresses per hour—26 times more than Ethereum’s paltry 31,000. It was as if the entire internet had suddenly decided Solana was the place to be.

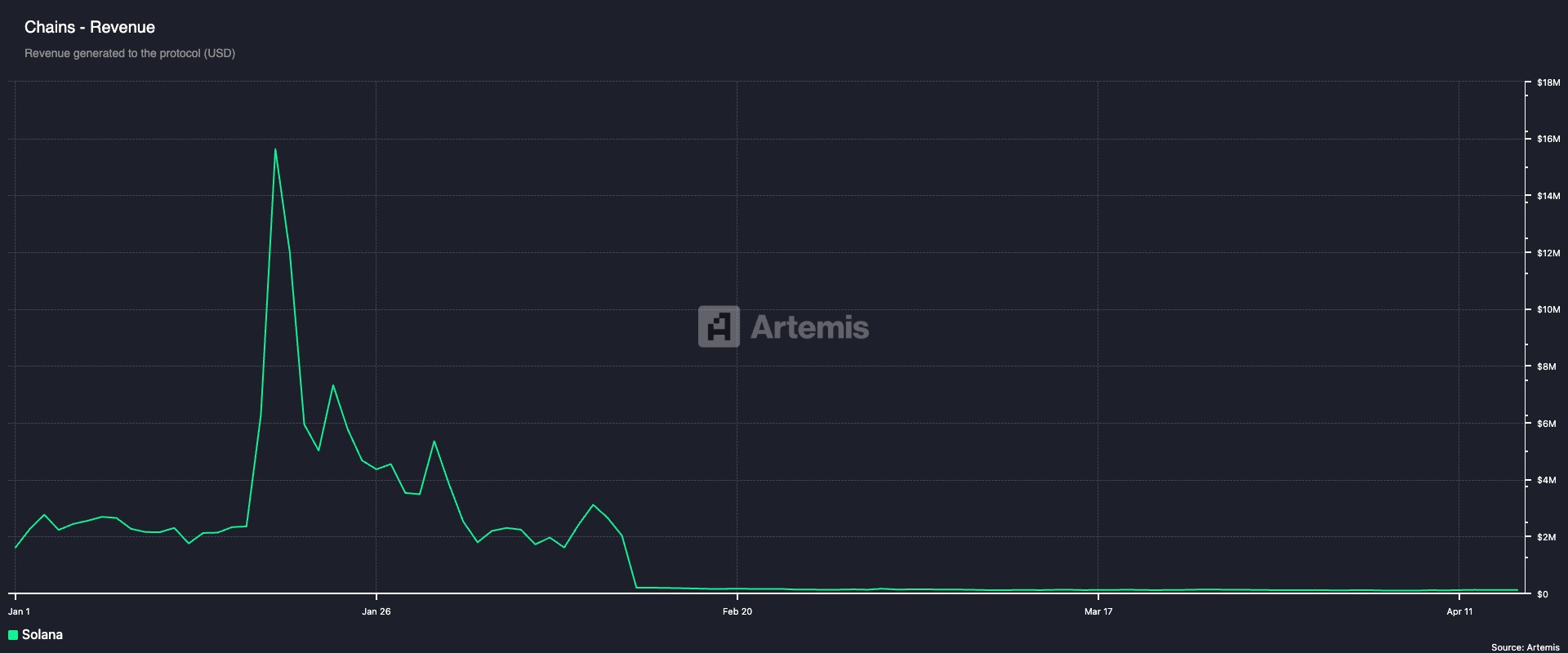

But, as with all things that burn bright, the flame didn’t last. The meme coin fever quickly began to cool, leaving Solana users wondering where the fun went. Transaction fees skyrocketed, and Solana’s network revenue soared to $32.43 million on January 19, a record. But, just as quickly, the bubble burst. By the end of the month, everything had deflated faster than a birthday balloon in a room full of puncture-happy toddlers.

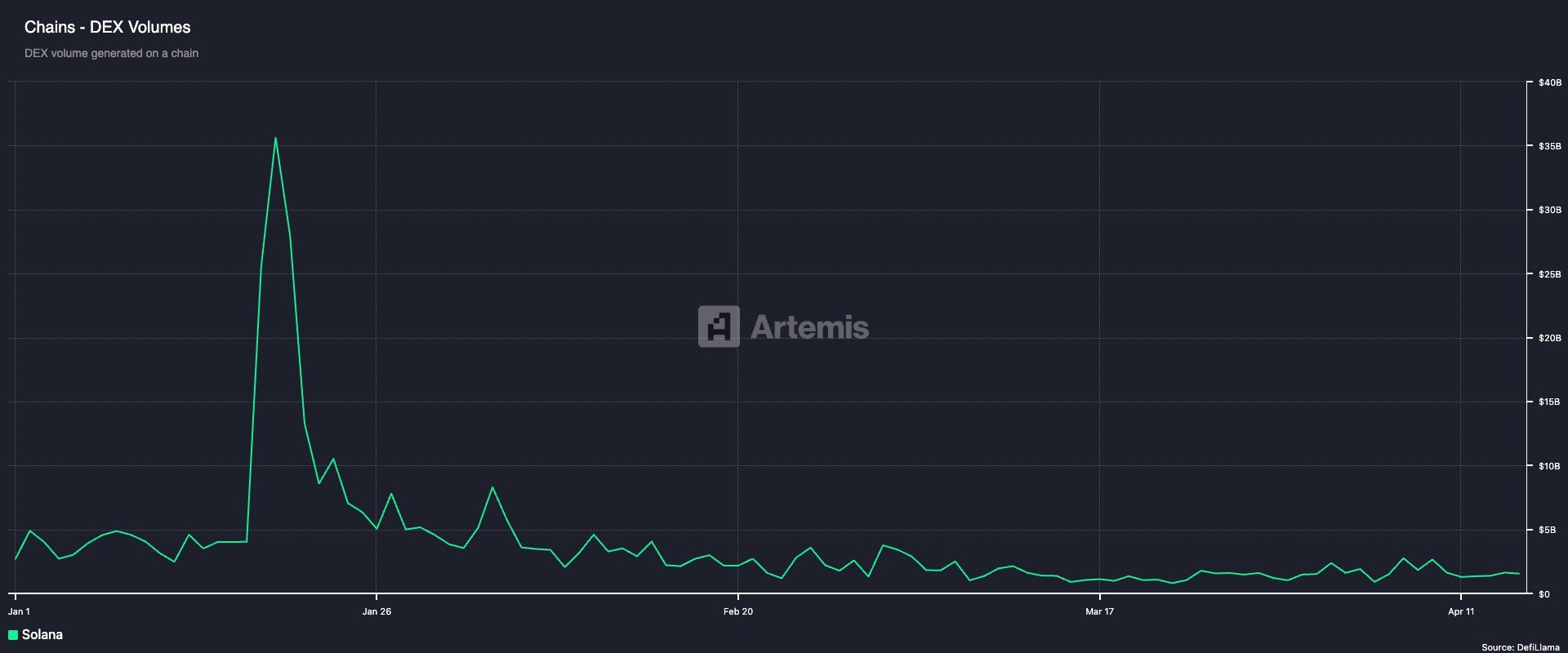

And with the meme coin dust settling, Solana’s DEX volume took a nosedive, dropping almost 90% from its high of $36 billion on January 19 to a mere $3.8 billion by January 31. It’s like going from the most popular kid at school to… well, nobody remembers your name.

But wait, there’s more! Solana’s revenue, which peaked at $16 million, soon plummeted to less than $5 million by month’s end. By yesterday, the network’s total revenue had dipped below $115,000. It’s a great day to be in crypto—said no one ever.

What’s Next? Analysts Say Solana’s Just Getting Started

But before you start writing Solana’s eulogy, here’s the twist: analysts aren’t ready to call it quits just yet. Sure, TRUMP, MELANIA, and all the meme madness brought some temporary glory, but Solana’s long-term plans? Well, those don’t involve spending all its time in the meme coin toy aisle.

In an exclusive interview with BeInCrypto, Marina Zibareva from Binance Research pointed out that Solana’s “performance is increasingly driven by broader ecosystem fundamentals.” In other words, Solana isn’t just about meme coins—it’s about real utility. Shocking, I know.

“We’ve seen DeFi TVL grow nearly 4x in SOL terms since January, and stablecoin supply has increased over 6x – pointing to lasting interest in real utility. Developer activity is also accelerating, with smart contract deployments rising almost 6x, suggesting strong long-term potential beyond the speculative wave.”

As for Solana’s future? Zibareva sees it as a playground for DeFi, DePIN, Gaming, and SocialFi. You know, the stuff that actually helps people—and maybe makes a little money in the process. Memes may have gotten the ball rolling, but it looks like Solana’s sticking around for the long haul, even if the meme coins are now a distant, slightly embarrassing memory.

“Meme coins have brought attention and users, but the long-term trajectory likely points toward use cases like DeFi, DePIN, Gaming, and SocialFi. Solana’s daily active addresses have increased nearly 6x year-to-date, and with its infrastructure battle-tested, we expect to see more developer activity focused on sustainable value creation,” she added.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-04-16 19:51