Ah, Google Finance, that oracle of our times! It whispers to us today that gold, like a persistent suitor, has finally breached the $3,300 mark. A triumph, no doubt, for those who find solace in shiny things. The investors, those restless souls, are abuzz, especially the gold enthusiasts, who, let’s be honest, probably wear gold-rimmed spectacles and dream of Midas. 🧐

And who should emerge from the shadows but Peter Schiff, that champion of bullion! He, with a dramatic flourish, questions the very essence of Bitcoin. Could it be, dear reader, that Bitcoin is not the digital savior we were promised, but merely a fleeting fancy? Schiff urges us to cast it aside, to sell, sell, SELL! One wonders if he’s secretly hoarding all the Bitcoin himself, chuckling into his golden chalice. 😈

At the dawn of this month, gold lingered around $3,114.040. A modest sum, wouldn’t you say? It then dared to climb to $3,132.63. But alas, hubris! Between the 3rd and 7th of April, it stumbled, falling from $3,131.085 to a paltry $2,980.780. This, it seems, was due to the bluster of one Donald Trump and his tariff policies. A pause was offered, a reprieve, but the market, like a skittish horse, was already spooked. 🐴

On the 8th, a battle raged! Buyers and sellers clashed in a furious dance, resulting in what they call a “long-legged Doji candlestick pattern.” Such dramatic terms for mere financial squabbles! 🙄

But fortune favors the bold! On the 9th, the tide turned. Gold, with renewed vigor, began its ascent. Between the 9th and 11th alone, it surged by over 8.52%! One can almost hear the triumphant trumpets! 🎺

Today, the market appears… bullish. A term that always amuses me. Does it mean the market is feeling particularly virile? At the start of the day, gold sat at $3,230.255. Now, it basks in the glory of $3,296.745. The trend, they say, indicates a bullish rally. Oh, the drama! 🎭

Meanwhile, Bitcoin, that digital upstart, has fallen below $83,380. In the last 24 hours, it has declined by over 2.6%. A mere flesh wound, some might say. But is it a sign of things to come? 🤔

Right now, Bitcoin is at least 5.87% below its monthly peak and over 23.53% below its all-time high of $109K. The mighty have fallen, it seems. Or perhaps, merely stumbled. Time will tell. ⏳

In the first quarter of this year, Bitcoin recorded a drop of no fewer than 11.7%. Last year, in the same quarter, it rose by 68.7%. Such fickle fortunes! One might almost feel sorry for it, if it weren’t for all the smug pronouncements of its devotees. 😏

Peter Schiff, that unwavering oracle, has advised investors to abandon Bitcoin entirely. A bold move, even for him! One imagines him perched atop a mountain of gold, cackling at the folly of digital currencies. 😆

And what, pray tell, does he recommend in its stead? Gold mining stocks, of course! The man is nothing if not consistent. 🪙

According to Yahoo Finance, companies involved in the extraction and smelting of gold have experienced an average surge of 16.69% in the last 30 days. The sector’s YTD return stands at +47.16%. The one-year return is +60.29%, and the 3-year and 5-year returns are +26.77% and +73.77%, respectively. Such impressive numbers! One might be tempted to invest, if one were not so cynical. 😒

The YTD change of Newmont Corporation sits at +46.64%, AngloGold Ashanti plc at +89.90%, Royal Gold Inc at 40.31%, Coeur Mining Inc at +6.64%, Seabridge Gold Inc at +9.20%, Caledonia Mining Corporation Plc at +44%, and Idaho Strategic Resources Inc at +78.41%. A veritable gold rush! 💰

In December 2024, when Bitcoin was at its zenith, Michael J Saylor, co-founder of Strategy, advised top US tech companies to adopt his aggressive BTC accumulation strategy. Oh, the hubris! Fortune, it seems, has a wicked sense of humor. 😂

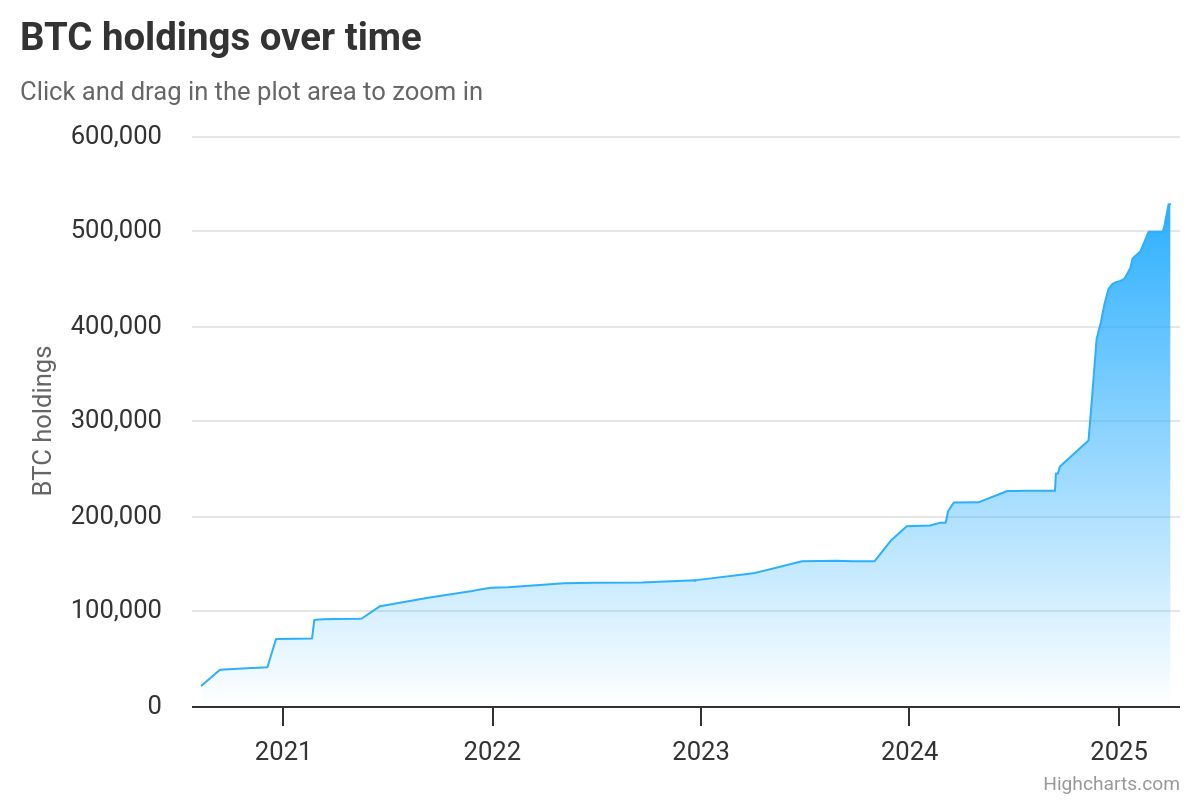

Strategy, with 528,185 BTC tokens worth $44,050,903,656, is the public company that owns the highest number of BTC tokens. A staggering sum! One wonders if they sleep on mattresses stuffed with digital coins. 😴

Schiff, naturally, has denounced Strategy’s BTC accumulation strategy. “Fools!” he cries, presumably. Or something to that effect. 🤔

Earlier, Schiff even predicted that BTC could drop as low as $10,000. A dire prediction! But then, prophets of doom are rarely disappointed. 😈

The renowned crypto analyst Eric Balchunas recently highlighted that Strategy has significantly outperformed U.S. tech stocks in 2025. A twist in the tale! Perhaps Bitcoin is not so doomed after all? 🤷♂️

Over the past year, Strategy’s stock has surged by 147.78%, with a year-to-date (YTD) growth of 7.29%. In the last 30 days alone, it has climbed 5.59%. In contrast, the broader U.S. tech sector has gained just 6.82% over the past year and recorded a YTD decline of -14.56%. So, who’s laughing now, Mr. Schiff? 🤣

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- ATHENA: Blood Twins Hero Tier List

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Clash Royale Furnace Evolution best decks guide

2025-04-16 11:58