One must appreciate the capricious nature of fortune in our theatrical world of finance: back in January, dear XCN reached a modest high of $0.049 before embarking on a rather dismal downward promenade, tumbling to a pitiful $0.007 on April 7. Yet, as any true star, it never remains in obscurity for long! 😏

From that humdrum despair arose a ravishing revival: demand soared like an over-enthused audience, lifting the price by a magnificent 171%. Our darling XCN is now strutting the stage, ready for an encore performance that promises even more applause! 🎩✨

XCN Struts Off the Downstairs Stage with Unbridled Flair

Having nursed its wounds with typical aplomb, XCN bounced back splendidly, shattering that tedious descending resistance like a critic dismissing the mundane. This breakout was nothing short of a flamboyant salute to bullish spirits, pushing the altcoin to exquisite gains over the past week. 🍸

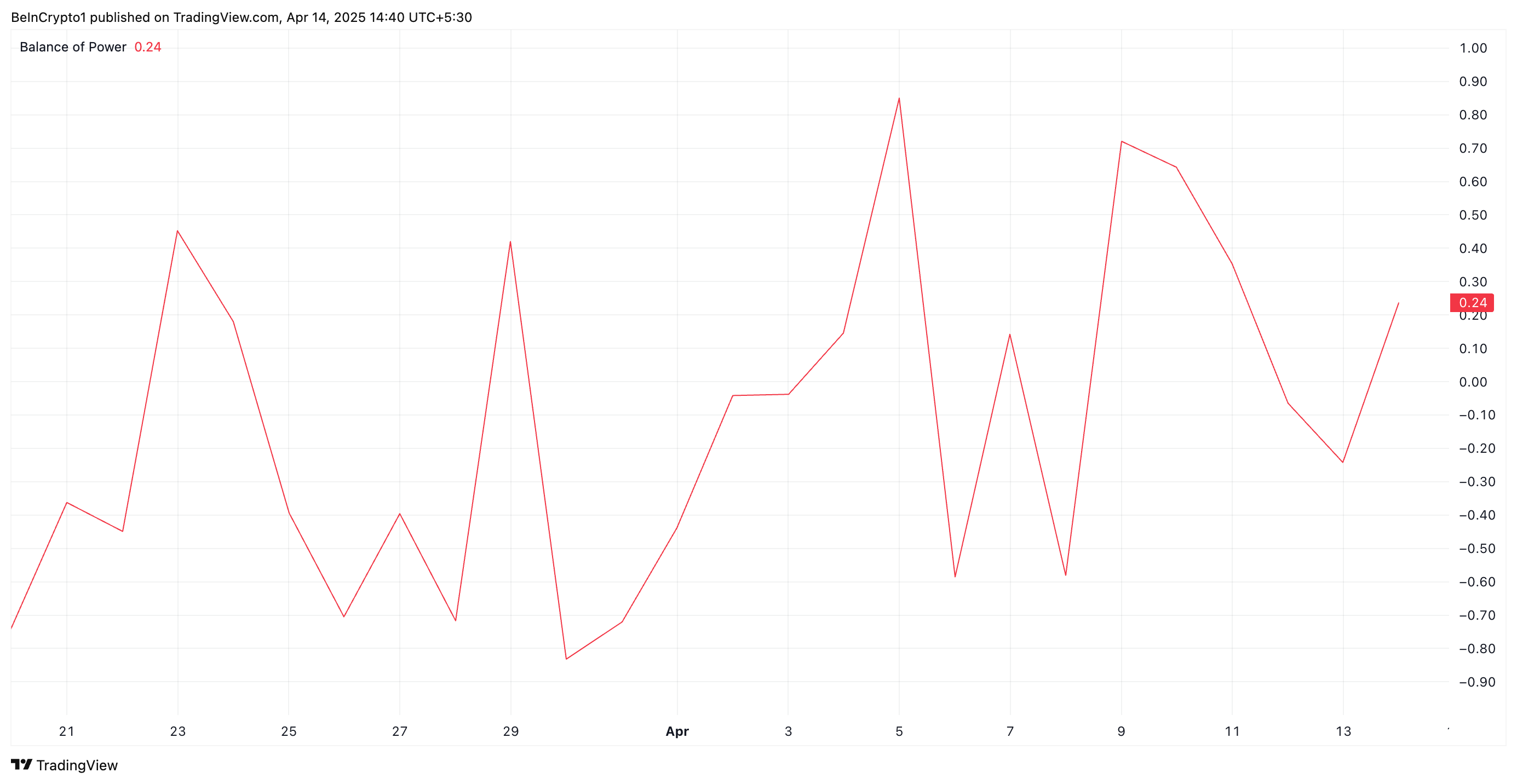

The daily chart, ever the obliging stage manager, shows XCN’s Balance of Power (BoP) flirting above zero at 0.24—a delightful nod to a performance where buyers outshine their gloomy counterparts. Bravo indeed! 👏

A positive BoP is simply the market’s way of revealing that the buyers are commanding the floor with enviable flair—an unmistakable sign that demand is driving our star upward like an ovation-worthy encore. 😎

Should this rhapsody of positive BoP continue unabated, expect a sustained buying momentum that might just lead to even higher curtain calls. Marvelous, isn’t it? 😉

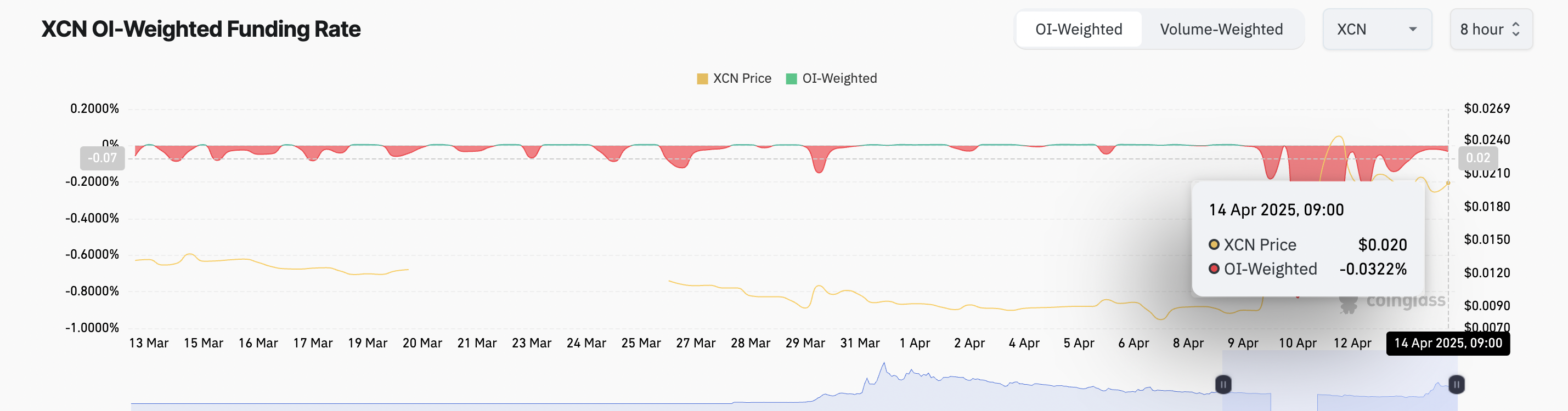

Yet, not all of our discerning thespians share in this jubilation. The derivatives traders, with their ever-cynical airs, boast a persistently negative funding rate of -0.032%. Their penchant for short positions is as ironic as a tragicomedy performed under a rain of sarcasm. 🤷♀️

For those uninitiated, the funding rate is a periodic “performance fee” exchanged between long and short position holders in the realm of perpetual futures—a mechanism designed to keep the prices in polite alignment with reality.

When this rate is in the red, it simply indicates that shorts are paying longs—a clear, if somewhat sardonic, sign of bearish sentiment as many wager on a dramatic decline. 💸

The mounting buying pressure on the spot market, juxtaposed with the dour outlook in derivatives, sets the stage for an intriguing divergence. If this bright rally continues, we may well witness a short squeeze finale to rival the most exquisite theatrical twist. Bravo, indeed! 🎭

XCN Defies the Mundane: Soars Past 20-Day EMA as Traders Await More Applause

In a delightful coup de théâtre, XCN’s recent rally has nudged its price above the 20-day exponential moving average (EMA)—that cherished metric which fondly weighs recent trading escapades. Such a graceful pirouette above the EMA unmistakably signals heightened buying fervour. Splendid! 🎉

This charming crossover serves as a cheeky wink from the market, confirming the asset’s flirtation with an uptrend. Ever the optimists, traders interpret it as a divine prelude to sustained bullish capers. Simply irresistible! 😏

On a more pragmatic note, if XCN maintains this melodious uptrend, one might expect it to trade around a tantalizing $0.023. Conversely, should a correction cramp the style of this glamorous performance, the token may retreat to a modest $0.016. Oh, the dramatic unpredictability of it all! 🎭

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-04-14 18:06