Ah, Dogecoin. From the icy gulags of internet jesting to the warm embrace of Swiss bankers. Who could have foreseen such a betrayal of true, soul-crushing seriousness? 21Shares, these purveyors of respectability, now openly sing paeans to this digital absurdity. They cite a 130,000% ascent. A figure so grotesque, it mocks the honest toil of generations. 😠

Meme Currency: A Cancerous Growth?

A joke! A mere online snicker in the desolate year of 2013. Now, 21Shares dares to call it a “movement.” As if the world needed another movement fueled by frivolous distraction. This Dogecoin’s performance, they say, speaks for itself. Indeed, it screams of societal decay and the triumph of the superficial. A 125% annual growth rate since its ignominious birth? Such numbers are an insult to the very concept of value. 🙄

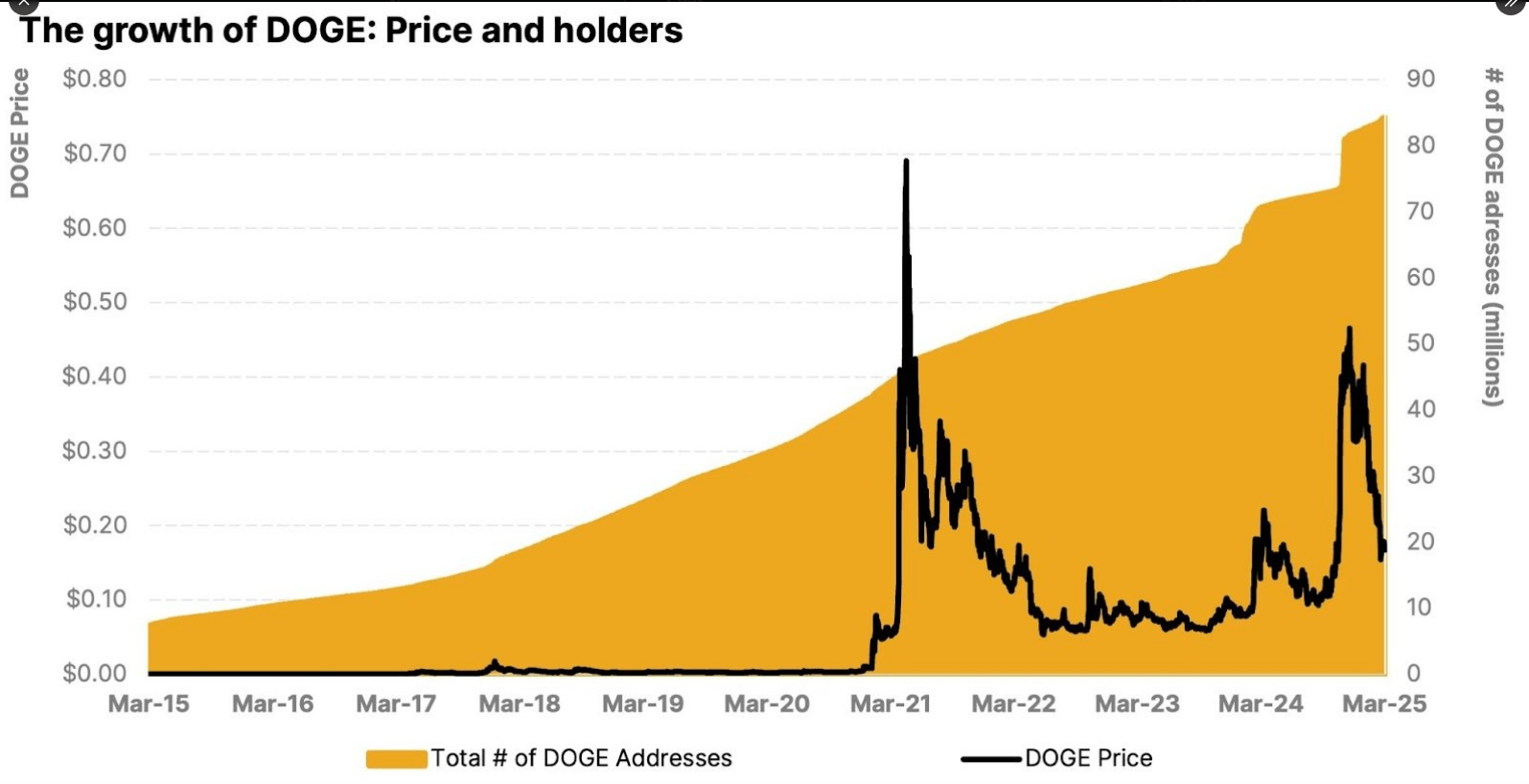

And the masses, ever eager to embrace the absurd, flock to it like moths to a flickering screen. Wallet addresses balloon from 44 million to 84 million. A doubling of the digital lemmings marching towards the cliff of meaninglessness. More people holding this… this digital bauble? It is a tragedy of our times. 😩

Dogecoin isn’t just a meme—it’s a movement. (A movement towards what, oblivion?)

With 130,000%+ returns, a $30B market cap, and 84M+ wallets, DOGE is rewriting what value means in the digital age. (Rewriting it in crayon, perhaps?)

Explore how culture, community, and memes drive this phenomenon. Read the full blog →

— 21Shares (@21Shares) April 10, 2025 (The year when all hope was officially abandoned.)

ETF Filing: The Final Nail in Seriousness’s Coffin?

An S-1 form submitted to the US Securities and Exchange Commission. Bureaucrats now grapple with the implications of a meme. The absurdity deepens. If accepted, this ETF will allow ordinary investors – the babushkas and factory workers – to gamble on a joke without even understanding the joke itself. A grand spectacle of financial folly. 🤦♂️

Commodity-based, they say. As if Dogecoin were grain or steel. No, it is more like a digital mirage, shimmering in the heat of collective delusion. A new method of bringing Dogecoin into portfolios, they boast. A Trojan horse of triviality, breaching the walls of traditional investment. 😒

21Shares Announces Partnership With Dogecoin Foundation: A Pact with the Devil?

They have partnered with the House of Doge. The official business entity of the Dogecoin Foundation. Even such a phrase drips with irony and despair. This partnership, they claim, will further entrench Dogecoin with conventional financial systems. As if the cancer is not yet pervasive enough. 🥶

Legitimacy! That is what they crave. Traditional financial institutions now viewing it as a legitimate asset class. As if legitimacy were a matter of opinion, not a reflection of intrinsic worth. This institutional support may entice more risk-averse investors. The sheep, always eager to follow the herd, even into the abyss. 🐑

New Exchange-Traded Product Launches With Physical Backing: A Monument to Folly?

An exchange-traded product fully supported by the Dogecoin Foundation. A temple built to worship the meme. This investment product will be collateralized by real Dogecoin in a 1:1 ratio. Every share equates to holding real cryptocurrency in cold storage. As if storing the absurd makes it any less absurd. 🤔

A management fee of 0.25%. A pittance, perhaps, but a fee nonetheless. A price to pay for participating in the great digital charade. This physical backing model provides investors with confidence. The comforting illusion of substance where there is only empty air. Such is the state of our world. 😔

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-04-11 06:42