Bitcoin and stocks, dear readers, took a bow and bowed out as reality waltzed through Wall Street. It seems that recession fears, our most uninvited guest, have commandeered the market soirée. 😅

No doubt both stocks and crypto markets decided to reverse their previous day’s ovation. On this fine Thursday, April 10, the S&P 500 flirted with 5,233.61, shedding 223.36 points (a droll 4.31%), while the venerable Dow Jones took its leave at 39,296.45, declining by 1,312.00 points (3.23%). Not to be outdone, the Nasdaq curtsied with a 4.66% fall—790.22 points—resting at 16,333.49. 😏

The dramatic downturn arrived right after what was then the third-biggest daily rally in S&P 500 history—the best performance since October 2008—sparked by Donald Trump’s rather theatrical 90-day tariff pause. Yet reality, with its customary disdain for pretense, marched in, and traders now price in the risk of a global recession.

Even as the U.S. tariff intermission lent short-term optimism, our ever-observant economists remind us that the trade war drama is far from its final act. Notably, Trump’s insistence on a 124% tariff extravaganza on China, our largest trading partner, continues to fuel the intrigue. 🙄

Goldman Sachs, ever the dramatic raconteur, places the odds of a recession at a tantalizing 45%, while whispering that core inflation might peak at 3.5%. Meanwhile, Mark Zandi of Moody’s casts his lot at a 60% chance of recession making a cameo. 😅

Bitcoin, Ethereum slip, while ETF outflows continue

The market’s downturn extended its performance to the crypto stage. Bitcoin (BTC) waltzed at $79,195.25—a $4,000 decline from its earlier high of $83,541. Ethereum (ETH) followed suit at $1,506.76, down 5.38%. XRP and Solana (SOL) politely bowed out by 3.82% and 6.00%, trading at $1.94 and $109.92 respectively. 🤷

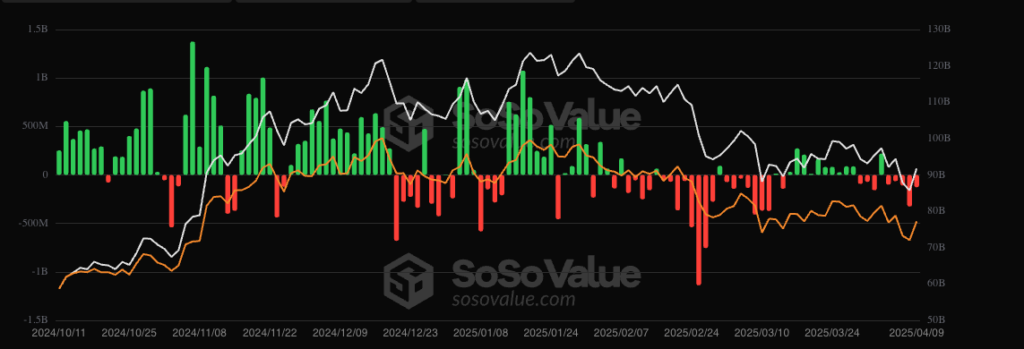

In a fitting encore, crypto ETFs experienced dramatic outflows—$127 million on Wednesday, April 9, following a more extravagant $326 million net outflow on Tuesday. 😲

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-04-10 21:33