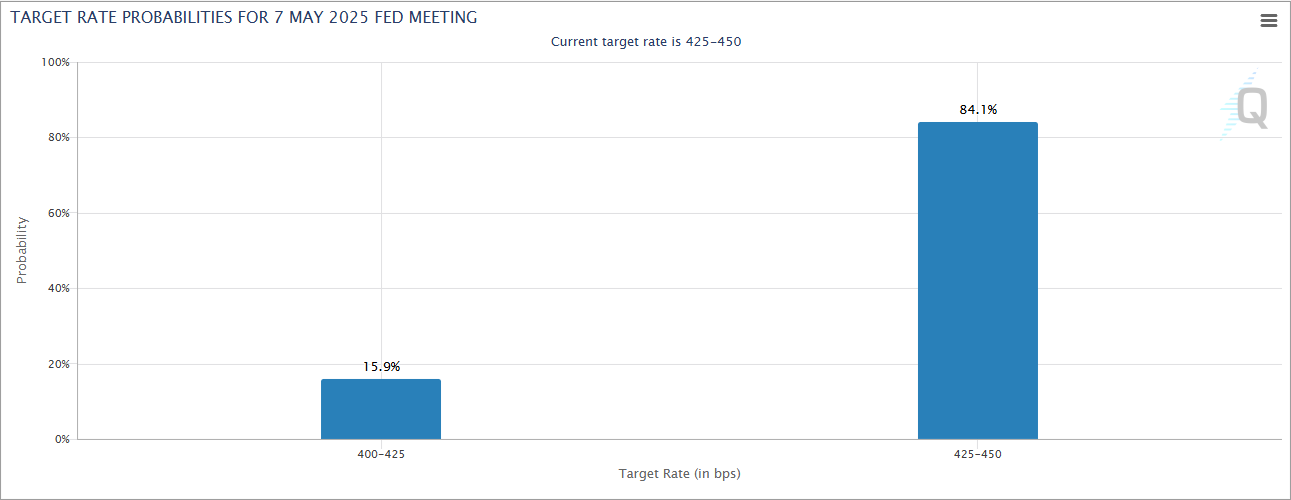

In a twist worthy of a Tolstoyan drama, the probability of a Federal Reserve interest rate cut in May has plummeted from 57% to a mere 15%, as revealed by CME FedWatch data. This seismic shift follows President Trump’s 90-day tariff pause and the release of the March FOMC minutes, which read like a cautionary tale of economic prudence.

The minutes from the March 18–19 FOMC meeting, unveiled on Tuesday, paint a picture of policymakers who, much like a Russian aristocrat pondering the meaning of life, remain deeply cautious about easing monetary policy.

FOMC Minutes: A Hawkish Manifesto

While the Fed acknowledged the robust growth of the economy and the stability of labor markets, they could not ignore the elephant in the room: inflation, which continues to gallop above the 2% target like a runaway horse. 🐎

Many participants highlighted the upside risks to inflation, particularly from broad-based tariff increases and potential supply chain disruptions. It seems the specter of inflation haunts the Fed’s deliberations like a ghost from a Chekhov play.

Several Fed members noted that inflation readings for January and February exceeded expectations, and they warned that the effects of new tariffs—especially on core goods—might linger longer than a Tolstoy novel. 📚

Although the participants supported maintaining current interest rates, they emphasized the need for policy flexibility, as uncertainty surrounding trade, fiscal, and immigration policy casts a shadow over the economic outlook, much like a storm cloud over the Russian steppe.

For now, Trump’s decision to pause new tariffs for most countries for 90 days—while raising Chinese tariffs to a staggering 125%—has alleviated fears of a full-blown trade war. However, the threat of retaliatory action from China and elevated inflation expectations have only reinforced the Fed’s hawkish stance. Policymakers are signaling, with the gravitas of a Tolstoyan hero, that they are in no rush to cut rates.

Crypto’s Rollercoaster Ride 🎢

As we’ve seen recently, crypto markets are macro-sensitive assets. A more hawkish Fed stance and reduced odds of near-term rate cuts could lead to:

- Lower liquidity expectations, which might weigh on crypto asset prices like a sack of potatoes. 🥔

- Stronger dollar pressure, potentially diminishing Bitcoin’s allure as an inflation hedge. 💸

- Higher volatility, as macro uncertainty intensifies and hopes for rate cuts fade like a Russian winter sunset. ❄️

For now, the Fed’s message is as clear as a Tolstoyan moral: monetary policy remains data-dependent, but a pivot is off the table unless economic conditions deteriorate sharply. The market is currently rallying after Trump’s 90-day tariff pause, but crypto investors hoping for tailwinds from rate cuts may have to wait, much like a peasant waiting for spring. 🌱

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-04-09 22:01