One cannot help but be mildly amused by Bitcoin’s prancing ascent to $80,000, all sparked by a certain presidential tariff ruckus. The crypto realm, ever so sensitive, scurried about in a tizzy for half a day, like startled cats witnessing a fireworks display. Such drama, all for a few economic squabbles.

Market Cap Teeters At $1.5 Trillion, With Bitcoin Grabbing The Spotlight

Market data, in its usual deadpan manner, reveals Bitcoin’s market capitalization to be flirting with $1.5 trillion. Altcoins, bless their hopeful little hearts, remain somewhat bedraggled. Meanwhile, Bitcoin’s share of the crypto pie has swelled to a bold 60%, as anxious investors cling to the largest and shiniest token. Who can blame them? The market seems more rattled by global financial jitters than by crypto’s own melodrama.

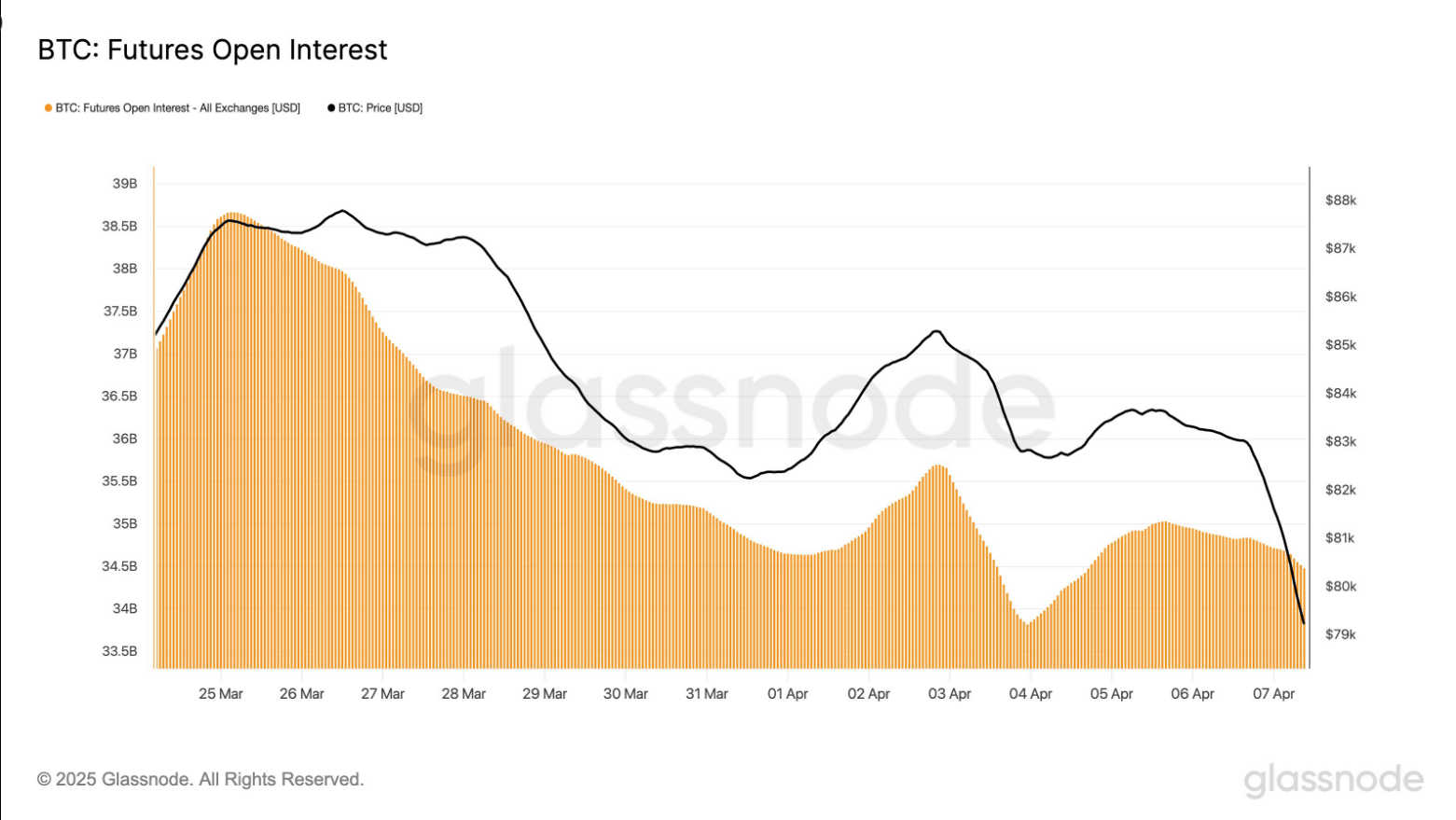

$BTC futures open interest sits at a paltry $34.5B. Though it staggered upward from the April 3 low of $33.8B, the general mood remains as chilly as an abandoned icebox. Traders, in a burst of prudence, are trimming risk and pretending not to be rattled by sliding prices.

— glassnode (@glassnode) April 7, 2025

Futures Market: Stiff Upper Lip (Sort Of)

According to our ever-watchful friends at Glassnode, open interest in Bitcoin futures sank to $34.5 billion, then made the feeblest of attempts at recovery. From March 25 onward, cash-margined open interest tiptoed down from $30 billion to $27 billion, while its crypto-margined cousin slipped from $7.5 billion to $6.9 billion. Some cheeky souls have evidently tiptoed back into risk, presumably seeking thrills and chills.

Today, crypto-collateralized futures contracts comprise 21% of open interest, compared to 19% days ago. Observers predict a potential uptick in heart palpitations and comedic market spasms in the near future.

Liquidations Gentle As A Spring Breeze

Apparently, $58 million in Bitcoin futures has vanished into the ether during the past 24 hours — pocket change compared to the crypto carnival of yesteryear. Long positions, dropping $42 million, have borne the brunt; shorts lost a meager $16.6 million. This modest liquidation spree barely rustles the curtains, despite a tidy 10% price plunge.

All told, $58.8M in Bitcoin futures liquidations in a day. Longs took the lion’s share of punishment at $42.1M, leaving short sellers to snicker with just $16.6M in losses. Really, it’s not even enough to choke on one’s tea.

— glassnode (@glassnode) April 7, 2025

In contrast to previous theatricals, where daily liquidations soared beyond $140 million, this event is most tame. The consensus suggests that traders were not stacking debt like crumpets on a tea tray, resulting in a more orderly price dip resembling a polite apology rather than a forced capitulation.

Big Players Still Fancy A Seat At The Table

Market chitchat reveals that institutions appear immune to the frenzy. Evidence shows 76 fresh corporate entities, each with over 1,000 BTC, marching into the scene over the last two months — a 4.5% swell in sizable holders. Isn’t it lovely when the band keeps playing, no matter how many times the ship tilts?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Deneme Bonusu Veren Siteler – En Gvenilir Bahis Siteleri 2025.4338

2025-04-08 18:43