In the realm of financial speculation, the fervor surrounding a potential emergency rate cut by the esteemed Federal Reserve has reached a most alarming pitch, driven by the rising trepidations regarding an economic downturn, all thanks to the trade skirmishes instigated by none other than President Donald Trump.

Speculators Engage in a Most Curious Bet on Emergency Rates

Indeed, Mr. Trump’s sweeping imposition of tariffs upon our global trading partners has sent tremors through the financial markets, resulting in a rather precipitous decline on Wall Street and amplifying the fears of a recession. Such a tempest of uncertainty has led to rampant conjecture that our central banks—most notably the Federal Reserve—might find themselves compelled to ease monetary policy to soften the impending blow. How delightful! 😏

The next gathering of the Federal Open Market Committee (FOMC) is set for the 7th of May. According to the rather intriguing CME’s Fedwatch tool, there exists a 71.8% probability that the central bank shall maintain its current rates. A most riveting affair, indeed!

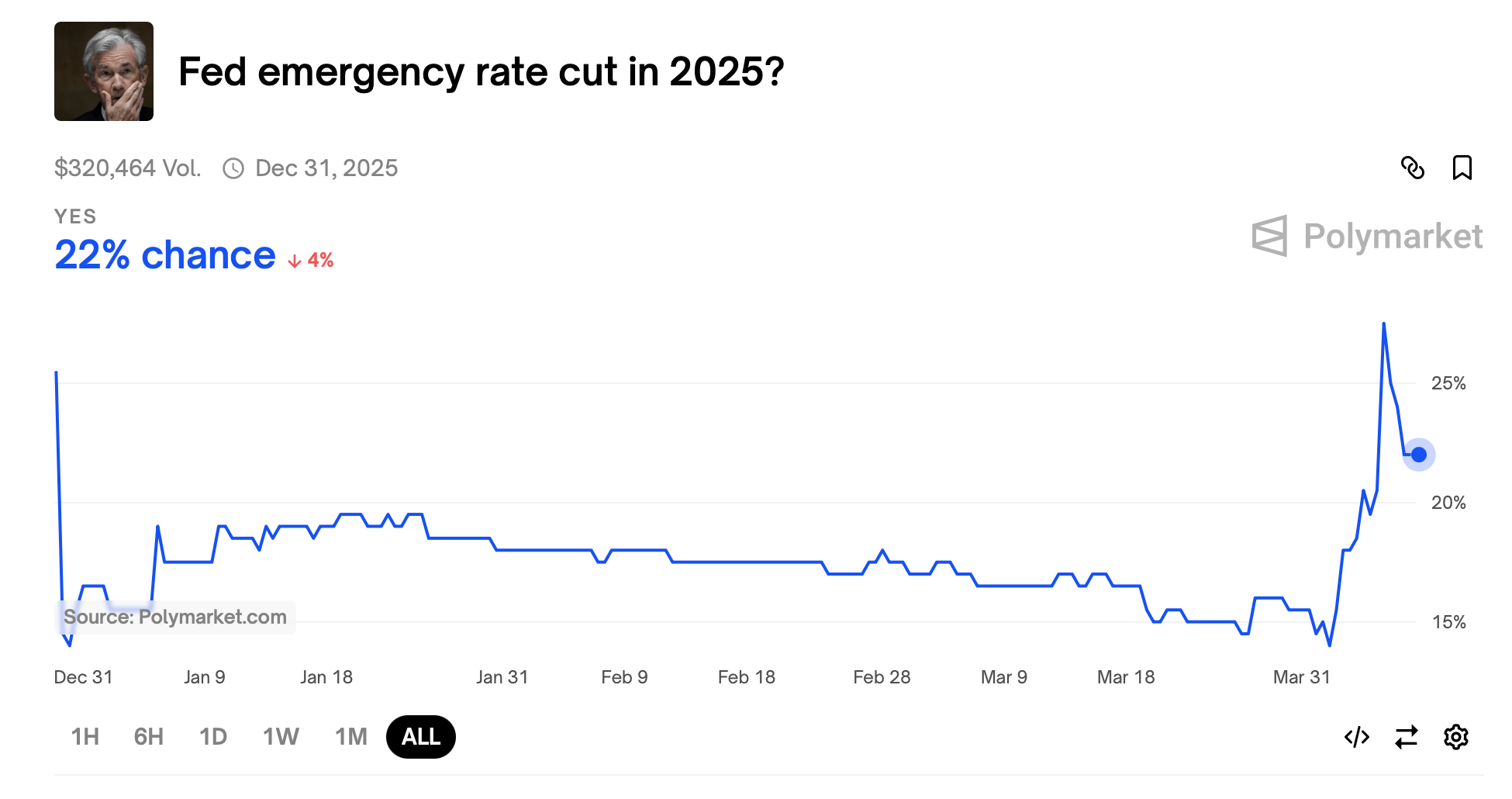

On the predictions platform known as Polymarket, the likelihood of no alteration stands at 75%, whilst Kalshi’s prediction market similarly suggests a 75% chance that rates shall remain steadfast. Polymarket is also hosting a wager on the prospect of an emergency federal funds rate cut, currently reflecting a rather modest 22% probability. How thrilling! 🎩

Emergency rate cuts were last employed during the tumultuous days of March 2020, at the very onset of the pandemic. Presently, the volume on Polymarket’s emergency rate cut bet rests at a staggering $320,464. One must wonder, what a time to be alive! 😂

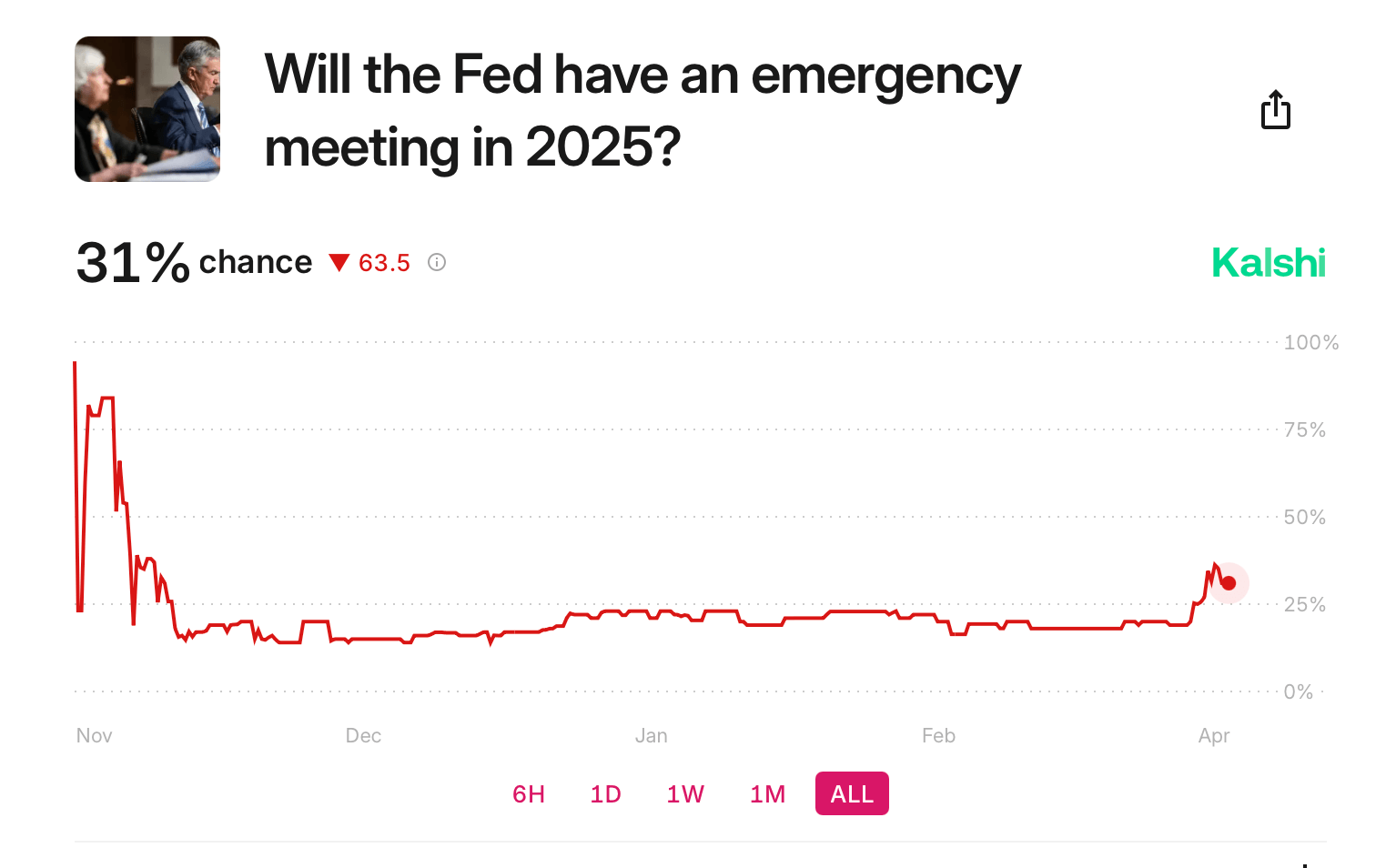

Kalshi, in its infinite wisdom, offers a similar wager, albeit with a higher figure, presenting a 31% chance priced in. Prior to the pandemic, the last instance of emergency cuts by the Federal Reserve occurred during the financial crisis of 2008. Ah, the memories! 🥴

Mr. Trump, ever the advocate, continues to implore the central bank to lower interest rates, asserting that the current economic conditions present the “perfect time” for such a course of action. How charmingly optimistic! 🙄

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-08 16:57