- In a delightful twist, Bitcoin’s $90 billion stumble remains but a trifling matter amidst the greater turmoil.

- Ah, but worry not, dear reader! The next surge might just ambush us when we least expect it.

Ah, how amusing it is to observe the ever-contradictory market whispers; Bitcoin’s ascent to the illustrious $100k now seems a tantalizing prospect following the recent “trade dump.” Fancy that!

With the U.S. stock market shedding an astonishing $11 trillion in market cap since the 19th of February—while 54.55% of this plummet hastened post the so-called ‘Liberation Day’—one must wonder: what wrath has befallen these equities?

Lo and behold, Gold (XAU) reached an impressive Q2 zenith of $3,143 per ounce, only to tumble nearly 3% like a clumsy dancer, wiping out a staggering $520 billion in market capitalization since April’s ill-fated 2nd day. As for our dear Bitcoin [BTC], its correction stands at a meager 5.17% from its $1.74 trillion valuation. Oh, the irony!

Indeed, a $90 billion slip is but a peculiar trifle in the face of the vast market whirlpool. Hence, Bitcoin’s ever-growing divergence from the reckless spiral of risk assets serves to fortify its long-term standing. One marvels at such audacity!

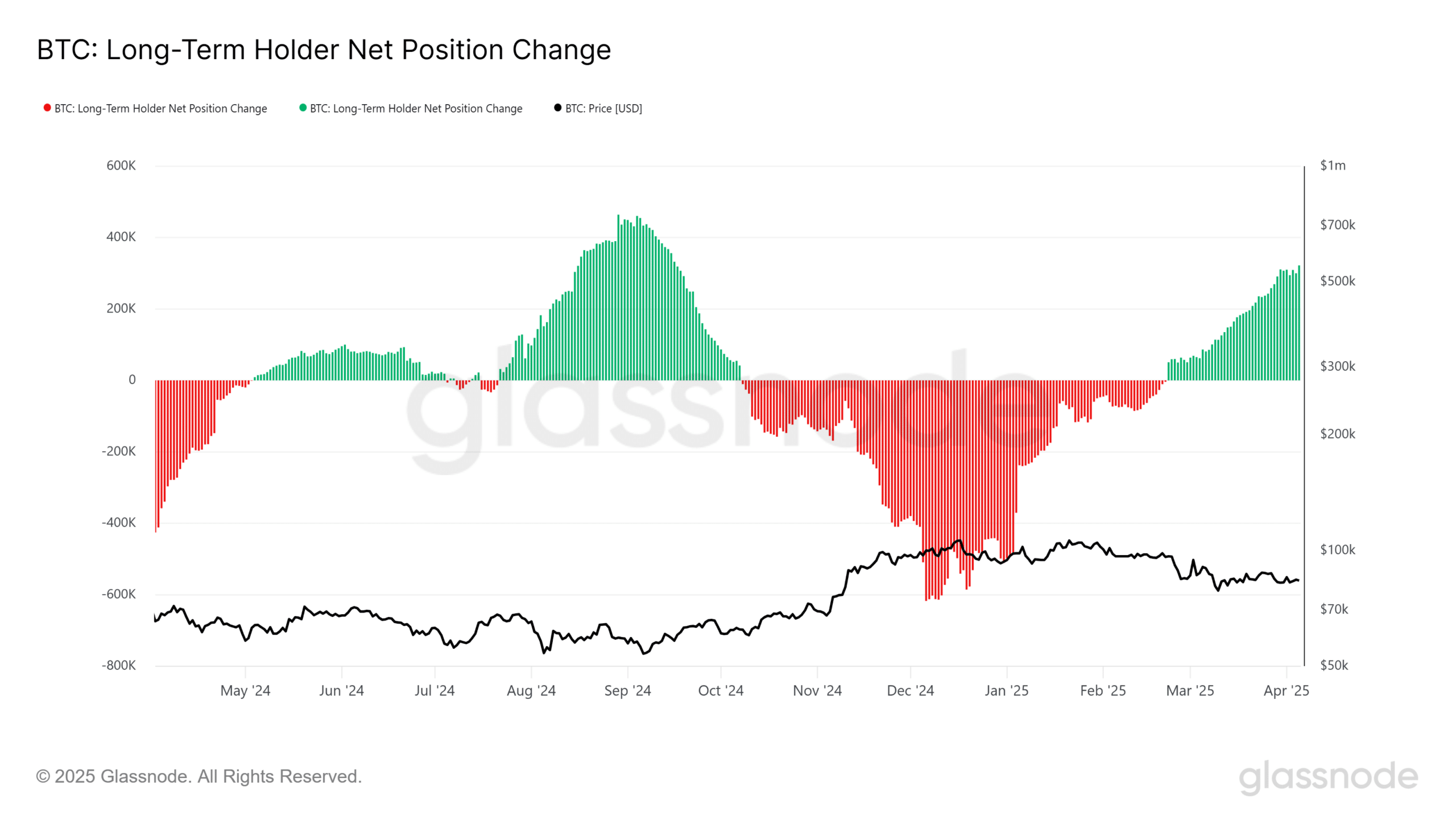

Long-term holders clench their pearls, reinforcing their cherished convictions

Meanwhile, those short-term holders—yes, the ones with such ephemeral plans—have dwindled to a delightful low of 3.7 million BTC, parading approximately 3 million BTC in realized losses as they trudge through Bitcoin’s retracing fortunes from its ethereal $109k summit.

In a baffling contrast, the long-term holders are on a charming spree, expanding their stashes with the enthusiasm of a child at a candy store.

The Net Position Change metrics reveal a daring accumulation at a rather extravagant average cost of $84k per BTC. Conviction, it appears, runs deep among these steadfast souls!

As we return to the present moment, alas, Bitcoin languishes beneath the $85k threshold, a vital point for the feeble-hearted. Nevertheless, the long-term holders’ continued accumulation and Bitcoin’s widening separation from U.S. equities suggest an exhilarating crossroads, poised for a leap towards $100k!

What could possibly lead us to this glorious state? Oh, merely capital making a thrilling escape from risk assets—yes, even the so-called safe havens—into BTC’s welcoming embrace.

Germany, in an act worthy of note, has begun retrieving 1,200 tonnes of gold, valued at an astonishing $124 billion, from New York reserves. Should a fleet of nations join this gallant retreat, Gold’s days as a global sanctuary might well become numbered.

With Bitcoin steadfastly-resistant while the S&P500 weeps away $4 trillion in a week—oh, what a melodrama!—and Gold’s luster fading, our dear BTC finds itself in prime position to draw eager capital from the pockets of governments, institutions, and retail investors alike. But my, what a spectacle!

Behold, Bitcoin’s haven status once more in the limelight!

In the short term, to ensnare those fateful FOMO-ridden souls, Bitcoin needs to surmount the resistance at $85k–$87k, a hallowed zone where speculation dances with profit-taking. It has been a dizzying month since these heights were last flirted with.

Thus, one must meticulously construct a sturdy bid wall within this alluring range for a bullish waltz to continue. Yet, it remains unlikely that we shall witness a taxing dip below $80k.

Since the 12th of March, our illustrious whale cohorts—those holding more than 1K BTC—have engaged in a spirited accumulation, sending their riches to a three-month high. The audacity of these deep-pocketed titans absorbing supply suggests that a retest of the $77k support might be as improbable as a cat embracing a bath.

Bitcoin’s remarkable resilience in the face of macro chaos only adds fuel to its narrative as a refuge amidst market tumult. Ah, what a tangled web we weave!

As long as fervor remains unwavering, Bitcoin’s path to a six-figure revelation waits in the wings. With U.S. stocks teetering amid rising tariff turmoil, one cannot help but anticipate a swell of capital inflows. How delectably chaotic!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Ireland, Spain and more countries withdraw from Eurovision Song Contest 2026

- Clash Royale Witch Evolution best decks guide

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- JoJo’s Bizarre Adventure: Ora Ora Overdrive unites iconic characters in a sim RPG, launching on mobile this fall

- ‘The Abandons’ tries to mine new ground, but treads old western territory instead

- How to get your Discord Checkpoint 2025

- LoL patch notes 25.24: Winter skins, Mel nerf, and more

- eFootball 2026 v5.2.0 update brings multiple campaigns, new features, gameplay improvements and more

2025-04-06 14:19