- As speculative capital once again finds its way into high-beta assets, the memecoin supercycle narrative heats up, much to the bemusement of seasoned investors.

- Shiba Inu (SHIB), a notorious memecoin, has a history of parabolic rallies fueled by speculative interest and liquidity surges, much like a cat chasing its own tail 🐱.

The memecoin market, ever so charmingly unpredictable, continues to outperform as major altcoins struggle under the looming shadow of Bitcoin’s [BTC] dominance. Memecoins, as if in a cheeky revolt, have registered a 6% increase in market capitalization amid BTC’s consolidation, a move that would make even the most cynical trader raise an eyebrow. 😏

Shiba Inu [SHIB], a prime example of a high-beta asset in this sector, has historically thrived during Bitcoin’s range-bound phases, much like a weed that flourishes in the cracks of a sidewalk. Speculative capital inflows have only fueled its parabolic expansions, a pattern that seems to repeat with each Bitcoin cycle.

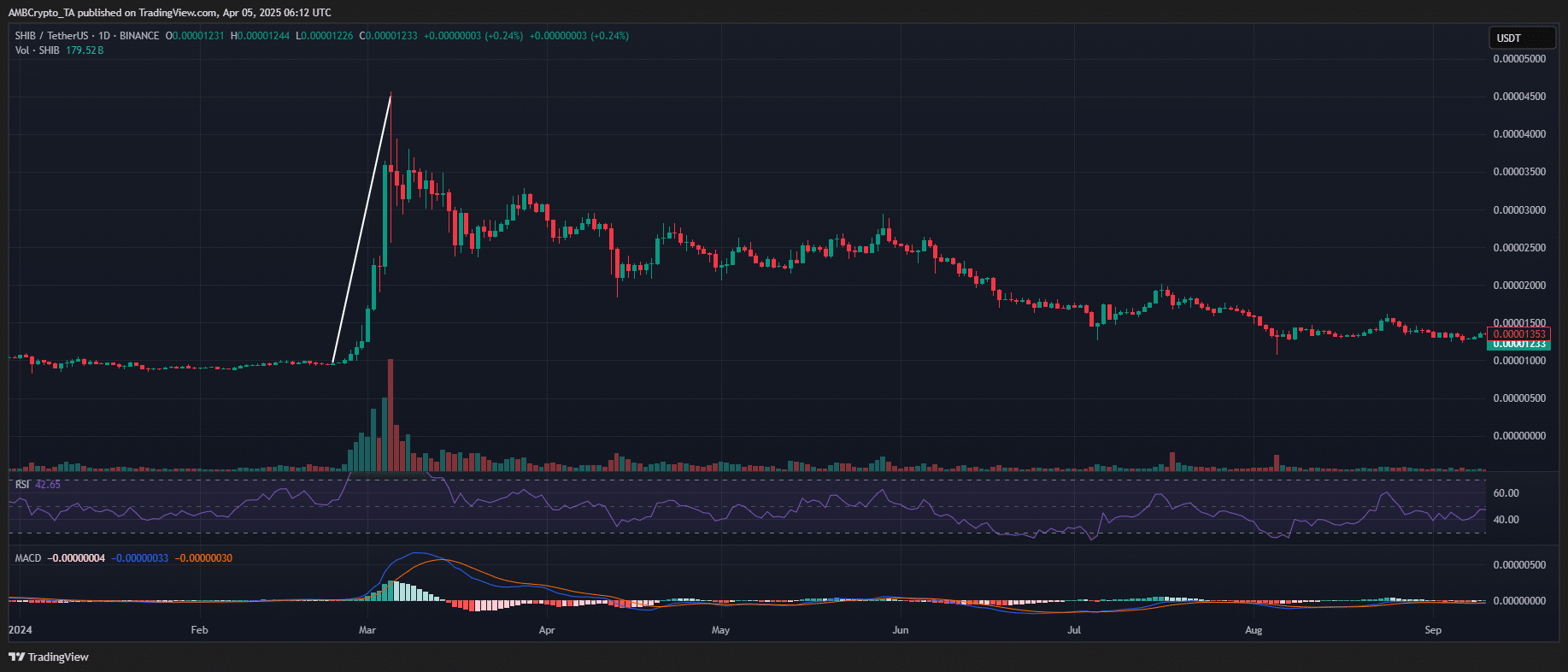

Notably, in early March 2024, SHIB printed three consecutive higher highs, each delivering a 30%+ intraday surge. This breakout from a prolonged accumulation phase was a testament to the fickle nature of memecoin speculation, a game of cat and mouse with the market’s liquidity. 🐭

Meanwhile, the persistent bid liquidity and sustained bullish sentiment around Bitcoin during that cycle preserved its structural range, preventing a broader market correction. This allowed capital to rotate into higher-volatility assets, much like a river finding the easiest path to the sea.

This divergence highlighted memecoins’ tendency to decouple from broader market flows, making them the go-to speculative assets during risk-on market cycles. A similar setup is now emerging, with the recent 6% uptick in memecoin market capitalization aligning with Bitcoin dominance approaching an overheated threshold, while high-cap altcoins remain under pressure. 🌡️

Catalyst for a memecoin supercycle?

Interestingly, SHIB’s exchange reserves across both spot and derivatives markets have plunged to a four-year low, signaling a tightening supply dynamic. It’s as if the market is holding its breath, waiting for the next big move. 🏃♂️💨

Simultaneously, an AMBCrypto report reveals that 80% of SHIB’s total supply is now under long-term holder (LTH) control, indicating strong accumulation and reduced sell-side liquidity. It’s a bit like hoarding the last cans of beans before a storm. 🥫

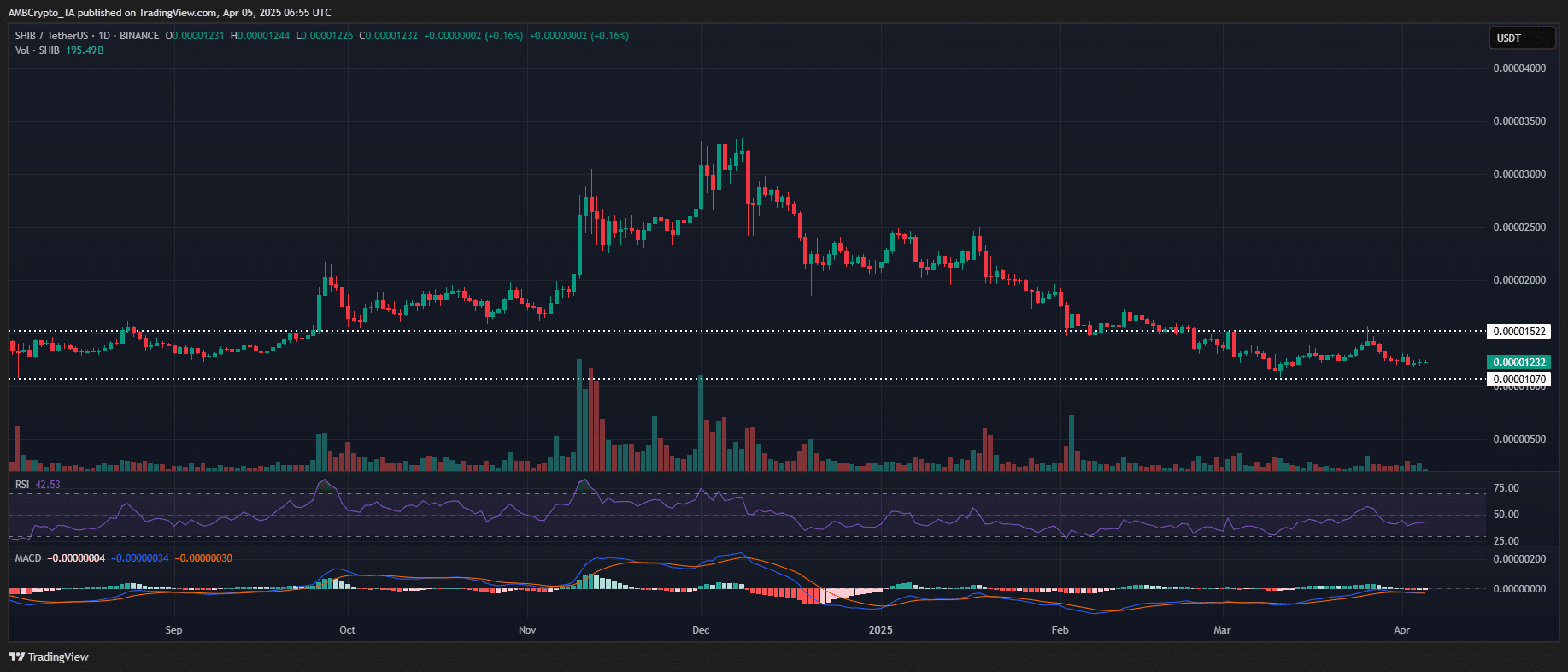

On the daily timeframe, SHIB has been in a month-long consolidation around $0.00001230, establishing a range-bound accumulation zone. This patience is almost admirable, like a panther stalking its prey. 🐆

Notably, high-cap memecoins are also exhibiting similar range-bound structures, suggesting a ‘sector-wide’ liquidity reaccumulation phase. It’s as if the market is preparing for a grand performance, with the curtain about to rise. 🎭

Supporting this narrative, Coinglass data reveals that SHIB’s liquidity profile and market structure resemble early 2024 conditions, signaling Q2 upside potential. However, to distinguish sustainable momentum from short-term “hype,” consistent monitoring of liquidity flows, open interest, and exchange reserves will be critical. 📊

For now, both on-chain analytics and market structure dynamics suggest that memecoins are primed for a supercycle, outperforming traditional altcoins. With tightening supply, increasing LTH dominance, and rising speculative inflows, the memecoin sector remains the high-volatility play to watch in Q2 2025. 📈💥

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

2025-04-05 14:19