Bitcoin (BTC) dances on the edge of $80K, but the big fish in the pond are on strike. No buying, no selling—just a whole lot of thinking. Large holders have been idle for over a week, keeping the market in a holding pattern.

Technical charts like the Ichimoku Cloud and EMA lines are like a see-saw, tipping back and forth, showing both bullish and bearish vibes. As BTC hovers near key support and resistance levels, April could decide if it’s a breakout or a deeper dive.

Whales Aren’t Buying, But They’re Not Selling Either

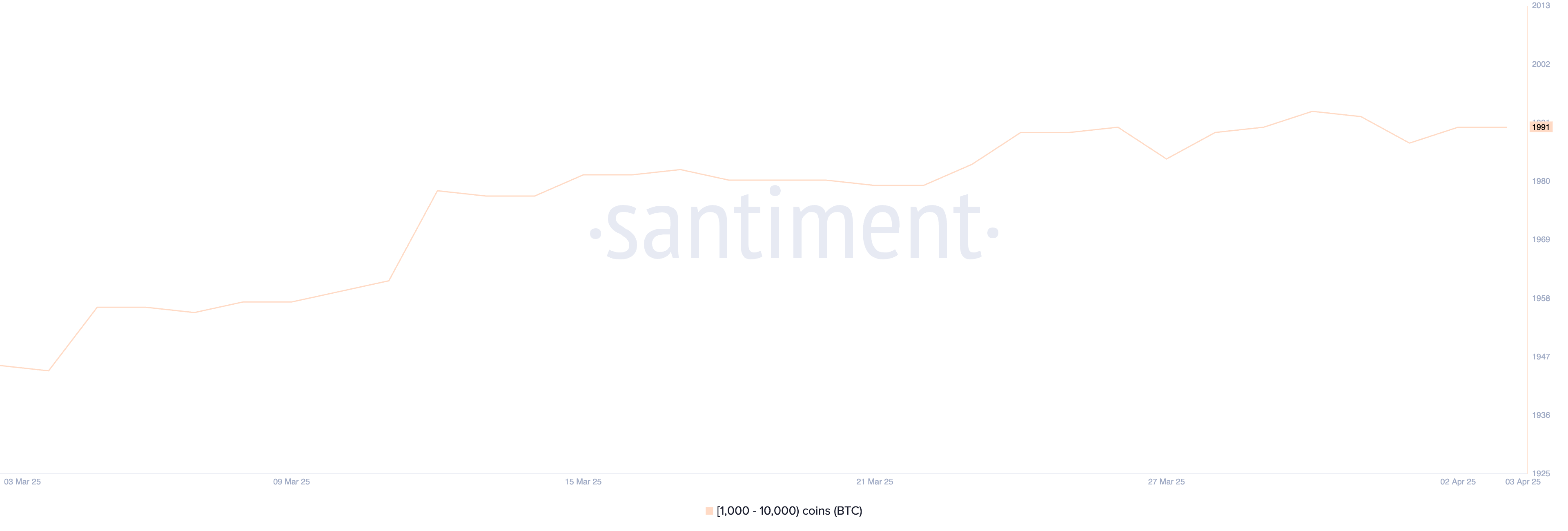

The number of Bitcoin whales—those holding between 1,000 and 10,000 BTC—has stayed at 1,991 since March 24. This stability is like a crypto cat nap, with big investors waiting for the perfect moment to pounce.

When whales accumulate BTC, it’s a sign they believe in future gains. But when they sell, it’s a sign of impending doom. With no movement, the market is in a holding pattern, waiting for the next big move.

Tracking these whales is key because they can move the market with a single click. Right now, they’re just chilling, waiting for the right signal to make their move.

BTC Ichimoku Cloud: A See-Saw Battle

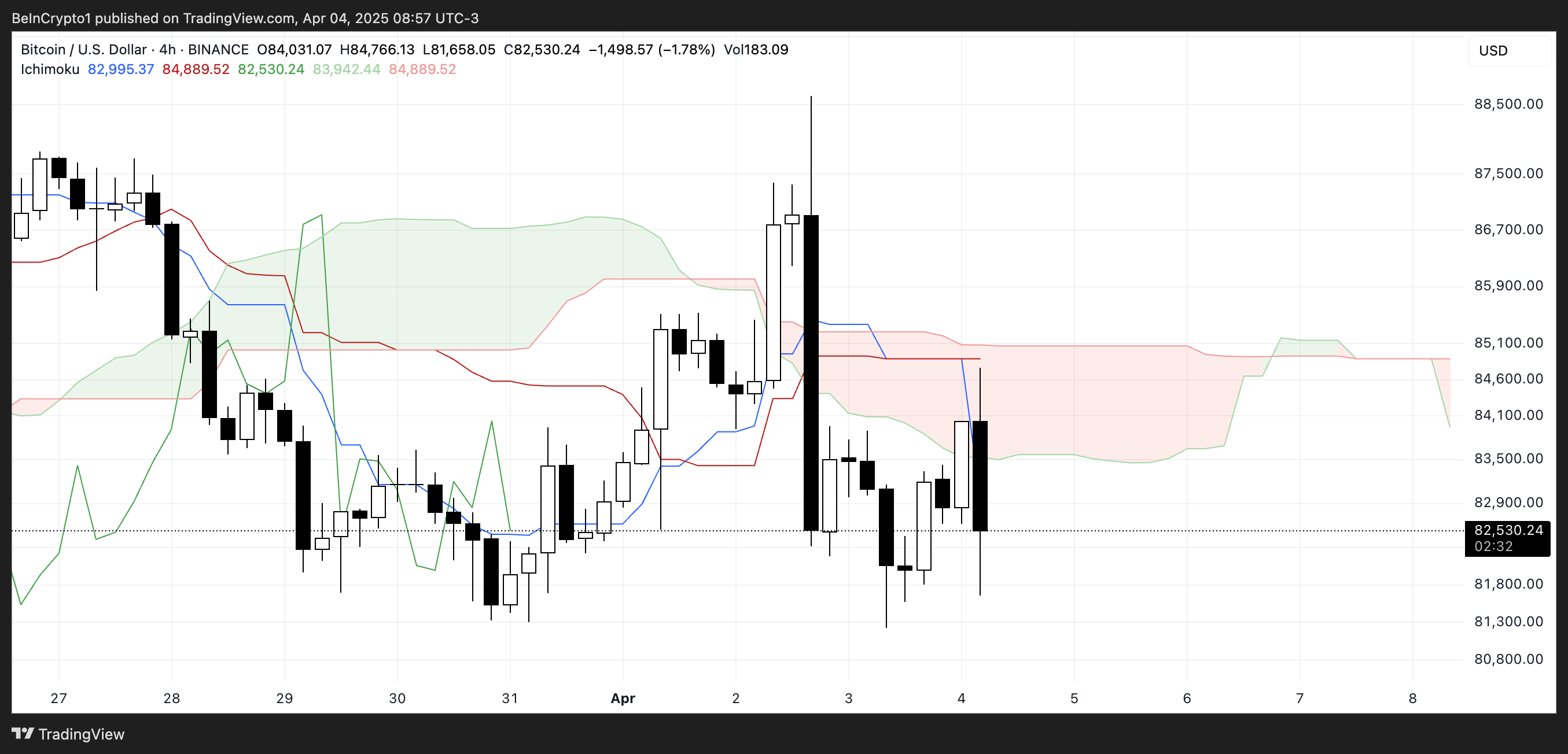

The Ichimoku Cloud setup for Bitcoin shows a mixed but slightly cautious sentiment. The price dipped below the red baseline but was rejected, showing that bullish momentum is lacking.

The blue conversion line is now trending downward, reflecting short-term bearish momentum. Meanwhile, the Leading Span A is flattening, while Leading Span B remains horizontal, forming a thin and neutral cloud. This suggests the market is indecisive and lacks strong trending momentum.

If the price can break back above the cloud, it could signal renewed bullish strength. But if it continues to be rejected, a corrective or sideways structure is likely. The Ichimoku setup is a clear sign of uncertainty.

Can Bitcoin Break $88K in April?

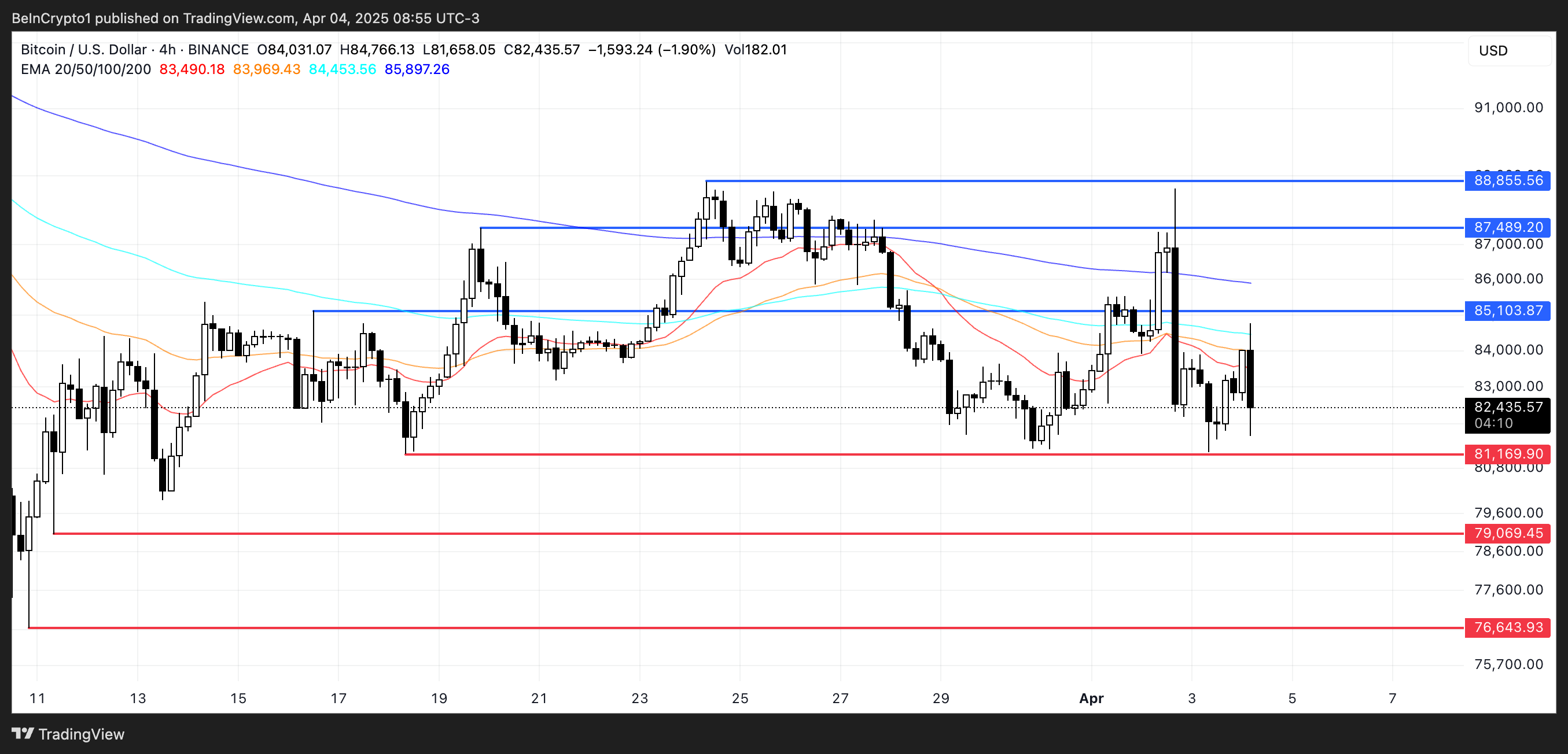

Bitcoin’s EMA structure is still bearish, with longer-term EMAs above the shorter-term ones. However, the recent upward movement in the short-term EMAs suggests a potential rebound.

If this short-term strength develops into a sustained move, BTC could test resistance at $85,103. A successful break above this level could open the door to higher targets at $87,489.

But if the rebound falters, downside risks remain. The first key level to watch is the support at $81,169. A drop below this could see BTC fall under the psychological $80,000 mark, with the next target around $79,069.

The trade war between China and the US is heating up. If Bitcoin fails to build enough momentum, the bearish trend could intensify, sending BTC further down toward $76,643.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- Mobile Legends: Bang Bang (MLBB) Marcel: Hero overview, skill analysis, and release date

2025-04-05 12:31