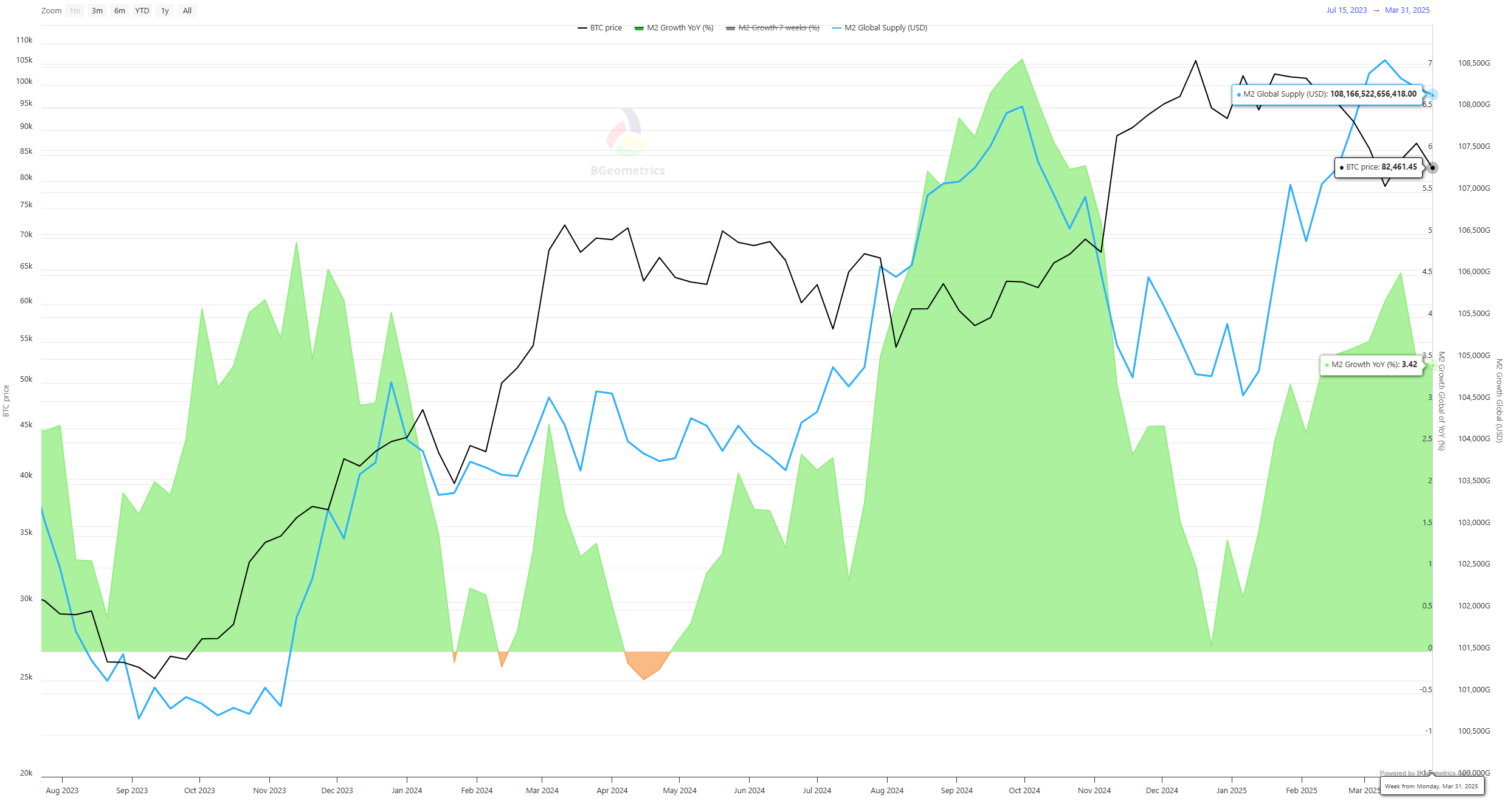

In the grand theater of finance, the M2 money supply has pirouetted to an unprecedented $108.4 trillion, igniting a flurry of speculation about Bitcoin’s next act. 🎭

As the curtain rises, we find ourselves amidst a cacophony of economic uncertainty, courtesy of former President Donald Trump’s audacious “Liberation Day” tariffs and China’s swift countermeasures, which have sent global markets into a delightful tailspin. 🎢

What is M2 and Why Does It Matter for Bitcoin?

Despite the tempestuous waves of volatility crashing around us, Bitcoin’s average value has remained as steady as a rock in a hurricane. 🌪️

Analysts, those brave souls, argue that Bitcoin’s recent fluctuations are merely reflections of macroeconomic fears and the ever-changing long/short ratios. But fear not, dear reader, for the largest cryptocurrency is far from a bear market! 🐻

This resilience is largely attributed to the historical dance between rising M2 levels and Bitcoin’s spectacular rallies. 💃

M2, you ask? It’s a broad measure of a country’s money supply, encompassing physical cash, checking and savings deposits, and other liquid assets that can be swiftly transformed into cash. 💰

When M2 rises, it’s like a signal flare for greater liquidity in the financial system. More money is on the prowl, seeking refuge in riskier assets like equities, real estate, or our beloved Bitcoin. 🏦

Historically, surges in M2 have heralded major Bitcoin rallies. After the COVID-era stimulus extravaganza of 2020-2021, the US M2 supply skyrocketed by over 25%. 🚀

This surge coincided with Bitcoin’s meteoric rise from under $10,000 in mid-2020 to a staggering high of over $69,000 by November 2021. Analysts are whispering of a similar pattern today, albeit with a slight delay. ⏳

“Market proponents say that Trump’s tariffs are primarily a negotiation strategy, and their effect on businesses and consumers will remain manageable. Adding to the uncertainty are the inflationary pressures that could challenge the US Federal Reserve’s rate-cutting outlook. Also, resolving the debt ceiling remains a pressing issue, as the Treasury currently relies upon ‘extraordinary measures’ to meet US financial obligations. The exact timeline for when these measures will be exhausted is unclear, but analysts anticipate they may run out after the first quarter,” said Maksym Sakharov, Co-Founder of WeFi Deobank.

Interestingly, Bitcoin’s price often lags behind global M2 growth by about two months. ⏲️

With M2 accelerating since late February and now reaching its zenith, market watchers are suggesting that Bitcoin could experience a delayed but robust upside if liquidity continues to flow. 🌊

However, let’s not forget the macroeconomic headwinds that could dampen our near-term gains. Trump’s tariff shock and China’s tit-for-tat have already triggered the steepest Wall Street losses in five years. 📉

$BTC hodlers need to learn to love tariffs, maybe we finally broke the correlation with Nasdaq, and can move onto the purest form of a fiat liquidity smoke alarm.

— Arthur Hayes (@CryptoHayes) April 4, 2025

Investors might hesitate to allocate capital to high-volatility assets until trade tensions cool down. 🥵

Yet, with M2 surging and Bitcoin’s supply capped, the stage is set for a renewed bullish performance. That is, of course, if historical patterns hold and markets regain their confidence. 🎉

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-05 02:16