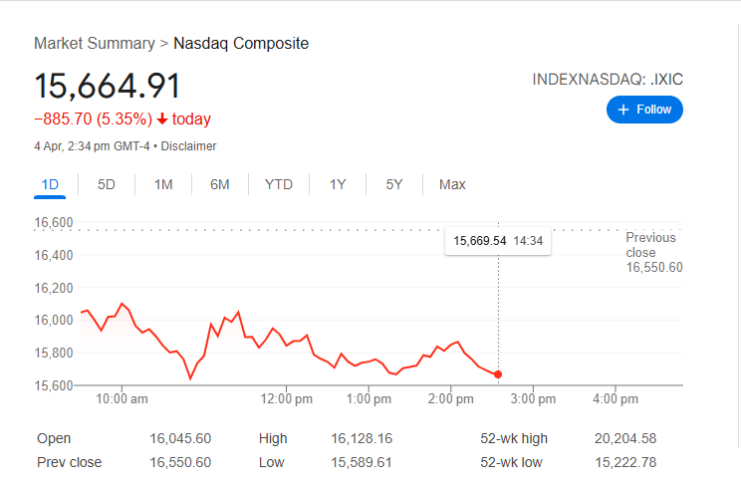

Oh, how the mighty have fallen! On a gloomy Friday, the American stock market 🦁lays wounded, drenched in a sea of red after a fierce tariff skirmish between the U.S. and China. The Nasdaq 🐻tumbles by 5.36%, shedding a whopping 888.48 points, the Dow Jones Industrial Average stumbles by 4.64%, plummeting by around 1,800 points, and the S&P 500 nosedives by 5.20%, losing about 280.09 points. Yet, amidst this chaos, a peculiar sight unfolds…

Lo and behold, the crypto market 🚀stands tall, defying gravity! At the time of writing, the total crypto market cap hovers at a robust $2.66 trillion, boasting an intraday gain of 1.53%. It seems the crypto beast is flexing its muscles, determined not to join the bear 🐻party of NASDAQ and DOW. But why, oh why, does crypto remain so resilient? Let us embark on a quest to unravel the mystery!

Investors’ Sentiments: A Shift in the Crypto Cosmos

The secret lies in a seismic shift in the hearts and minds of investors, governments, banks, and institutions. In recent years, crypto has garnered mainstream acceptance, akin to a knight being welcomed into the royal court. From the launch of Bitcoin and Ethereum ETFs to cryptocurrency becoming a part of the U.S. Strategic Reserve, these events have transformed the perception of crypto, casting it in a new light. Institutions are pouring in like never before, viewing crypto as a digital fortress against market turmoil. However, a twist in the tale awaits…

The Bear Market Lurks: A Tale of Two Perspectives

Amidst the positive vibes, a dark cloud hovers. Reports suggest Bitcoin plunged to $81,498, succumbing to the pressure of Trump’s tariff tantrums. Altcoins lost over $50 billion in market cap in mere days. Yet, today’s market bounce offers a glimmer of hope, presenting a buy-on-dip opportunity for the brave-hearted. Bitcoin’s price sprung back from the critical support level of $81000, leaving many scratching their heads. But beware, dear reader, for the bear market still lurks in the shadows.

CryptoQuant data reveals a chilling truth: 1,057 Bitcoins, dormant for 7-10 years, have suddenly awakened. Could this be a sign of long-term holders ready to unleash their wrath upon the market? Furthermore, on-chain data paints a grim picture, depicting a decline in active wallet addresses and new wallet creations. It appears investors have adopted a cautious stance, with the market poised for a potential liquidation frenzy.

The fear and greed index remains at a meager 25 points, a testament to the prevailing negativity among investors. Thus, tread carefully, for this market rebound may well be a bull trap, luring the unwary into its clutches.

Conclusion: As the stock market trembles, crypto emerges as a beacon of resilience. However, bearish signals loom on the horizon. Investors, be wary, for changing sentiments and on-chain indicators hint at a temporary reprieve. Despite crypto’s growing mainstream acceptance, the road ahead remains uncertain. May the crypto beast continue to defy the odds, but let us not forget the lessons of history…lest we repeat them.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Witch Evolution best decks guide

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- Clash Royale Furnace Evolution best decks guide

2025-04-04 22:29