Well, well, well! Ethereum is doing its best impression of a sinking ship, trading below the $1,900 mark like it’s auditioning for a role in “Titanic 2: The Ethereum Edition.” 🚢💔 With bullish momentum fading faster than my will to exercise, market sentiment is about as cheerful as a cat in a bathtub. After a brief attempt to stabilize, ETH has decided to take a nosedive, down over 35% since late February. Talk about a dramatic exit! 🎭

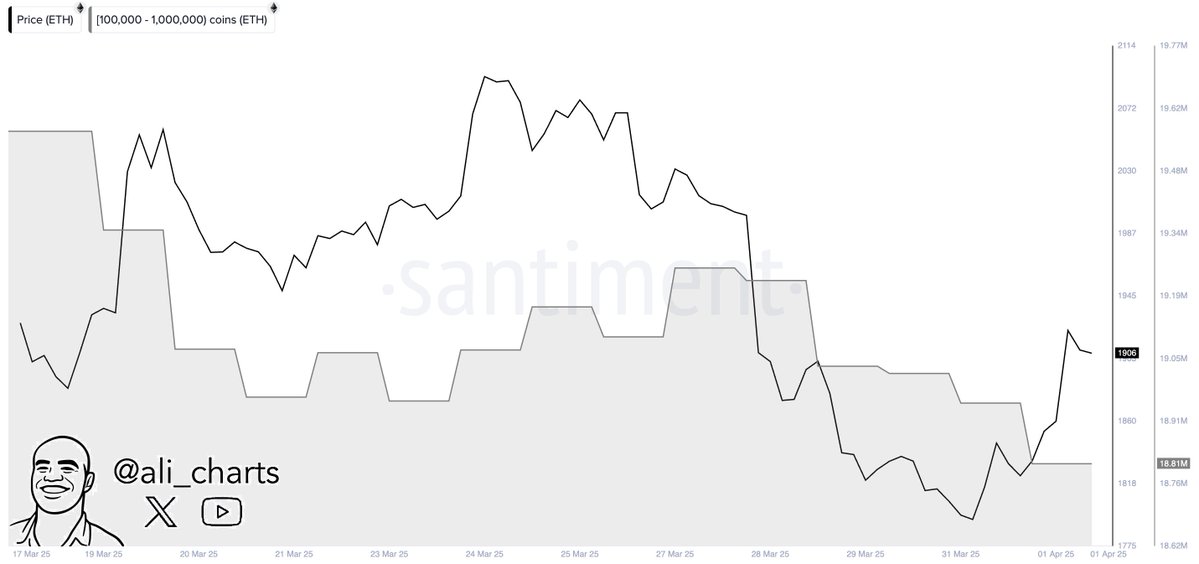

Now, hold onto your hats, folks! According to the crystal ball of Santiment, our friendly neighborhood whales have dumped a whopping 760,000 ETH in just two weeks. That’s right, folks! These big fish are swimming away, and it’s making everyone else in the pond a little nervous. When whales start selling, it’s like watching a stampede of elephants in a china shop—chaos ensues! 🐘💥

With the economy wobbling like a three-legged table and Ethereum’s support levels looking shakier than a tightrope walker on a windy day, the outlook for ETH is about as stable as a politician’s promise. Bulls need to act fast, or they might find themselves in a lower demand zone—yikes! Until then, the combination of fading demand, technical weakness, and aggressive whale selling is casting a dark cloud over Ethereum’s future, leaving traders on edge like a cat near a dog park. 🐱🐶

Ethereum Whale Selling Grows and Market Confidence Fades

Ethereum is showing signs of sustained selling pressure, and the broader market is starting to accept that the current downtrend may be here to stay—like that one relative who overstays their welcome at Thanksgiving dinner. With ETH trading well below key resistance levels and struggling to hold above $1,900, confidence among traders is about as high as a limbo stick at a retirement home. 🕺

But wait! There’s a glimmer of hope! Some investors believe Ethereum could mount a comeback, especially if the broader conditions stabilize or if ETH finds strong support around current levels. However, that optimism is fading faster than my enthusiasm for Monday mornings. ☕️

Top analyst Ali Martinez shared insights on X, revealing that whales have sold approximately 760,000 ETH over the past two weeks. This significant offloading by large holders adds to the ongoing bearish pressure and suggests that confidence among big players is declining. Whale movements are closely watched, like a hawk eyeing a field mouse—one wrong move, and it’s game over! 🦅

But hey, markets are like a rollercoaster—full of ups and downs! If Ethereum can hold key support zones and macroeconomic conditions begin to calm, those same large players currently selling might just jump back in, hoping for the next big thrill ride. For now, though, Ethereum is in a fragile state, and continued selling is likely to dominate the short-term outlook. Bulls, it’s time to step up or watch ETH slide further into the abyss! 🎢

Bulls Struggle to Reclaim Key Levels

Ethereum is currently trading at $1,880 after several days of weak price action, caught in a tight range between $2,000 resistance and $1,750 support. It’s like watching a hamster on a wheel—lots of effort, but not going anywhere! Despite multiple attempts, bulls have failed to reclaim the critical $2,000–$2,200 zone—a level that would signal strength and potentially mark the beginning of a broader recovery phase. Instead, ETH remains trapped in a downtrend, with momentum continuing to favor the bears. 🐻

The inability to push higher is putting bulls in a vulnerable position. With Ethereum now hovering just below the $1,900 level, the coming days are crucial. If ETH fails to hold above this mark and can’t break back above $2,000 with conviction, we might be looking at a sharp drop—like a bad haircut! Such a move could lead to a retest of the lower $1,700s or even deeper, especially if broader market sentiment remains negative. 😱

As macroeconomic instability and market uncertainty persist, investors are growing cautious, and risk appetite continues to fade. For Ethereum to avoid a deeper selloff, bulls must step in quickly, reclaim lost ground, and reestablish confidence above the $2,000 level. Until then, the path of least resistance appears to remain to the downside—like a bad joke that just keeps getting worse! 🎤

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-04-02 20:12