- Circle crypto, darling of the NYSE, plots debut under the enigmatic ticker “CRCL.”

- Ripple or Coinbase may just throw a lifeline to Circle post-IPO shenanigans.

Oh, Circle, you cunning issuer of the USDC stablecoin, is it a bird? Is it a plane? No, it’s an IPO!

The company has, with a flourish, submitted its prospectus to the SEC, aiming to make a splash on the New York Stock Exchange with the rather catchy ticker symbol “CRCL.”

This marks Circle’s second foray into the public arena after a rather unfortunate SPAC fiasco in 2022—those pesky regulatory hurdles!

Circle’s Revenue: A Rollercoaster Ride

Backed by the financial titans JPMorgan Chase and Citigroup, Circle eyes a valuation of a whopping $5 billion—champagne problems, indeed.

Alas, as Circle preens for its IPO debut, whispers of financial wobbles are in the air.

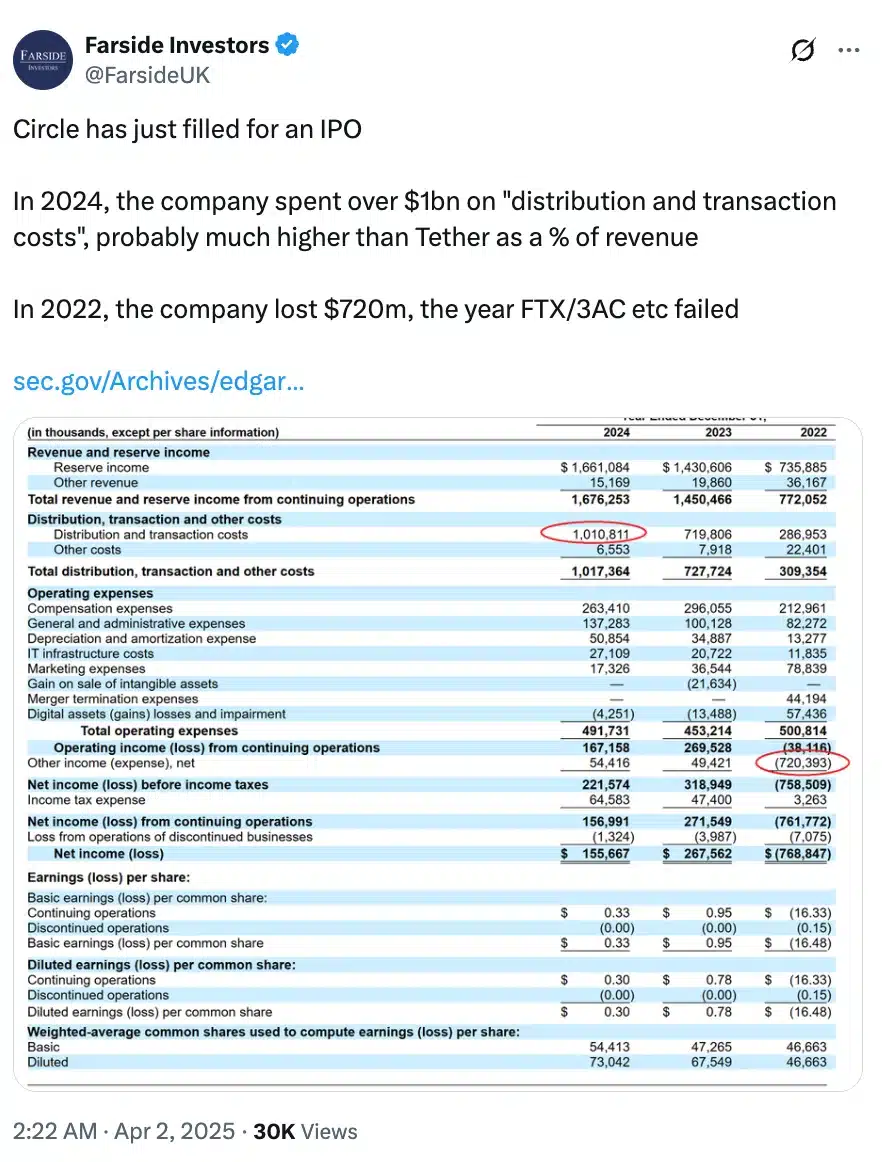

In 2024, Circle reported a rather splendid $1.68 billion in revenue and reserve income, up from $1.45 billion in 2023 and $772 million in 2022. Bravo!

But wait! Its net income took a rather ungraceful dive to $156 million—a 42% nosedive from the previous year’s $268 million. Tut-tut!

Critics: Circle’s Growth, A Puzzling Affair

Matthew Sigel, the Head of Digital Assets Research at VanEck, points out a 29% EBITDA plunge, blaming it on, oh, the usual suspects: rapid expansion, costly integrations, and the discontinuation of revenue streams like Circle Yield. Quelle horreur!

These financial hiccups have sparked doubts about Circle’s valuation and longevity, making its IPO a rather dicey game of investor confidence.

Sigel muses further,

“Restructuring, legal settlements, and acquisition-related expenses have all had a delightful part to play in the EBITDA and net income decline, amidst the revenue revelry.”

And Farside Investors chime in with their two cents,

Contrarians: A Different Tune Altogether

Wyatt Lonergan, General Partner at VanEck, paints a rather mixed picture of Circle’s IPO trajectory.

In a sunny scenario, Circle could ride the stablecoin wave and strategic partnerships to new heights. But in a gloomier forecast, market miseries might push Circle into the arms of Coinbase.

Lonergan hints,

“Circle IPOs, the market tanks, Circle stock plummets. Business blunders cited. Coinbase scoops up Circle at a steal. USDC is theirs at last. Coinbase acquires Circle, and the IPO dream dies.”

USDC vs. USDT: The Battle Rages On

As Circle soldiers on with its IPO quest, the stablecoin battlefield remains fierce.

Visa on-chain analytics reveals USDT still reigns supreme, with a colossal $422.24 billion in transaction volume in March, leaving USDC’s $248.45 billion in the dust.

But wait! Over the past three months, USDC has expanded its supply by $16.60 billion, dwarfing USDT’s $4.70 billion increase. Could Circle’s IPO tip the scales in USDC’s favor? Stay tuned!

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-02 13:17