Bitcoin ETFs, those darlings of the financial circus, are hemorrhaging funds like a punctured piñata as President Trump’s Liberation Day looms ominously on the horizon.

The crypto markets, ever the drama queens, are cloaked in a shroud of caution, with traders and investors adopting the posture of a cat stalking a particularly elusive mouse. 🐱👤

Bitcoin ETFs: The Great Exodus

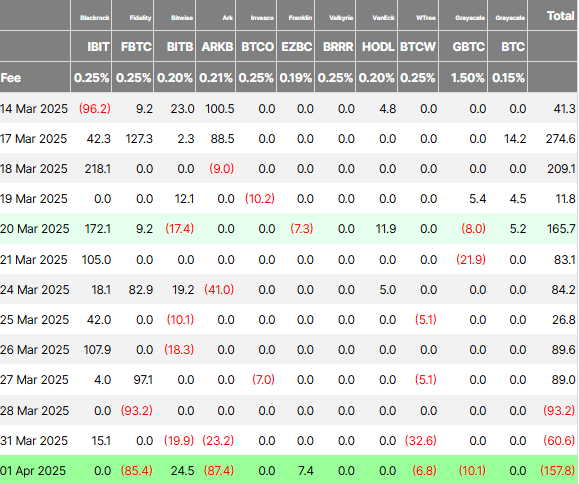

Farside Investors’ data paints a grim picture: two consecutive days of net outflows for Bitcoin ETFs since Monday. Bitwise (BITB), Ark Invest (ARKB), and WisdomTree (BTCW) were the unfortunate stars of Monday’s $60.6 million exodus, with only BlackRock’s IBIT managing to cling to positive flows like a lifebuoy in a stormy sea.

Tuesday, however, was a veritable bloodbath, with outflows nearing $158 million. Bitwise and Ark Invest led the charge, while BlackRock’s IBIT recorded a grand total of zero flows. Ethereum ETFs, not to be outdone, saw net outflows of $3.6 million. Institutional investors, it seems, are channeling their inner Chicken Little. 🐔

“The Spot Bitcoin ETFs saw $157.8 million outflow yesterday. The Spot Ethereum ETFs saw a $3.6 million outflow. Institutions are reducing risk ahead of today’s tariff announcement,” analyst Crypto Rover noted, with the gravitas of a man predicting the apocalypse.

Indeed, sentiment suggests traders are exercising caution, choosing to remain in “wait-and-see” mode. The caution comes ahead of Trump’s Liberation Day announcement, which is due later in the day on April 2. The anticipation is palpable, like the calm before a particularly dramatic storm. 🌪️

With POTUS poised to unveil sweeping new tariffs, traders and investors across financial playing fields wait to see the scope of an onslaught that could spark a global trade war. Specifically, there is generally very little information about the tariffs’ specifics, which creates uncertainty regarding their impact on the broader economy and the crypto market. It’s like trying to predict the weather with a broken barometer. 🌡️

“The White House has not reached a firm decision on their tariff plan,” Bloomberg reported, citing people close to the matter. In other news, water is wet. 💧

Despite the lack of clarity, it is understandable why investors would be cautious considering the impact of previous tariff announcements on Bitcoin price. Meanwhile, analysts predict extreme market volatility, with potential stock and crypto crashes reaching 10-15% if Trump enforces broad tariffs. It’s like watching a high-stakes game of Jenga, but with the global economy. 🎲

“April 2nd is similar to election night. It is the biggest event of the year by an order of magnitude. 10x more important than any FOMC, which is a lot. And anything can happen,” economic analyst Alex Krüger predicted, with the enthusiasm of a man who enjoys roller coasters. 🎢

While sentiment is cautious in the crypto market, some investors are channeling toward gold as a safe haven. A Bank of America survey showed that 58% of fund managers prefer gold as a trade war safe haven, while only 3% back Bitcoin. It’s like choosing a reliable old sedan over a flashy but temperamental sports car. 🚗

These findings came as institutional investors cite Bitcoin’s volatility and limited crisis-time liquidity as key barriers to its safe-haven adoption. Trade tensions have historically driven capital into safe-haven assets. It’s a tale as old as time, or at least as old as the stock market. 📜

With Trump’s Liberation Day announcement looming, investors preemptively position themselves again, favoring gold over Bitcoin. It’s like watching a game of musical chairs, but with assets. 🪑

Nevertheless, despite Bitcoin’s struggle to capture institutional safe-haven flows, its long-term narrative remains intact. This is seen with Bitcoin supply on exchanges dropping to just 7.53%, the lowest since February 2018. It’s like a phoenix, always ready to rise from the ashes. 🦅

When an asset’s supply on exchanges reduces, investors are unwilling to sell, suggesting strong long-term holder confidence. It’s like holding onto a winning lottery ticket, even if the jackpot is still a ways off. 🎫

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Hero Card Decks in Clash Royale

2025-04-02 09:57