- Crypto scam and hack losses nosedive to a mere $28.8 million in March

- Paul Atkins, SEC’s new hope, vows to build a rational crypto regulatory framework

Despite the turbulent year 2025 has been, the crypto world has found a glimmer of hope in the most unexpected of places. 🤑

March Sees a Spectacular Dip in Crypto Scams

Losses from crypto scams, exploits, and hacks took a nosedive to just $28.8 million in March – a breathtaking plunge from February’s sobering $1.5 billion. Much of February’s loss was courtesy of the infamous Bybit hack. 🤦♂️

This sharp decline suggests either improved security measures or, more amusingly, that attackers are simply running out of ideas. 🤔

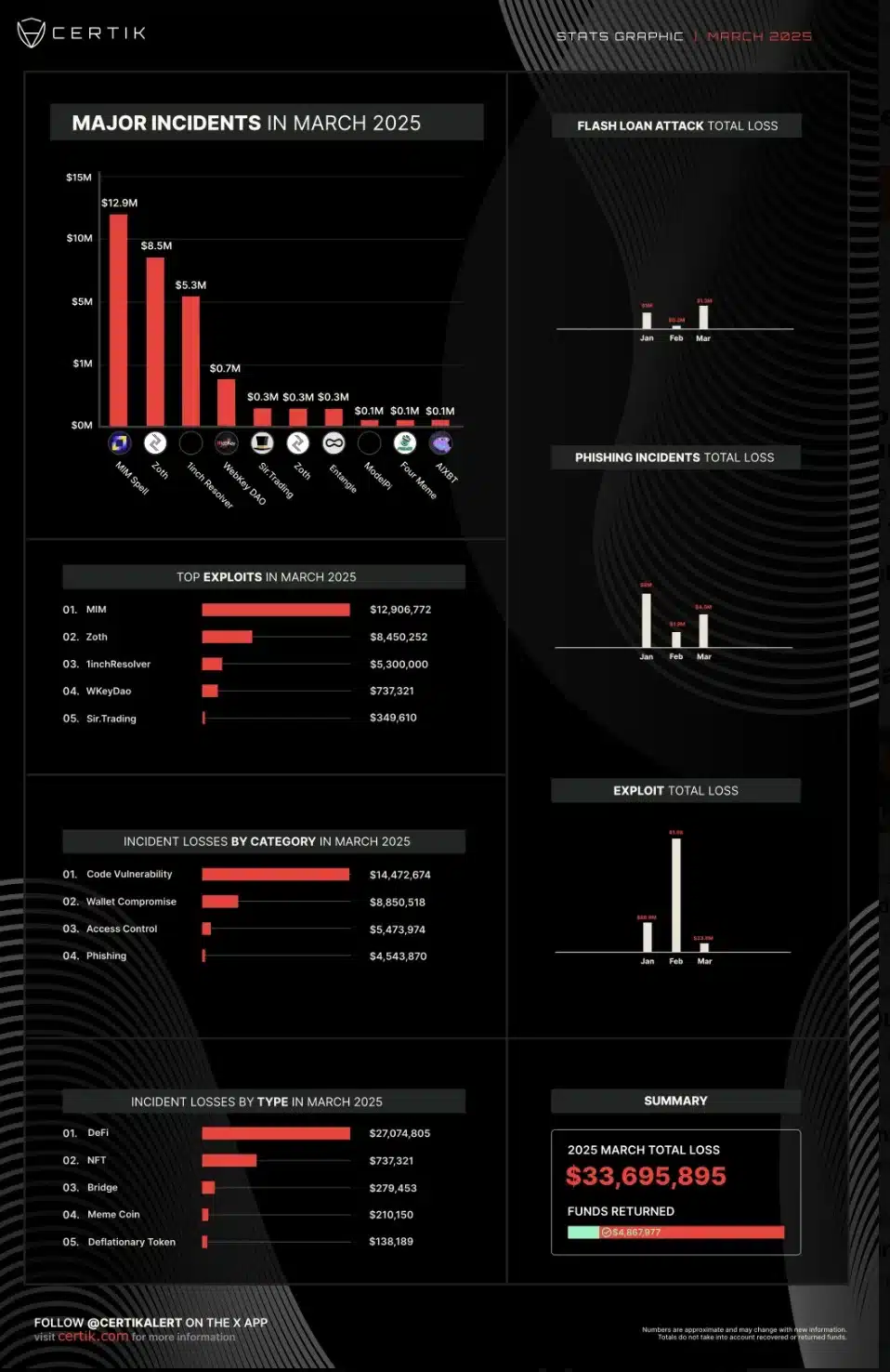

According to data and stats shared in an X post by blockchain security firm CertiK,

“Code vulnerabilities reigned supreme, accounting for over $14 million in losses, while wallet compromises raked in a tidy $8 million.”

One of the more notable March exploits was a $13 million smart contract breach on the 25th, targeting the decentralized lending protocol Abracadabra.money. 🕵️♂️

What Sparked the Decline?

According to a report from a blockchain security firm, the attacker cleverly manipulated the system by borrowing funds, liquidating their own positions, and borrowing again without ever repaying. A real game of financial tag! 🏃♂️

CertiK remarked,

“This was due to the liquidation process not overwriting records in RouterOrder that counted as collateral, allowing the exploiter to falsely borrow additional funds after liquidation.”

In addition to the significant Abracadabra.money exploit, March saw other high-profile losses. The restaking protocol Zoth was breached, with over $8.4 million in assets stolen after the deployer’s wallet was compromised. 😱

While some funds were returned, including a recovery of $5 million by decentralized exchange aggregator 1inch through a bug bounty agreement, the total losses for the month were over $33 million. A notable addition to this tally was an unreported loss of 400 Bitcoin, valued at $34 million, by an unidentified Coinbase user. 🙀

Phishing scams and spoofing crypto exchanges may have contributed to over $46 million in potential losses, emphasizing the ongoing risks in the crypto ecosystem. 🚨

Is the Trump Admin Proving to Be Better Than Biden’s?

These episodes highlight a shift in the regulatory approach under the Trump administration compared to the Biden administration’s more stringent stance. 🤝

Hence, with mounting concerns over crypto scams and security breaches, the introduction of a well-defined regulatory framework could significantly reduce such losses. And who better to lead this charge than Paul Atkins, nominated by President Trump for the SEC chair?

As expected, in his statement during the U.S. Senate Banking Committee hearing, he put it best when he said,

“A top priority of my chairmanship will be to work with my fellow Commissioners and Congress to provide a firm regulatory foundation for digital assets through a rational, coherent, and principled approach.”

This move could bring much-needed clarity and stability, paving the way to mitigate risks and further reduce crypto scams and losses. Here’s to a brighter, more secure crypto future! 🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- World Eternal Online promo codes and how to use them (September 2025)

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Hero Card Decks in Clash Royale

2025-04-02 09:17