Bitcoin ETFs, the financial world’s darlings, have once again proven their magnetic allure, pulling in a cool $90 million like moths to a flame, while their less fortunate cousin, ether ETFs, saw a modest $6 million slip away, much like a forgotten plot line in a Bulgakov novel.

The Bitcoin ETF Juggernaut:9 Days of Glorious Inflows

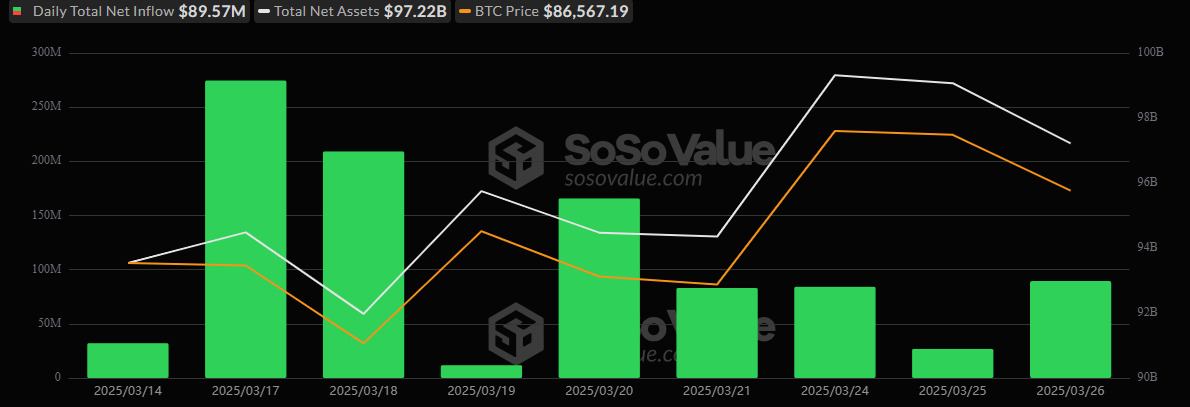

Bitcoin, that digital Midas touch, has seen its ETFs bask in the limelight, securing a9th consecutive day of inflows, amounting to an almost suspiciously precise $89.57 million. Blackrock’s Ishares Bitcoin Trust (IBIT), the undisputed hero of our tale, single-handedly attracted a staggering $107.89 million, leaving others in the dust.

Alas, not all is rosy in the garden of crypto ETFs. Bitwise’s BITB experienced an $18.32 million exodus, a sobering reminder that not every ship sails smoothly. The remaining ten bitcoin ETFs, like stoic statues, observed the commotion without a flicker of activity. The trading volume for bitcoin ETFs, however, surged to an impressive $1.87 billion, underscoring the feverish interest of investors. Yet, in a twist worthy of Bulgakov himself, total net assets for bitcoin ETFs dipped to $97.22 billion, a puzzling $1.78 billion less than the day before.

Meanwhile, in the land of ether, the mood was less jubilant. Ether ETFs, like a melancholic character in a Russian novel, faced yet another day of outflows, totaling a somber $5.89 million. Grayscale’s ETH, leading the charge (or retreat, as it were), saw $4.90 million vanish into the ether (pun intended), while Fidelity’s FETH bid adieu to a modest $996,090. The total net assets for ether ETFs, in a plot twist no one asked for, slipped below the $7 billion mark, settling at $6.84 billion.

As the tale unfolds, bitcoin ETFs continue to bask in the spotlight, while ether ETFs ponder their next move, much like characters in a Bulgakovian drama, where fortunes rise and fall with the whims of unseen forces. The divergence in investor sentiment is as stark as the contrast between the bustling streets of Moscow and the quiet contemplation of a lone figure in the moonlight.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

2025-03-27 16:00