- Bitcoin bounces back to $88K after a nosedive, but wallet growth? Still snoozing.

- Fidelity analysts scratching their heads over Bitcoin’s returns vs. the S&P 500. Spoiler: Not great!

So, Bitcoin [BTC] is back on its feet, strutting around at $88K after a dramatic drop to $78K. You know, like a bad sitcom character who just won’t quit. But wait, what’s this? Wallet growth is still as exciting as watching paint dry. 🥱

As our favorite cryptocurrency makes a comeback, there’s still a nagging worry about its network growth. It’s like a party where no one shows up, but the music is still playing. 🎶

Jurrien Timmer weighs in

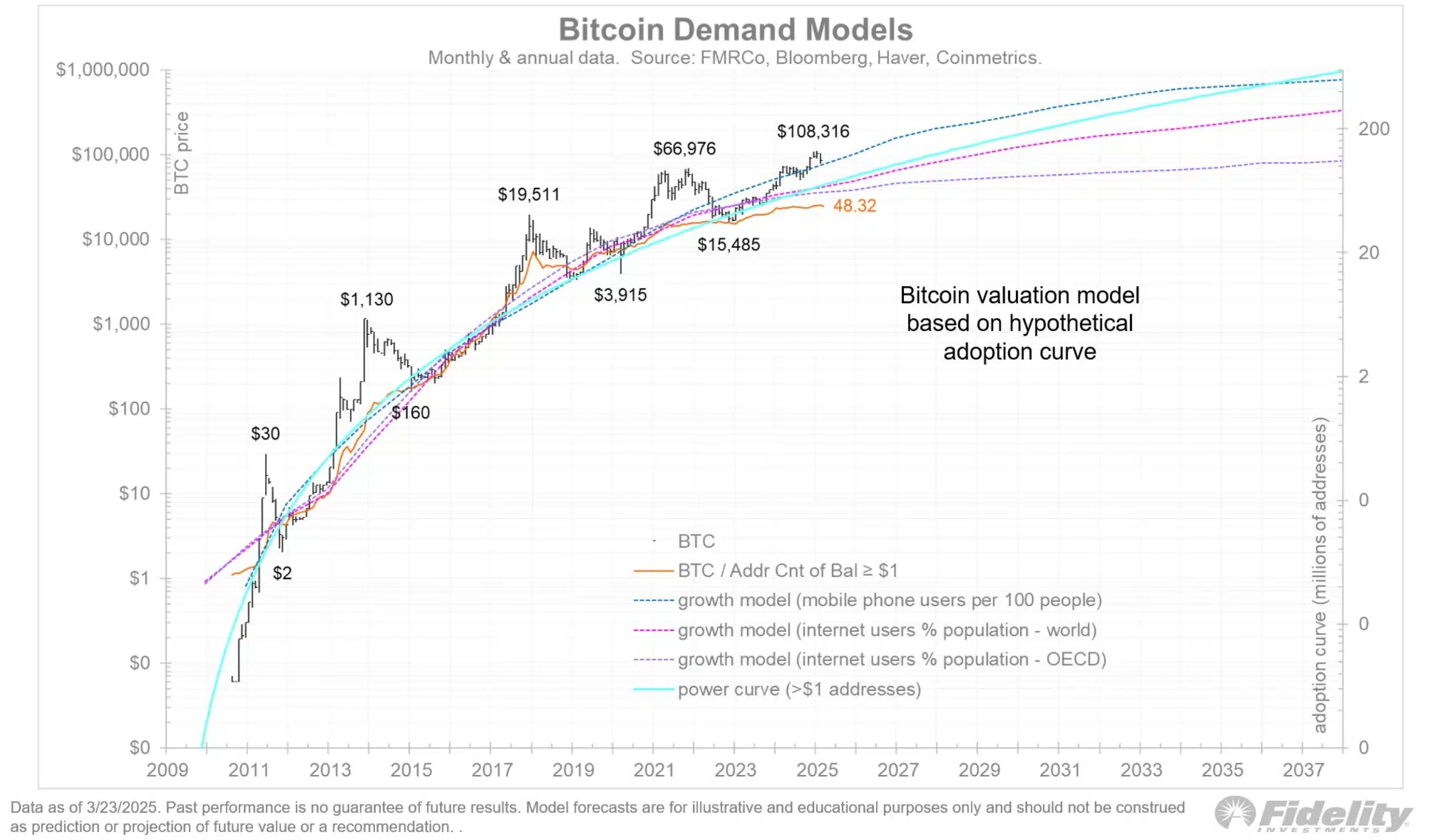

Jurrien Timmer, the big cheese at Fidelity Investments, points out that BTC’s wallet count has barely budged in the last year. Minimal expansion? More like a snail’s pace! 🐌

This raises the million-dollar question: Is this price surge due to real adoption or just a bunch of folks speculating like it’s a game of Monopoly? 🎲

Timmer blames the stagnant wallet growth on U.S.-based spot ETFs and MicroStrategy’s wallet hoarding. I mean, come on! Institutional buyers only need a couple of wallets to manage their massive piles of cash. It’s like having a few fancy shoes while the rest of us are still in flip-flops. 👡

But don’t worry, Timmer is still optimistic about BTC’s long-term future, claiming it follows the S-curve of other tech trends. Sure, buddy, let’s hope that curve doesn’t turn into a flat line! 📉

The power law model

Bitcoin’s value is supposed to follow the power law model, meaning it should get more valuable as more people join the party. But hey, if no one’s showing up, how’s that supposed to work? 🤷♂️

On X, Timmer lamented,

“Unfortunately, this will make it more difficult to track the adoption curve going forward.”

And then there’s Sina from 21stCapital, who chimed in,

“Good take. Wallet addresses are deviating from the decade-long trend.”

Bitcoin vs. stocks

Chris Kuiper, the research guru at Fidelity Digital Assets, also pointed out that Bitcoin’s performance has been about as thrilling as a trip to the dentist compared to traditional markets over the last four years. 🦷

Bitcoin’s got a 17% compound annual growth rate (CAGR), while the S&P 500 is trailing at 13%. But when you factor in risk-adjusted returns, BTC is like that friend who always shows up late to the party. Four times the volatility for a measly higher return? Yikes! 😬

Kuiper said,

“So this particular 4-year period has so far underperformed the previous cycles. If we really did peak earlier this year, then this will be quite the disappointing cycle.”

He’s also open to the idea that this market cycle might not follow the usual script. Because why would it? That would be too easy! 🙄

Bitcoin’s current price action

As of now, Bitcoin is trading at $88,036.11 after a 0.64% daily bump. It’s also managed a solid 4.90% weekly gain, according to CoinMarketCap. Not too shabby, right? But let’s not get too excited. 😏

Its recent breakout above the $86,800 resistance on March 24th is a sign of renewed bullish momentum. Or is it just a blip? Who knows! Investors are on high alert for signs of a sustained rally or a potential nosedive in the coming weeks. 🎢

But whether this price surge will actually drive adoption? That’s still up for debate. Just like whether pineapple belongs on pizza! 🍍🍕

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-03-27 04:14