Oh, the intrigue of it all! In Coin Metrics’ latest State of the Network report, we discover that our dear Bitcoin miners are engaged in an endless balancing act—stabilized revenues on one hand and fee pressures on the other. Add some geopolitical pyrotechnics, renewable energy soirées, and shiny hardware upgrades, and voilà! The drama unfolds post-halving.

China Tariffs, Texas Turbines, and AI Shenanigans: Bitcoin Mining’s 2025 Soap Opera

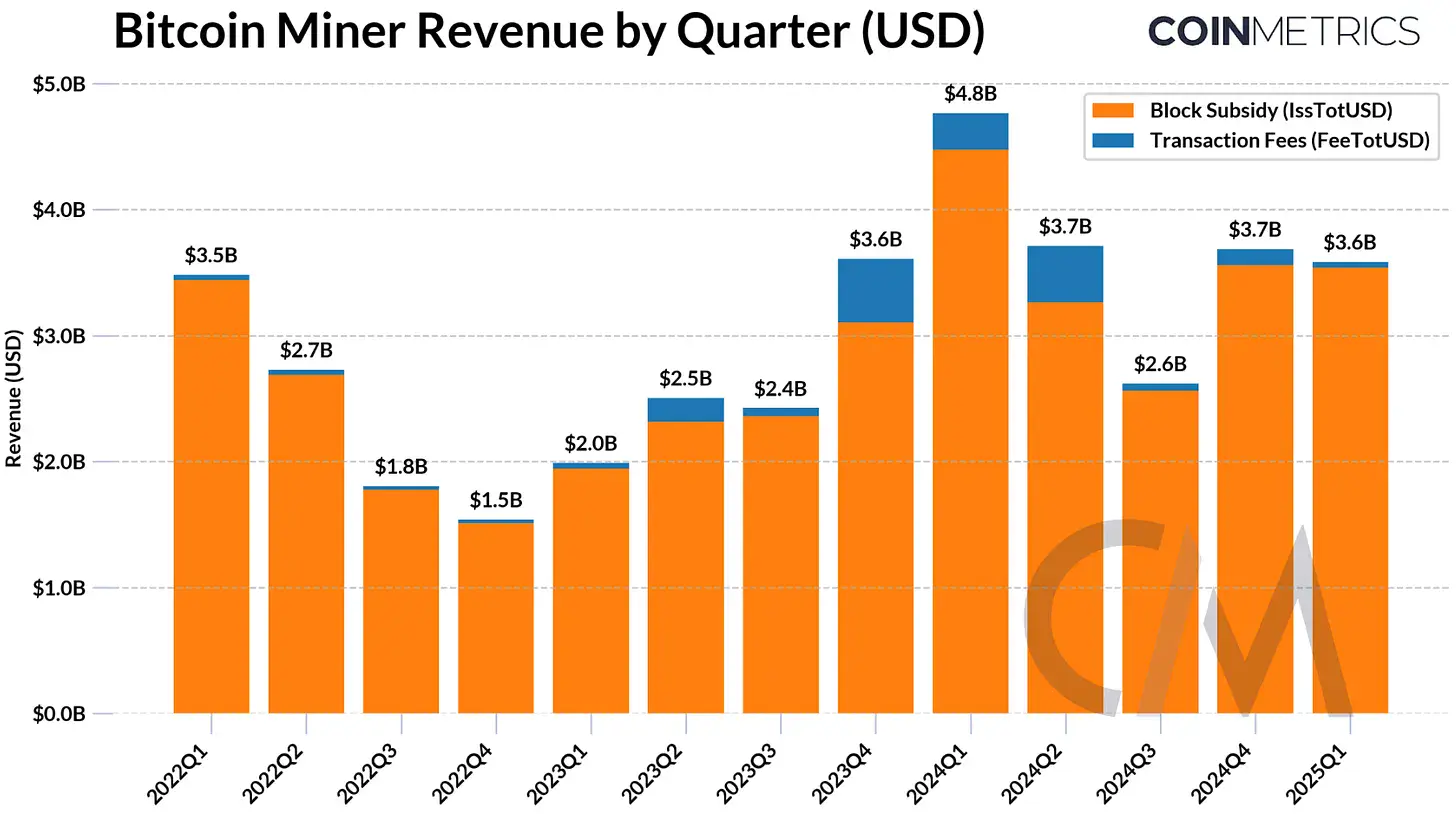

Coin Metrics’ Q1 2025 State of the Network report delivers the spicy details: miner revenues hit a delightful $3.7 billion in Q4 2024—a positively giddy 42% quarterly leap. Of course, they achieved this feat not by magic wands but by improving operational efficiency and betting on a plucky Bitcoin price recovery. And the highlight? An electrifyingly nerdy 807 EH/s 30-day average hashrate by early 2025. Numbers to make calculus professors weep! 🤓📈

Now picture this: mining operations are strutting to Texas and friends like they’re at a renewable energy fashion show. Eyes on Africa and Latin America, too—those regions have the kind of cheap and flashy renewable energy that gets miners hot under ASICs. Oh, and Core Scientific? They’re throwing an AI party in their 200 MW data center. One supposes the machines will start writing Shakespeare any day now. ✍️🤖

Now picture this: mining operations are strutting to Texas and friends like they’re at a renewable energy fashion show. Eyes on Africa and Latin America, too—those regions have the kind of cheap and flashy renewable energy that gets miners hot under ASICs. Oh, and Core Scientific? They’re throwing an AI party in their 200 MW data center. One supposes the machines will start writing Shakespeare any day now. ✍️🤖

Now, the pièce de résistance, the juicy bit—the perils of hardware centralization. Bitmain appears to have cornered the ASICs market like a 1930s monopoly villain twirling their mustache. Some 59%–76% of the network’s hashrate powered by their machines? Darling, we call this a “single point of failure,” though it has a certain dramatic flair. Oh, and those Chinese tariffs on hardware shipments to the U.S.? A supply chain tragedy in three acts. Bitmain hardware delays? Positively tragicomical. 🧐🎭

And the drama doesn’t stop there! Bitcoin—ahem, our digital leading lady—is still finding her footing as a “medium of exchange,” though she seems far more comfortable playing the Cinderella of “stores of value.” But fear not! L2 solutions like the Lightning Network are here for their curtain call—if only someone could sort out the diminishing number of channels (down to 52,700 in Q1 2025, darlings)! Channel liquidity is holding steady, though—thank heavens for small mercies. ⚡💰

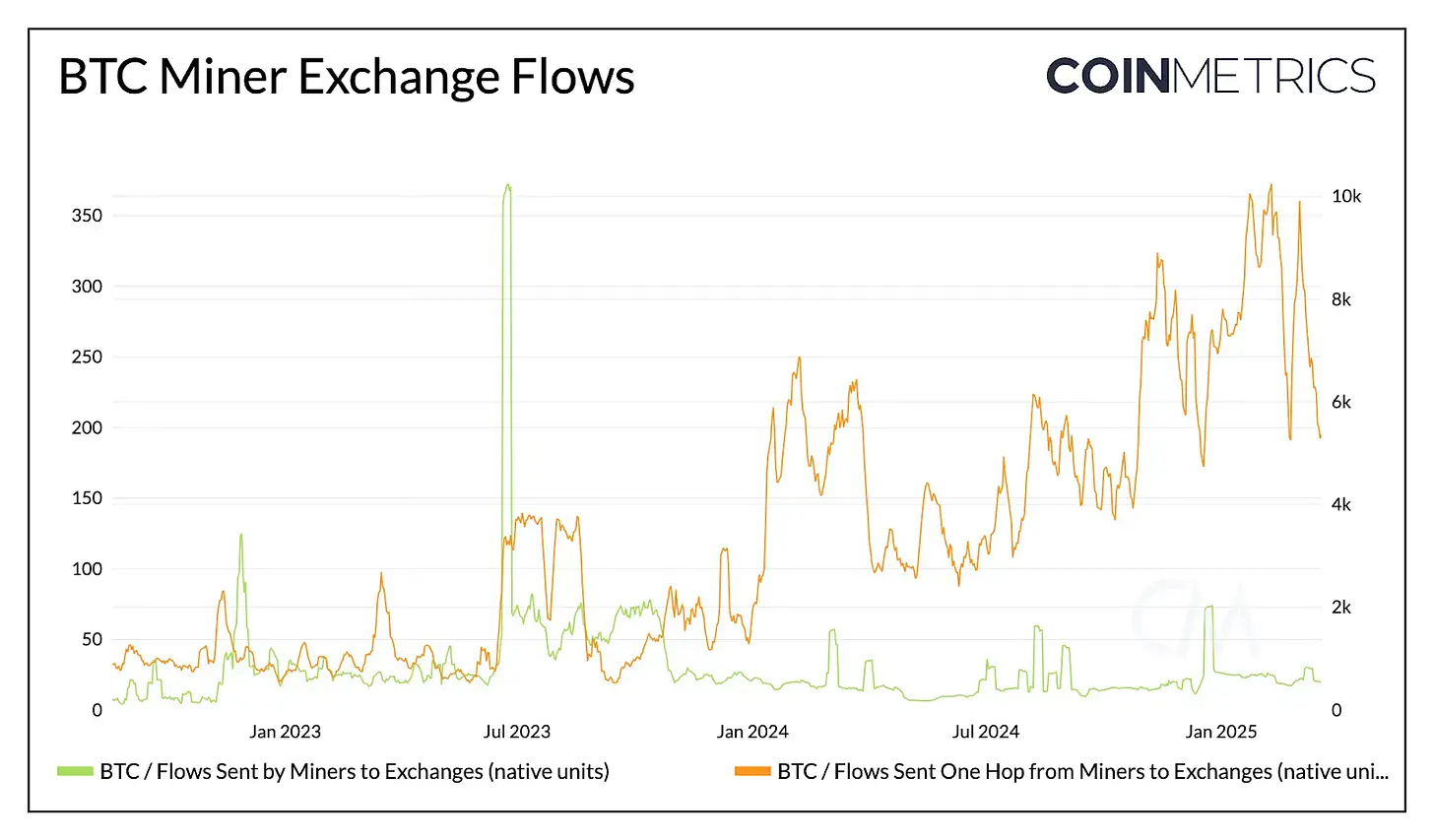

Meanwhile, the miners—those hardy souls—are selling off Bitcoin bit by bit, like old aristocrats parting with the family silver. Incremental liquidations, they call it. Treasury management, if you please. Larger players managing to hold their heads high, while smaller miners are left clinging to the coattails of volatility. It’s almost Shakespearean. 🎩⌛

And as for the denouement? Sustaining miner incentives as block rewards dwindle will take nothing less than a miracle—or perhaps a spike in transaction fees, courtesy of L2’s revival tour. But let us not be too grim! Coin Metrics warns of risks, yes, but also urges innovation. Adaptation across the mining ecosystem is the order of the day. Shall we raise a glass to resilience—or to renewable energy? Either way, somebody had better cue the curtain call. 🥂✨

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-03-26 00:01