Ah, the intoxicating dance of recession risks and macroeconomic uncertainty has once again taken center stage in the grand theatre of finance! As our dear Bitcoin frolics down a delightful -20% from its lofty heights, one might wonder if it is not merely rehearsing for an encore. Tomas, the macro analyst with all the charm of an over-caffeinated philosopher, posits that the economic backdrop resembles less a tragicomedy and more a whimsical farce, despite early 2025’s teasing hints of weakness.

“A recession? Bah! Doesn’t look very recessionary to me,” he quipped in a recent post on X, channeling the spirits of skeptical pundits past. He referenced those daring indicators that dipped like an ill-fated soufflé in February, only to find themselves steadying the ship (or should I say yacht?) in recent weeks. What a truly marvelous tableau of growth and optimism! His analysis tells us that US growth nowcasts, those mystical aggregators of real-time economic growth, have found solace by leveling off after their February blunders.

In the great narrative of market sentiment, the Citi Economic Surprise Index (CESI) plays a pivotal role. “Falling CESI = data being a dreary disappointment, rising CESI = a delightful surprise!” Tomas elucidated, revealing the complex intricacies of the index. As the curtain drew on the dismal early-year weakness, these indicators, like a refined wine, have begun to breathe anew.

And Now, the Grand Parallels of Bitcoin and Summer 2024

With a flair for the dramatic, Tomas now draws our attention to echoes of past market calamities—specifically, the tempestuous Summer of 2024 and the rather unfortunate rout of late 2018. In both instances, a delightful concoction of “growth/recession scares” and other unexpected pressures rattled the markets, like a jester at a royal banquet.

“Upon my honor, the two markets that resemble our current quandary most closely are Summer 2024 and late 2018,” he mused. During the summer soirée of 2024, the growth concerns coupled with the notorious yen carry trade unwind resulted in a rather dramatic 10% dip in equity markets. Ah, the memories! And who could forget the late 2018 fiasco, a tempest fueled by trade wars and tariffs that expanded the correction to a spine-chilling 15%?

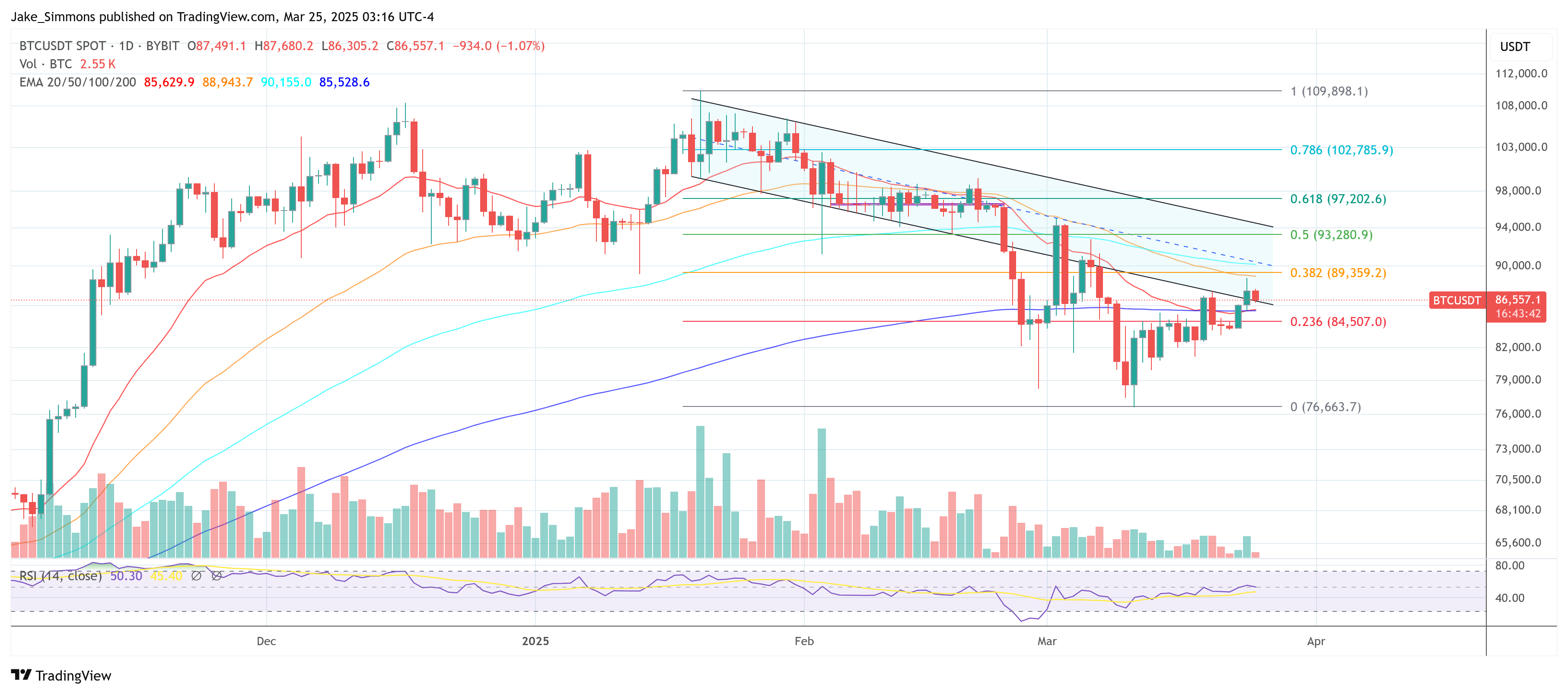

Now, as our beloved equity markets share stories of their recent 10% slumber party, Tomas detects haunting echoes of history in Bitcoin’s own escapades—30% decline in Summer 2024, 54% in late 2018, and here we are again, witnessing a 30% twist of fate!

“So, which way shall the winds blow?” he pondered, gesturing grandly at the uncertain crossroads before us. He leans toward a scenario akin to the relatively tame Summer of 2024, rather than the Shakespearean tragedy that was late 2018. In his own whimsical words, “I dare say these tariffs will be less villainous than one might expect—my belief has remained steadfast for months!” Such is the charm of hope amid disarray!

Several supporting players bolster his claim: the recent easing of financial conditions (a sigh of relief from our financial drama), the US dollar’s lackluster performance akin to a washed-up actor during a revival, and the ever-optimistic seasonal rebounds in US equity indices. And let us not forget the stable credit markets, behaving as well-behaved children at a party.

Alas, Tomas admits to a touch of ennui over the ceaseless tariff debates. “I find myself quite spontaneously bored with all this tariff chatter,” he lamented, with a sly wink. And as the clock ticks towards April 2, “Tariff liberation day,” agog anticipation hums through the air, promising revelatory drama!

As we tiptoe across this financial landscape, Bitcoin now prances at a price of $86,557, a true star of our contemporary tale.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- M7 Pass Event Guide: All you need to know

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

2025-03-25 10:37