Ah, mesdames et messieurs, as our dear Bitcoin takes a wobbly step from its recent tumble, it finds itself attempting to rise like a phoenix from the ashes of its one-month nadir. Alas! Some wise analysts, those seers of the digital coinage realm, caution us that our beloved cryptocurrency is perched precariously, much like a cat on a very thin ledge, echoing the dismal beginnings of the last bear market.

Will Bitcoin Stumble Again into the Abyss?

This past Sunday, our valiant Bitcoin experienced an ennui-inducing 3.6% plunge, closing below its yearly opening for the first time-a true tragedy for the ages! Since the fateful month of November, this noble coin has bounced between $86,000 and $93,500, desperately trying to turn its resistance into a supportive embrace, yet failing spectacularly at every attempt.

In early January, Bitcoin took a jubilant leap from its $87,600 opening price, reaching a dizzying high of $97,924-only to deflate like a sad soufflé, erasing all its hard-earned gains and languishing at the base of its range like a forlorn lover.

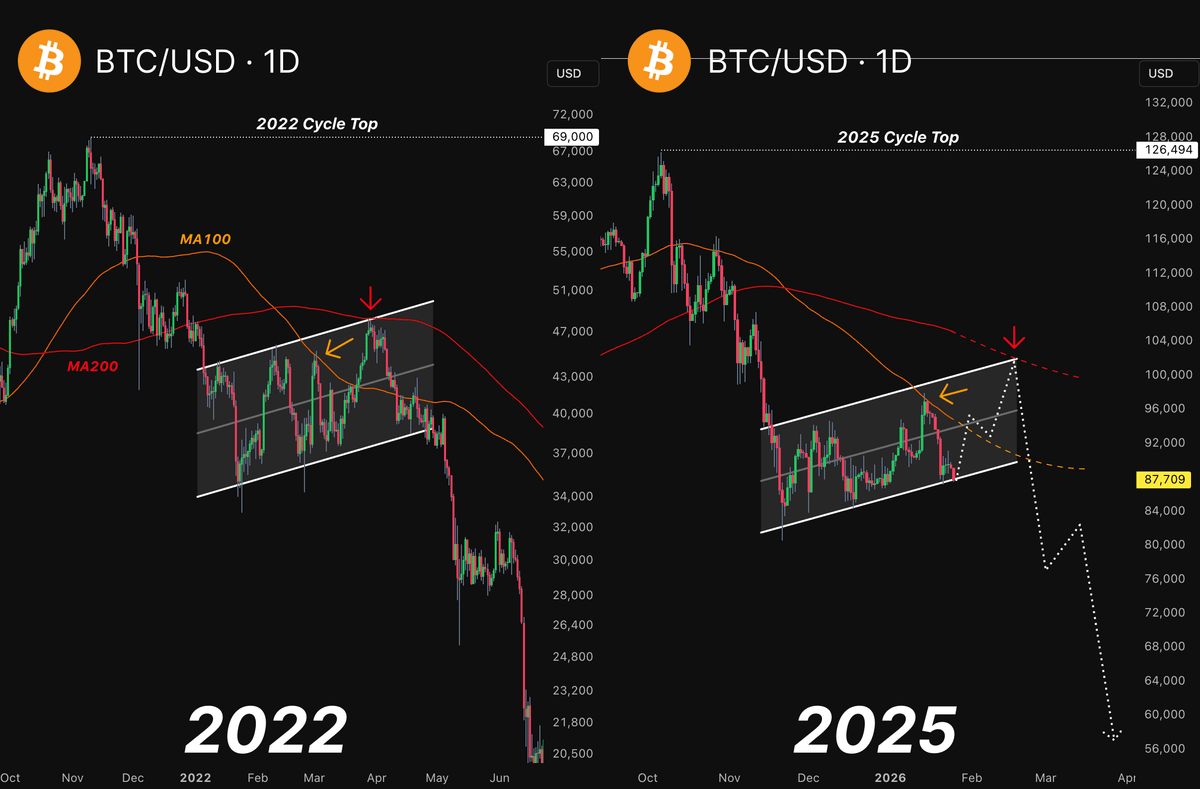

Our astute market chronicler, Philarekt, has noted that Bitcoin appears to be following its 2022 script with all the grace of a clumsy dancer, drawing parallels between its current antics and the initial blunders of the previous bear market.

As illustrated in our charming chart, Bitcoin has donned a bear flag pattern after its dramatic drop from the lofty heights of $69,000. It flirted with the 100-day Moving Average, only to be rebuffed, leading to a retreat towards the lower boundaries of its own creation.

Then came a hopeful rebound towards the upper boundary, where the 200-day Moving Average awaited like a stern teacher, only to see Bitcoin rejected again, spiraling downwards into a sorrowful 55% correction.

Now, it seems Bitcoin is once more facing the 100-day MA with trepidation, currently testing the support line of its own making. Our sage predicts that perhaps Bitcoin may attempt one last gallant leap towards the $100,000 mark before the curtains rise on “the real show.”

Bitcoin in a Delicate Dilemma

Meanwhile, the ever-watchful Rekt Capital warns us that Bitcoin is in a “particularly fragile position”-not unlike a juggler with too many balls in the air-needing to cling to last week’s marginal close above the range high. “When weekly closes occur just shy of key levels, the subsequent retest becomes like a high-wire act without a net,” he quips.

In his astute observations, he notes that Bitcoin faced a sharp rejection from the $98,000 region-a place where the 21-week and 50-week Bull Market Exponential Moving Averages frolic together. This unfortunate event coincided with the loss of a higher low structure, akin to losing a cherished trinket on a windy day.

Ah! Losing that Higher Low, what a tragedy! It strips away a critical buffer that could have supported our Bitcoin in its quest for stability within the Weekly Range. The rejection now shifts our focus to the strength of the $86,000 support-a veritable fortress! Yet, beware, for shallower bounces from these depths may suggest waning demand, increasing the peril of a breakdown.

Historically, strong rejections leading to further declines tend to occur later in the cycle, often towards the end of Q1 or the start of Q2. However, Bitcoin is already flirting with the lower boundary of its weekly range-oh la la! This adds a layer of significance to the integrity of this support, as any premature collapse would signal a rather rude awakening from our typical timing. At present, the weekly range remains a pivotal stage, serving as the grand decision point between prolonged relief and the specter of deeper despair, concludes our analyst with a flourish.

Read More

- VCT Pacific 2026 talks finals venues, roadshows, and local talent

- EUR ILS PREDICTION

- Lily Allen and David Harbour ‘sell their New York townhouse for $7million – a $1million loss’ amid divorce battle

- Will Victoria Beckham get the last laugh after all? Posh Spice’s solo track shoots up the charts as social media campaign to get her to number one in ‘plot twist of the year’ gains momentum amid Brooklyn fallout

- SEGA Football Club Champions 2026 is now live, bringing management action to Android and iOS

- Vanessa Williams hid her sexual abuse ordeal for decades because she knew her dad ‘could not have handled it’ and only revealed she’d been molested at 10 years old after he’d died

- Battlestar Galactica Brought Dark Sci-Fi Back to TV

- eFootball 2026 Manchester United 25-26 Jan pack review

- The five movies competing for an Oscar that has never been won before

- Everything to Know About the Comics Behind Ryan Murphy’s Wild New Series The Beauty

2026-01-27 12:10