Ah, Bitcoin, that capricious prima donna of the financial world, has once again taken to the stage, performing a dramatic pas de deux with the market’s whims. From its lofty perch at $97,939, it has descended with all the grace of a falling chandelier, flirting briefly with $88,665 before settling, for the moment, at $89,396. The audience holds its breath, wondering if this is the prelude to a triumphant encore or merely the awkward silence before the curtain falls.

Bitcoin Chart Outlook

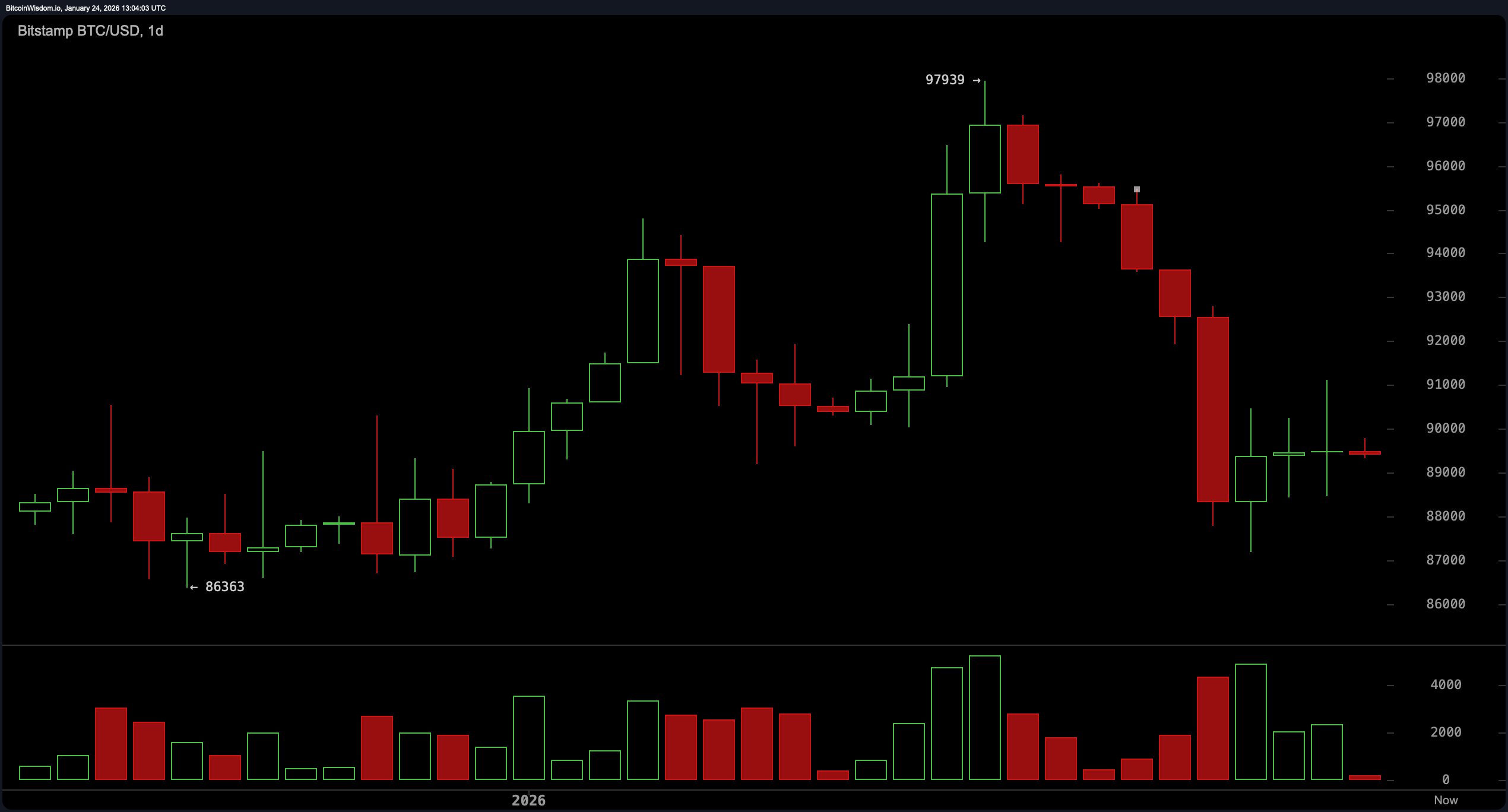

On the daily chart, our protagonist sits in the aftermath of a selloff as elegant as a mudslide, cascading from nearly $98,000 to a low of $86,000. Volume, that fickle chorus, sang of panic, as traders fled like guests at a poorly catered ball. Yet, not all is lost; the price has rebounded to the $89,000-$90,000 zone, forming what might be the embryonic stages of a base-or perhaps just another pause in its endless waltz.

Candlesticks, those silent narrators, speak of indecision, their narrow ranges reminiscent of a crowd collectively holding its breath. Support lingers between $86,000 and $88,000, while a break above $91,000 might stir the short-term optimists. But the true test lies at the $94,000-$95,000 resistance ceiling, a barrier as formidable as a mother-in-law’s disapproval.

The 4-hour chart presents a more contemplative scene-Bitcoin, like a philosopher with a hangover, sips its coffee and ponders its next move. The descent from $95,480 to $87,193 has softened into sideways meandering, with candles as tight as a miser’s purse and volume as subdued as a library. A minor spike near January 23-24 hints at fleeting interest, but it’s hardly the stuff of legend. The sweet spot? A breakout above $90,500 might open the door to a short-term uptrend, though without volume to serenade it, the attempt may falter like a forgotten ballad.

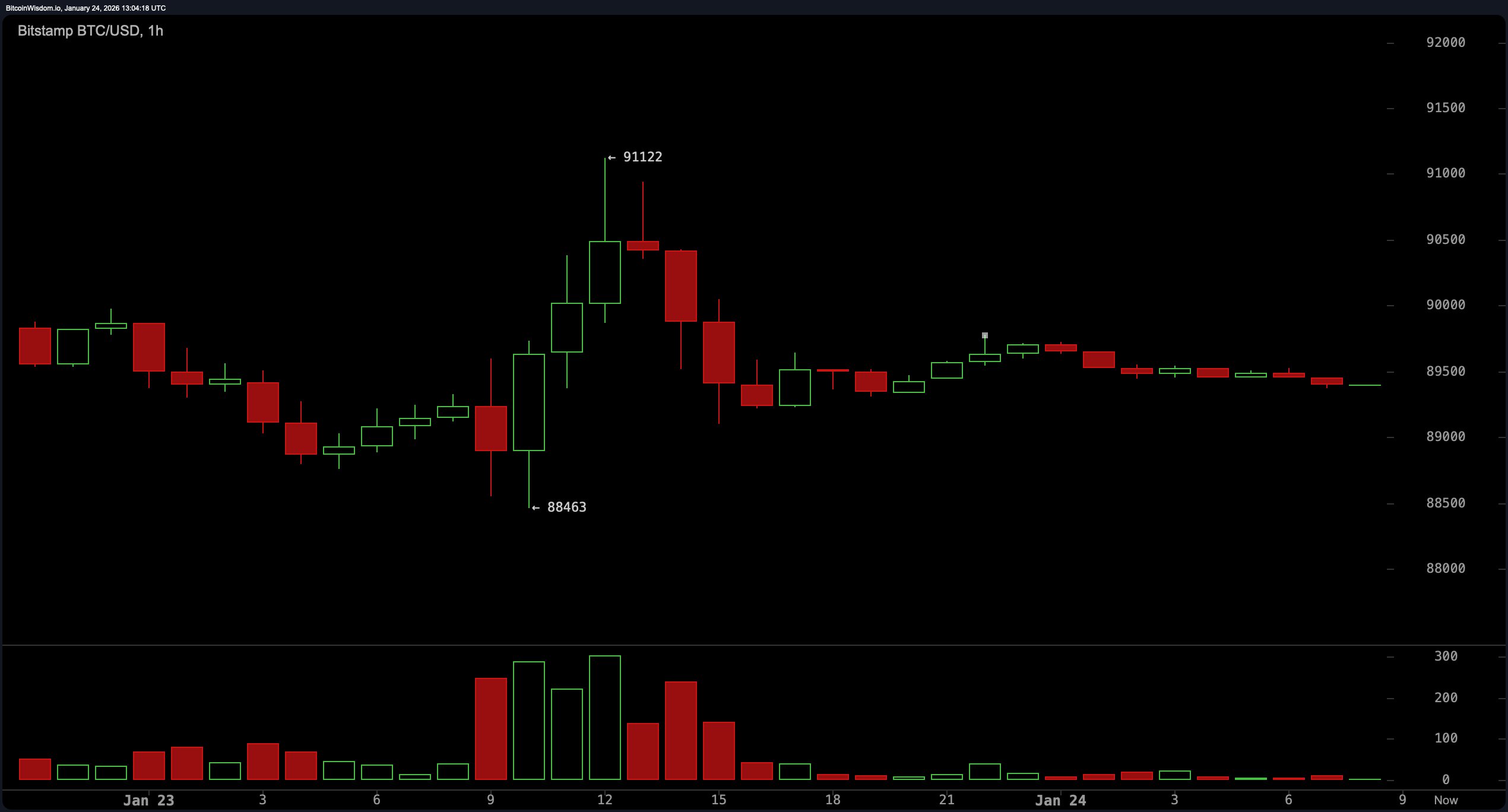

Zooming into the 1-hour chart, Bitcoin’s personality grows twitchy, darting between $88,500 and $91,000 like a squirrel evading a broom. Higher lows suggest a micro uptrend, though the rejection at $91,122 casts doubt on its resolve. Volume, ever the wallflower, continues to fizzle, indicating the market’s risk appetite is on a strict diet. A clean break over $91,000, accompanied by a burst of volume, could spark a dash toward $91,500-$92,000. Until then, short-term traders might eye dips to $88,500, though support, like a fickle lover, could vanish without warning.

Oscillators, those diplomatic bystanders, offer little clarity. The RSI lingers at 43, as neutral as a Swiss diplomat. The stochastic oscillator at 21 and the CCI at -84 are equally noncommittal. Yet, the momentum indicator, at -7,546, and the MACD at -146, lean bearish-like a cat eyeing a new piece of furniture with suspicion.

Moving averages, those dour partygoers, have all RSVP’d to the bear’s soiree. Every key EMA and SMA, from the 10-period to the 200-period, looms above the current price, signaling pressure. The 10-period EMA at 90,867 and the 200-period SMA at 105,248 are miles above Bitcoin’s current position, creating a traffic jam of resistance. Until the price climbs above these averages, upward momentum remains but a whisper in the wind.

In sum, Bitcoin leans on its support zone while its indicators hedge their bets. The charts paint a picture of a market at a crossroads-momentum wanes, yet a breakout remains possible. Patience, that rare virtue, is the only strategy worth its salt.

Bull Verdict:

Should Bitcoin muster the strength to breach $91,000 with convincing volume, a short-term recovery to $94,000-$95,000 is not beyond the realm of possibility. Oscillators may be neutral, but the price structure hints at a rebound from support. Momentum remains cautious, yet bulls could find their footing if resistance levels begin to crumble.

Bear Verdict:

With all key moving averages stacked above the current price and momentum indicators flashing red, the path of least resistance remains downward. Fading volume and failed breakouts underscore market hesitation. Unless Bitcoin breaks through overhead resistance with conviction, bears retain their grip on the stage.

FAQ ❓

- What is Bitcoin’s price today?

Bitcoin trades at $89,396 as of January 24, 2026. - What’s the current support level for Bitcoin?

Key support lies between $86,000 and $88,000. - Where is Bitcoin facing resistance?

Major resistance zones are $91,000 and $94,000-$95,000. - Is Bitcoin trending up or down right now?

Charts show a weak bounce with bearish pressure from moving averages.

Read More

- VCT Pacific 2026 talks finals venues, roadshows, and local talent

- Lily Allen and David Harbour ‘sell their New York townhouse for $7million – a $1million loss’ amid divorce battle

- EUR ILS PREDICTION

- Vanessa Williams hid her sexual abuse ordeal for decades because she knew her dad ‘could not have handled it’ and only revealed she’d been molested at 10 years old after he’d died

- Will Victoria Beckham get the last laugh after all? Posh Spice’s solo track shoots up the charts as social media campaign to get her to number one in ‘plot twist of the year’ gains momentum amid Brooklyn fallout

- Binance’s Bold Gambit: SENT Soars as Crypto Meets AI Farce

- eFootball 2026 Manchester United 25-26 Jan pack review

- Dec Donnelly admits he only lasted a week of dry January as his ‘feral’ children drove him to a glass of wine – as Ant McPartlin shares how his New Year’s resolution is inspired by young son Wilder

- Invincible Season 4’s 1st Look Reveals Villains With Thragg & 2 More

- SEGA Football Club Champions 2026 is now live, bringing management action to Android and iOS

2026-01-24 17:53