Ah, dear reader, let us take a moment to revel in the grand theater of cryptocurrency-a realm where fortunes rise and fall like characters in one of Turgenev’s novels. Recently, Ethereum has ascended to heights never seen before, leaving many to ponder: what mysterious forces propel this digital titan? To uncover the truth, we engaged in a tête-à-tête with Lennaert Snyder, crypto analyst extraordinaire and official partner at Bybit. Surely, his insights will illuminate the shadows cast by Ethereum’s meteoric rise-though perhaps not as dramatically as a duel at dawn. 🤺

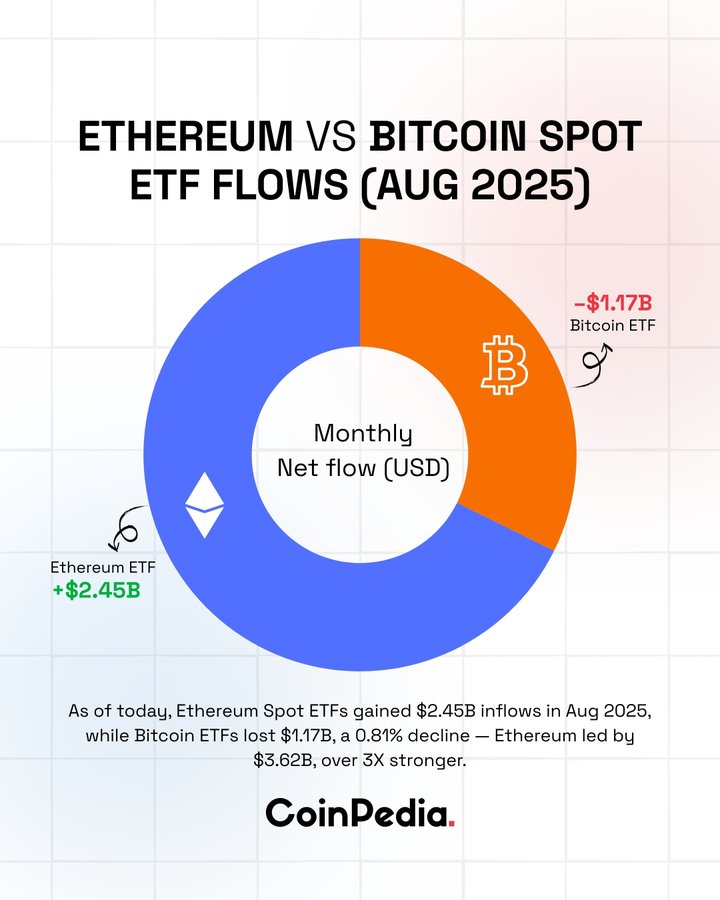

Snyder’s perspective reveals a tale of two drivers: institutional flows and organic chain activity. The spotlight shines brightly on spot ETH ETFs, which have siphoned $2.9 billion in mere days-a sum so staggering it makes Bitcoin ETF inflows look like pocket change. One might say Ethereum is dining on caviar while Bitcoin nibbles on toast. 🥲

“On-chain metrics paint an intriguing picture,” Snyder mused during our conversation (which, alas, lacked samovars and philosophical musings). “High bridge inflows and swelling stablecoin supplies signal robust DeFi engagement.” Indeed, the stablecoin ecosystem thrives, and decentralized finance blossoms like springtime flowers. According to Snyder, approximately 60 to 70 percent of Ethereum’s price surge stems from ETF inflows, while the remaining 30 to 40 percent owes its gratitude to staking and DeFi participation. A rather well-balanced diet for a blockchain, wouldn’t you agree? 🌱

Institutional Appetite for Ethereum

Now, let us turn our gaze toward the ever-fickle institutions. It appears they are smitten with Ethereum, seduced by its multifaceted charm. Unlike Bitcoin, which clings stubbornly to its “digital gold” persona, Ethereum offers a veritable feast of opportunities: smart contracts, staking rewards, and access to a sprawling DeFi landscape. Who could resist such allure? As Snyder sagely noted, these features entice funds hungry for returns beyond mere value storage.

The data confirms this flirtation. ETH ETFs outpace their Bitcoin counterparts, and treasuries like Bitmine eagerly hoard ETH. Yet, Snyder tempers enthusiasm with pragmatism, reminding us that Bitcoin remains the darling of conservative institutions-“digital gold” wrapped in a cozy blanket of predictability. Ah, how quaint. 😴

Thus, the stage is set: Bitcoin anchors the ship, steady but static; Ethereum dances boldly, promising innovation and yield. Institutions may begin their journey with BTC, but soon enough, they find themselves lured into Ethereum’s orbit, captivated by its dynamism. And so, the great crypto saga continues, each player vying for dominance in this modern-day aristocracy of algorithms. 👑

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-08-26 07:37