Wall Street is warming up to rate cuts like a bagel in a toaster, and crypto’s sitting there with popcorn, waiting for the fireworks! 🎆 Meanwhile, Donald Trump’s on the warpath, yelling at Jerome Powell like he’s a waiter who brought the wrong order. “Cut those rates, Jerome! Make America’s wallet great again!” 💸

With inflation cooling faster than a melted ice cream cone, markets are adjusting their expectations. And guess who’s licking their lips? Crypto, the wild child of finance, ready to party like it’s 2021! 🥳

Trump Wants Fed to Bring Interest Rate Down to 1% 🤡

Earlier today, Trump renewed his attack on Powell, calling for a 3% rate cut. “It’ll save $1 trillion!” he shouted, probably while tweeting from Mar-a-Lago. 🏖️ He also accused Powell of keeping rates high for “political reasons.” Because, you know, nothing says “politics” like monetary policy. 🤷♂️

Jerome Powell said he won’t cut rates, citing inflation and tariffs. Yet he cut them in December with higher inflation and pending tariffs. 🤔 Watch for an incoming Trump tweetstorm. 🌪️

— The Constitutionalist (@WeWillBeFree24) July 22, 2025

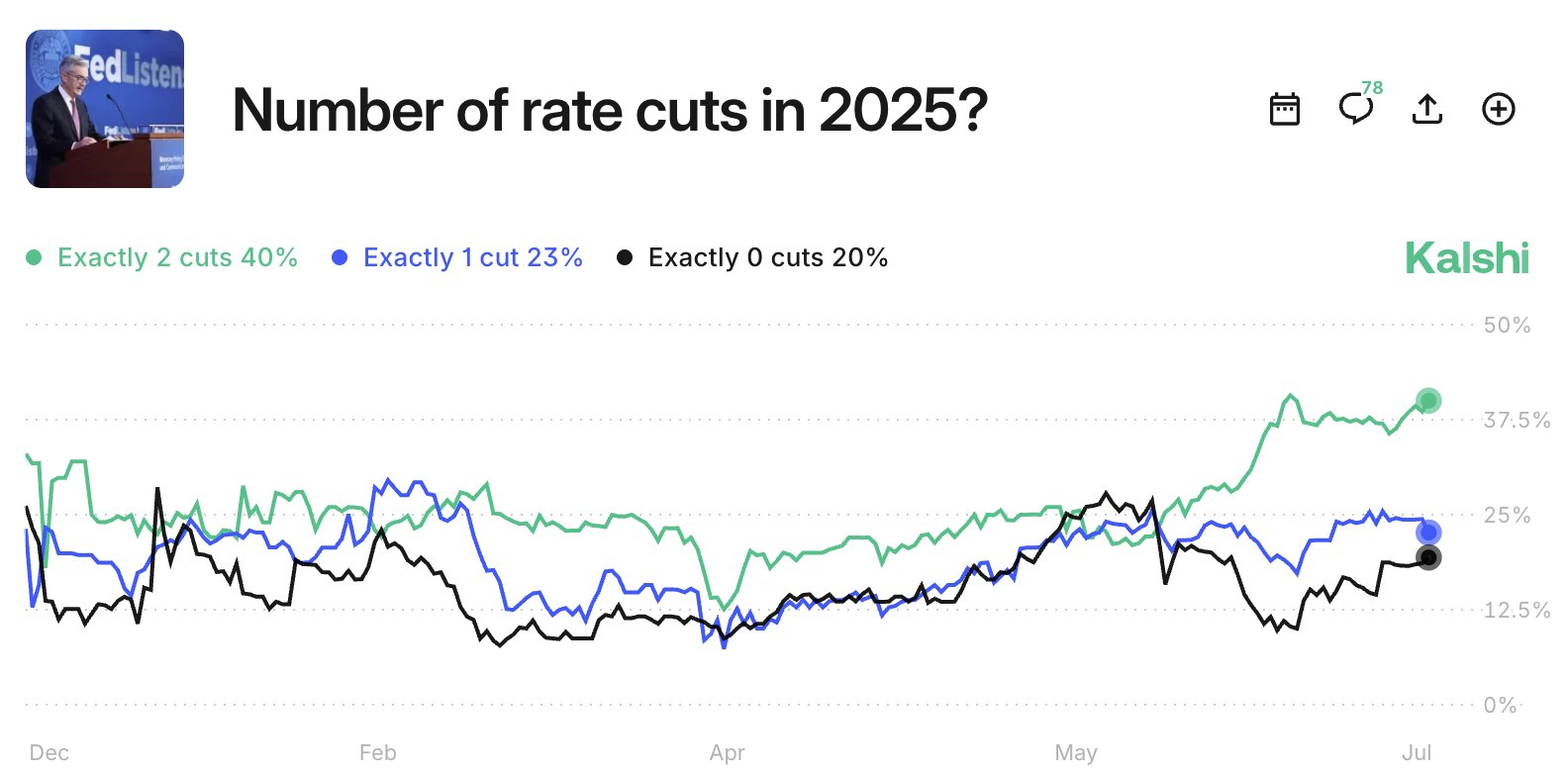

The Fed’s been holding rates steady at 4.25%–4.50% since June, but speculation is hotter than a summer sidewalk. Goldman Sachs thinks the first cut’s coming in September. Meanwhile, traders on Kalshi are betting on a 40% chance of two cuts before year-end. Place your bets, folks! 🎰

US inflation expectations dropped like a lead balloon, with one-year consumer expectations hitting 4.4% in July. That’s the lowest since February—a 2.2% plunge in just two months! 📉 Longer-term expectations are also chilling out, sitting pretty at 3.6%. Looks like the Fed’s got some wiggle room. 🕺

Crypto’s watching all this like a hawk eyeing a mouse. Bitcoin’s holding strong above $118,000, and Ethereum’s chilling near $3,700. Both have a history of throwing parties after rate cuts, thanks to extra liquidity and investors feeling risky. 🎉

Americans’ inflation expectations are changing:

US consumers’ 1-year inflation expectations fell to 4.4% in July, the lowest since February 2025.

Over the last 2 months, expectations have declined 2.2 percentage points—one of the largest drops ever! 📉

This…

— The Kobeissi Letter (@KobeissiLetter) July 22, 2025

Could a Major Crypto Bull Run Begin? 🚀🚀🚀

Historically, rate cuts have been crypto’s cue to go bananas. Remember March 2020? Bitcoin went from under $10,000 to over $60,000 in a year! Ethereum tagged along, riding the DeFi and NFT wave. 🌊 If cuts start in September, we could see a repeat performance. Lower yields mean investors might ditch bonds for Bitcoin, Ethereum, and their favorite altcoins. 🤑

Plus, with falling inflation expectations and shiny new regulations like the GENIUS and CLARITY Acts, investors might feel extra confident. This could push the current cycle past previous highs. But timing’s everything—crypto’s already near record levels, so the Fed’s gotta act fast and deep. Otherwise, it’s just a fizzle, not a bang. 🎆

Key Dates to Watch 📅

Mark your calendars, folks! The Fed’s next meeting is July 29–30. No cuts expected, but everyone’s hanging on Powell’s every word. Then, September 16–17 is the big show—the first real chance for a cut, especially if inflation keeps cooling. 🧊

Other dates to circle:

- July CPI print: Coming in August, this’ll set the tone for September. 📊

- Jackson Hole Symposium (Aug 22–24): Powell’s speech could shake things up. 🎤

- US Jobs Reports (August & September): Weak jobs numbers might push the Fed to act. 👷♂️

For crypto traders, these dates are like Christmas morning. A Fed pivot could spark a buying frenzy, especially in Bitcoin, Ethereum, and high-liquidity altcoins. So grab your popcorn and buckle up—it’s gonna be a wild ride! 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-07-22 21:17