Ah, the spot ETF market-a veritable bazaar of financial whimsy, where institutional investors frolic like peacocks in a field of altcoins. The United States Securities and Exchange Commission (SEC), that august arbiter of fiscal decorum, has been inundated with dozens of spot crypto ETF applications, their deadlines looming like a society matron at a tea party. How delightful! 🍵

The SEC’s Inbox: A Cornucopia of Crypto Dreams

REX-Osprey’s Grand Overture

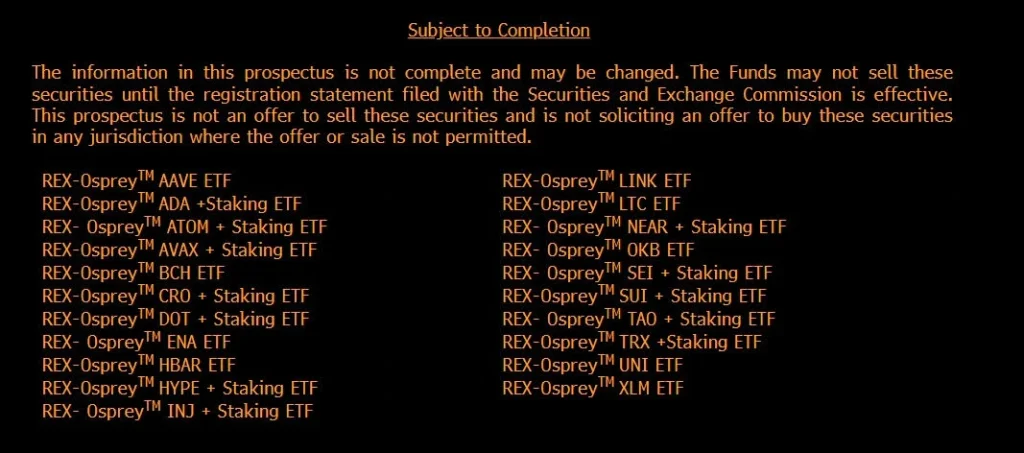

On a Friday-that most frivolous of days-REX Shares, in cahoots with Osprey Funds, unleashed upon the SEC a torrent of 21 spot crypto ETF applications. A veritable feast of staking options, including NEAR, SUI, CRO, ADA, and TRX, among other darlings of the crypto sphere. How très chic! 🦚

With these filings, REX-Osprey cements its status as the grande dame of spot ETFs-provided, of course, the SEC deigns to approve them. One can only imagine the champagne corks popping in anticipation! 🍾

Defiance’s Leveraged Extravaganza

Not to be outdone, Defiance-that audacious upstart founded in 2018-filed nearly 50 3x leveraged ETFs, some of which dare to include crypto. Ethereum and Bitcoin, those stalwarts of the digital realm, make a cameo in this financial ballet. Bravo, Defiance! Encore! 🎭

The Government Shutdown: A Farce in Three Acts

Alas, the trading of these spot crypto ETFs has been delayed, thanks to the ongoing U.S. government shutdown. The SEC, poor dear, missed its deadline for the Canary Litecoin ETF on October 2-a tragedy of bureaucratic proportions. How utterly tedious! 😴

Last month, the SEC-ever the stickler for procedure-requested fund managers to withdraw their Form 19b-4 to streamline approvals via generic listing standards. ETF analysts, led by the indefatigable James Seyffart, insist approval is nigh. One can only hope they’re not merely tilting at windmills! 🏰

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Hero Card Decks in Clash Royale

2025-10-04 02:23