Ah, the markets. That glorious rollercoaster of hope, greed, and occasional existential dread. Just when everyone’s sipping champagne and declaring themselves the next Warren Buffett, along comes a grumpy old trader named Wealthmanagerrr (yes, with three ‘r’s, because why not?) to rain on the parade. 🌧️✨

Apparently, this chap has sold off most of his positions faster than a Vogon reading poetry, claiming a “major correction” is nigh. And no, he’s not just making this up because he lost his car keys and is taking it out on the S&P 500. The data, as they say, is as solid as a Hitchhiker’s Guide to the Galaxy-though slightly less useful when you’re stuck on a spaceship with a depressed robot. 🤖

Margin Debt: The Financial Equivalent of a Bad Hangover 🍷💸

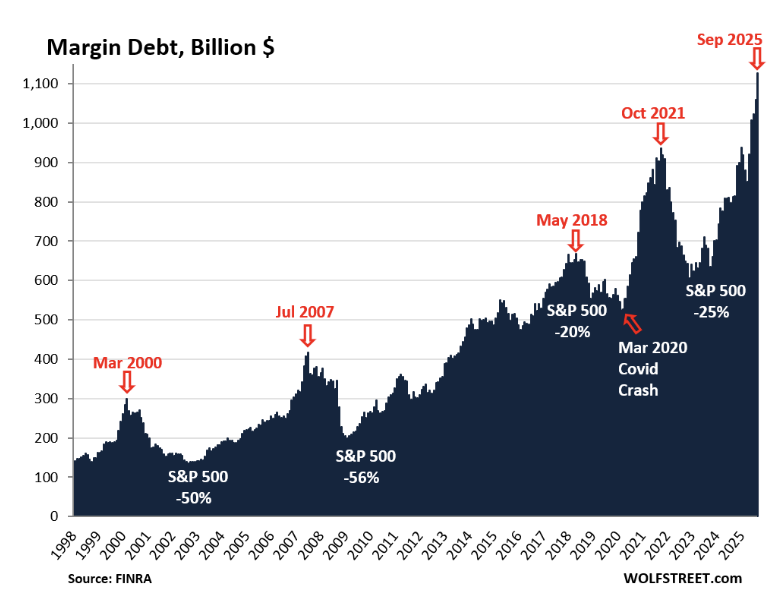

FINRA (those lovely folks who keep an eye on financial shenanigans) reports that U.S. margin debt has soared past $1.1 trillion. That’s right, trillion. With a ‘T’. As in, “Time to panic?” According to history, this level of debt is like showing up to a party with a bowl of soggy lettuce-it never ends well. 🥗💥

Investors are borrowing like there’s no tomorrow, hoping to turn their life savings into a yacht. But as we all know, when the music stops, someone’s left holding the bag-or in this case, the bill. And that bill? It’s bigger than the Restaurant at the End of the Universe’s dessert menu. 🍰

Wealthmanagerrr warns this could trigger a “chain reaction” worse than a Babel fish in a bowl of petunias. 🌸🐟

History Repeats Itself, But With Fancier Spreadsheets 📉📊

Remember 2000, 2008, and 2021? Good times, good times. Except for the part where markets crashed harder than a Heart of Gold hitting a space mine. In 2000, the S&P 500 dropped nearly 50%. In 2008, it plummeted 56%. And in 2021, we got a cozy 25% correction. Each time, leverage was the villain-the Marvin of the financial world. 😒

Now, with margin debt higher than ever and inflation creeping up like a surprise tax audit, it’s starting to feel like déjà vu all over again. 🕰️

And let’s not forget Fed Chair Jerome Powell, who recently dropped the bombshell that a December rate cut isn’t “a foregone conclusion.” Thanks, Jerry. That’s as reassuring as a Vogon captain saying, “Don’t worry, we’re almost there.” 🚀💣

Stocks and Crypto: The Next Victims of the Great Market Splat? 📉🪙

While retail investors are busy “buying the dip” like it’s going out of style, Wealthmanagerrr has gone full survivalist. He’s ditched most of his positions, keeping only Bitcoin and Ethereum (because, you know, hodl or something). The rest? Stablecoins. Because when the world ends, at least your money will be… stable. 🤷♂️

He’s predicting a major correction within 3-9 months, hitting both stocks and crypto. So, if you’re reading this while sipping a latte and checking your portfolio, you might want to switch to decaf. ☕💔

With the cost of living rising faster than a space elevator and borrowing costs still through the roof, Wealthmanagerrr believes markets are “highly overextended.” In other words, they’re due for a fall bigger than Arthur Dent’s jaw when he found out Earth was a computer simulation. 🌍💻

So, buckle up, folks. It’s going to be a bumpy ride. And remember: always carry a towel. 🧘♂️🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-11-03 16:04