The dusty roads of the cryptocurrency world stretched out before us, with Bitcoin standing at the crossroads, like a lone cowboy eyeing the horizon. The bulls, those eternal optimists, were rubbing their hands in glee, anticipating a breakout past key resistance. And why not? The derivatives and spot markets were singing the same tune, a chorus of bullish sentiment that echoed across the land. With the price hovering around $107,095 and posting a tidy 2% daily gain, the whole crypto market was watching with bated breath. The question on everyone’s mind: where would the liquidity zones lead us? Would they act as traps for short sellers, or would sustained momentum above $107k ignite an altcoin rally? Saddle up, partners, and let’s ride into the unknown.

The Options Market: A Bullish Stampede

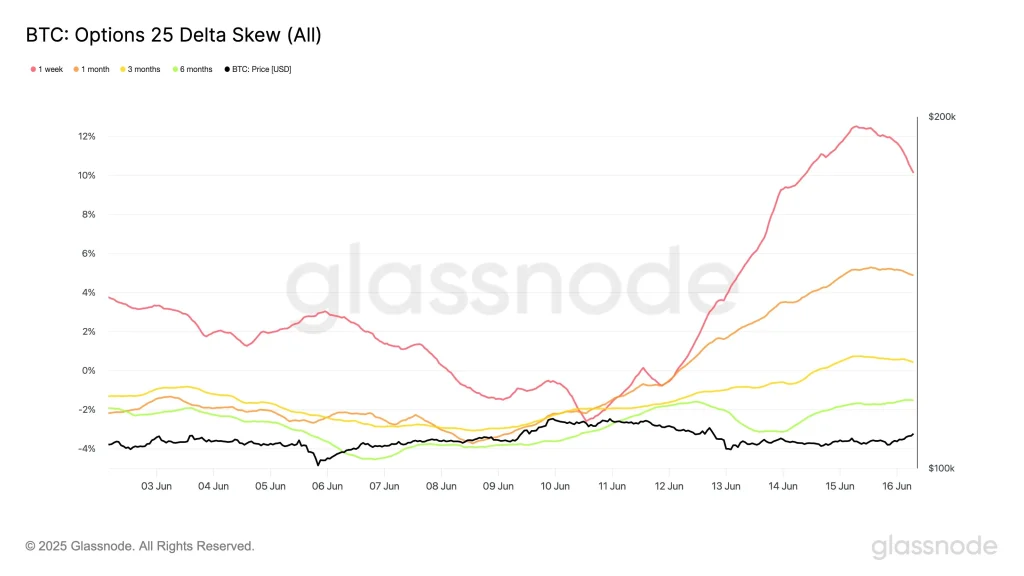

As we rode into town, the options market caught our eye. Glassnode’s 25 Delta Skew, a metric that measures the demand for calls versus puts, had turned decidedly bullish. It seemed the traders were accumulating short-dated call options like there was no tomorrow, expecting upward volatility to sweep them off their feet.

- 1-week skew jumped from -2.6% to +10.1% 🚀

- 1-month skew rose from -2.2% to +4.9% 📈

This shift was like a shot of adrenaline straight to the heart of the market. Traders were betting big on an imminent breakout, and the divergence between rising skew and stagnant spot prices suggested that the market was holding its breath, waiting for the other shoe to drop.

Skew dynamics like these usually preceded sharp directional moves, and the current bias was screaming “upside!” The surge in skew, especially for near-term expirations, was like a neon sign flashing “confidence” in a bullish catalyst within the next few days.

Bitcoin Price Analysis: The Calm Before the Storm

Analyst Michael van de Poppe’s post was like a message in a bottle, washed up on the shores of our consciousness. He said that Bitcoin’s price structure was coiled like a spring, ready to unleash a larger expansion if the price sustained above the $107,000 mark. His chart analysis was like a treasure map, leading us to the crucial area for momentum ignition: the $106.6k to $107k range.

He warned that if the liquidity build-up around $105.5k was broken, a sweep toward $103k was likely. But fear not, dear reader, for the spot buy zones lay in wait like a safety net, ready to catch us if we fell. And if we did, the psychological elements of geopolitical stability, particularly in the Middle East, could boost risk-on appetite and trigger a breakout momentum. If the bulls cleared $107k, an upside move toward $108k could be on the horizon, and the gates to $110.5k might swing open like a golden door.

FAQs: Because You Asked Nicely

What price levels should I be watching this week?

Resistance lies at $107k–$108.9k, while support zones are around $105.5k and $103k. Keep your eyes peeled, partner! 👀

What’s the 25 Delta Skew telling us?

It’s signaling that traders are expecting volatility and are skewed heavily toward short-term upside. Buckle up, Buttercup! 🎢

Could BTC price fall below $100k again?

Only if $105.5k and $103k support fail, a move under $100k would likely occur, and be liquidity-driven. But don’t worry, we’ll be here to catch you if you fall. 😊

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-06-16 14:38