Oh, the drama! 🎭 Ethereum, the leading altcoin, had quite a bumpy ride in March, with bearish trends taking center stage. 😬 But fear not, dear readers, for there’s hope on the horizon! 🌅

As the market shows signs of recovery, we’re left pondering: Can Ethereum shake off its woes and regain its bullish momentum? 🐂 Will it be a triumphant comeback or another chapter in the ETH saga? 📖

Ethereum’s March Meltdown: 💥 Price Crash, Activity Slump, and Supply Pressure

March 11 brought a shocking low for Ethereum, plunging to $1,759 – a two-year nadir. 😱 But, as they say, “When life gives you lemons, buy the dip!” 🍋 Traders rallied, pushing ETH up to $2,104 by March 24. 💪

Alas, the joy was short-lived, as profit-takers returned, causing a sharp decline. By March 31, ETH closed below $2,000, settling at $1,822. 💸

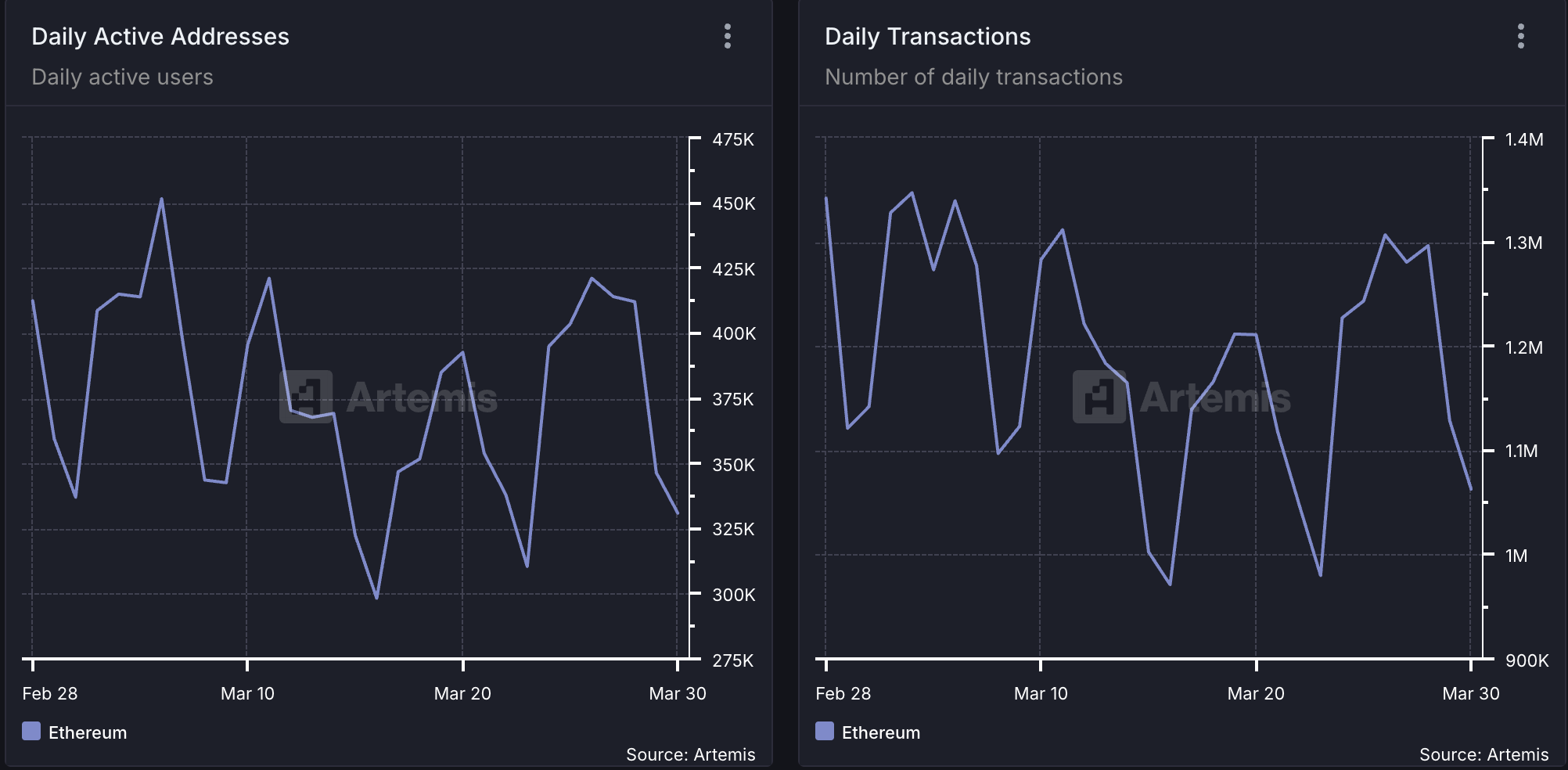

Meanwhile, Ethereum’s network faced a severe decline in activity. Per Artemis, daily active addresses with at least one ETH transaction fell by 20%. 😵

As a result, monthly transactions took a nosedive, falling by 21% in March. 📉

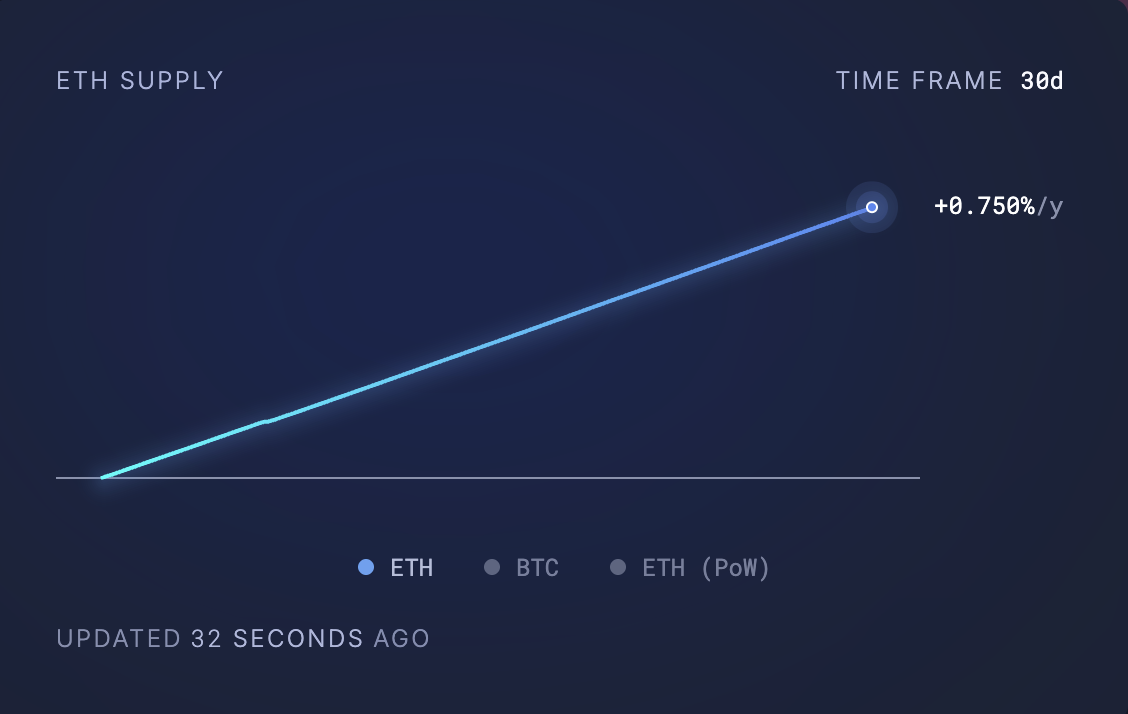

Now, when user activity drops, so does the burn rate, leaving more coins in circulation. And guess what happened in March? Yep, ETH’s circulating supply spiked! 🚀

Data from Ultrasound Money reveals that 74,322.37 coins were added to ETH’s circulating supply in the past 30 days. 💰

With this sudden supply surge, ETH risks further decline if demand doesn’t step up. But fear not, for our expert has spoken! 🗣️

Expert Insight: Inflation Not a Major Concern?

According to Gabriel Halm, Research Analyst at IntoTheBlock, ETH’s inflationary trends might not be a cause for alarm. 🚨

“Even though Ethereum’s supply has recently stopped being deflationary, its annualized inflation rate is still only 0.73% over the last month. That’s dramatically lower than pre-Merge levels and lower than Bitcoin‘s inflation rate. So, investors, take a deep breath and focus on network usage, developer activity, and institutional adoption.”

Regarding Ethereum’s declining network activity, Halm suggests that its impact may be exaggerated. 🙄

“Historically, Ethereum’s supply remained deflationary, yet ETH/BTC still trended lower. This indicates that macroeconomic factors and broader market forces play a more significant role than token supply changes alone.”

So, what should ETH holders expect this month? 🕒

“Whether Ethereum dips or rallies in April will likely depend more on market sentiment and macro trends than on short-term supply dynamics. But hey, keep your eyes peeled for network developments that could reignite activity and solidify ETH’s position in the crypto world!”

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-03 20:07