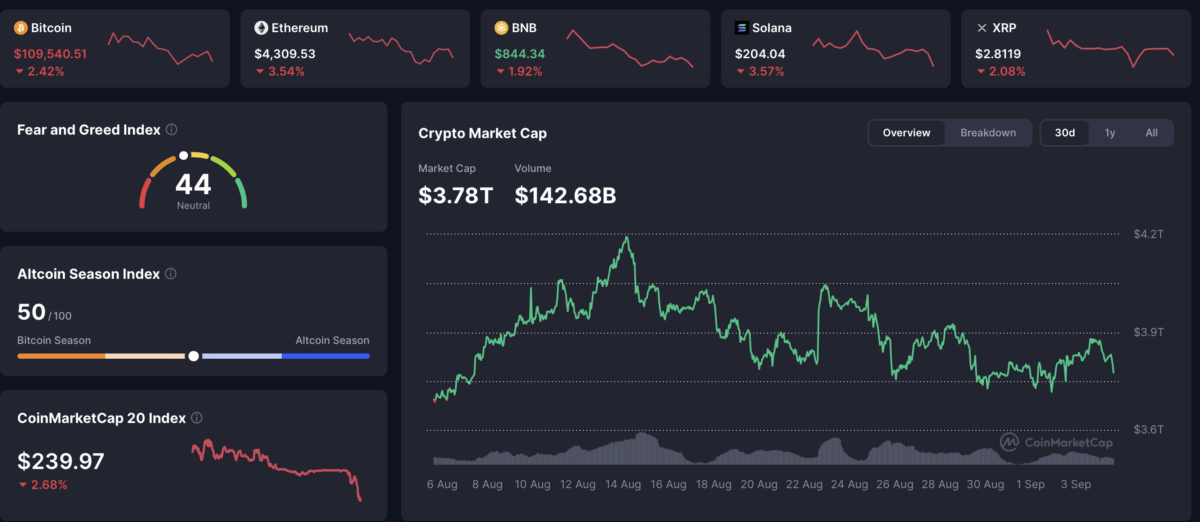

Ah, the crypto market-a realm where fortunes are made, lost, and occasionally misplaced like one’s sense of reason. Today, it stands resolute in its mediocrity, with major tokens painted a delightful shade of red. A modest decline in value has left the overall market valuation down by 2.3%. Truly, the gods of blockchain must be weeping-or perhaps just laughing at us. 😂

Bitcoin Takes a Bow (and a Hit)

Behold Bitcoin, the so-called king of cryptocurrencies, which has graciously descended to $109k. Yes, dear reader, despite beginning its day above $112k during the Asian session, it now sits at $109,393-a drop of 2.44%. One might call it a correction; I prefer to think of it as Bitcoin taking an unplanned vacation. 🏖️ Market activity is also down by 15%, with $55.69 billion recorded, leaving its market cap at $2.18 trillion. How quaint.

Altcoins Join the Sell-Off Parade 🎭

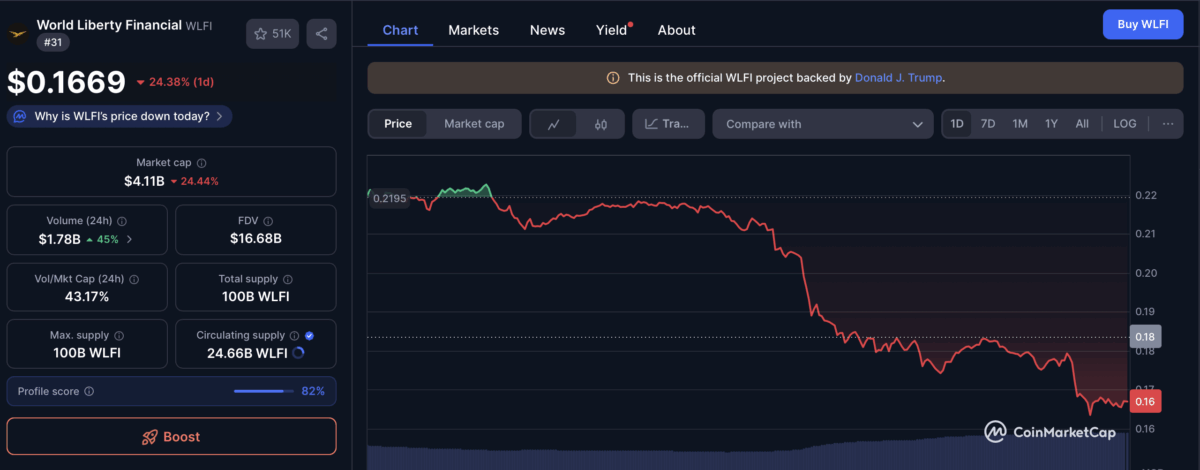

Ethereum, that ever-faithful second fiddle, has dropped by 3.45% in the last 24 hours. It clings precariously to the $4,000 level after falling from an intraday high of $4,481. At the time of writing, ETH trades for $4,317. Trading volume? Down a modest 1.45%, with $35.45 billion exchanged. Its market cap now rests at $521 billion. Meanwhile, World Liberty Financial (WLFI) has decided to make a grand exit, plummeting over 24% in 24 hours. Currently trading at $0.1663, it’s down 27% from its launch price. Bravo, WLFI-truly, you’ve mastered the art of dramatic exits. 🎉

The Trendsetters of Today 🌟

Allow me to introduce you to the “it” cryptos of the moment:

- Collector Crypto (CARDS)

- World Liberty Financial (WLFI)

- XPIN Network (XPIN)

- BNO Attestation Service (BAS)

- Unstable Two (USD2)

- INFINIT (IN)

Gains, Losses, and Liquidations: The Drama Continues 🎭💸

Investors, bless their hearts, remain steadfast in their decisions. The Fear and Greed Index sits at 44-a perfect embodiment of neutrality. The overall market valuation? A cool $3.78 trillion. But let us not forget the 102,160 traders who were liquidated in the past 24 hours, losing a collective $253 million. Of this, $198.79 million came from those pesky long-position bettors, while the rest belonged to shorts. Oh, the irony! 🍿

And so, dear reader, the crypto market continues its eternal dance-a blend of hope, despair, and the occasional dash of absurdity. Shall we applaud? Or simply pour ourselves another cup of tea? ☕

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- How to find the Roaming Oak Tree in Heartopia

2025-09-04 20:22