Hark! From the hallowed halls of the Russian Central Bank, a report emerges, smelling faintly of borscht and intrigue! It appears that Bitcoin, that digital rascal, has brazenly outpaced the more… shall we say, *dignified* investments in this year of our Lord 2025. A return of nearly 40%! One shudders to think what Gogol himself would make of it! 😱

Bitcoin Leads 2025 Rally (Or Perhaps, a Spontaneous Combustion of Rubles?)

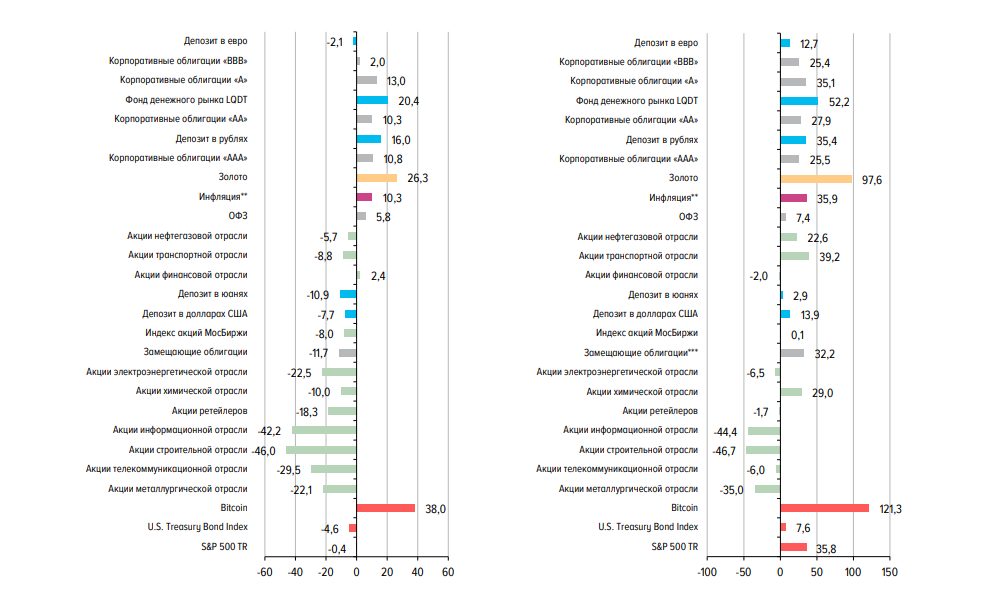

According to the Central Bank, those esteemed guardians of the nation’s coffers (and presumably, their babushkas’ savings), Bitcoin’s cumulative return since 2022 has reached a staggering 121%! A sum so immense, it makes one want to weep with joy or despair. Gold, alas, merely glitters faintly in comparison. Corporate bonds? Don’t even mention them, lest they crumble into dust from sheer embarrassment.

While gold, that ancient symbol of wealth and dental fillings, managed only single‑digit increases (pathetic, truly pathetic!), Bitcoin has nearly doubled its value in a mere three years. This audacious leap has, naturally, grabbed the attention of investors, those poor souls accustomed to the snail’s pace returns from banks or stock funds. They now eye Bitcoin with a mixture of awe and suspicion, like a peasant eyeing a samovar filled with caviar.

Sharp Swings Test Investors’ Sanity (And Their Vodka Supply)

Based on the Central Bank’s reports, Bitcoin’s price swung wildly in early 2025, like a drunken Cossack on a runaway troika. The first four months brought a near 20% drop, a plunge so precipitous, it sent shivers down the spines of even the most seasoned traders. Many faced nerve‑racking weeks as prices slid, their faces as pale as a St. Petersburg winter. But April! Ah, April brought a comeback as glorious as a May Day parade! 🥳

Bitcoin climbed more than 10% that month, easing the worries of those who had watched its dip with mounting dread. These fast moves highlight just how far digital coins can swing in a short time, like a pendulum in a haunted clock tower. One moment, riches! The next, utter ruin! Such is the nature of the beast, my friends. 😈

ETFs And Adoption: The West Embraces the Madness!

The rise of spot Bitcoin exchange‑traded funds, those devilish contraptions of modern finance, has made it easier for bigger investors to get in on the action. In places like the United States and Hong Kong, new ETFs let people buy Bitcoin through their regular brokerage accounts, as if buying bread or turnips. 🤪

This convenience has helped push demand higher, like a snowball rolling downhill. More folks don’t have to wrestle with crypto wallets or complex trading platforms anymore. They can tap Bitcoin through tools they already use for stocks and bonds, blissfully unaware of the potential for both unimaginable wealth and abject poverty. Such is the folly of man! 🤦

Local And Global Factors: A Stew of Uncertainty

Global uncertainty has driven some of this interest. Big swings in currency values and low yields on bank deposits have left people hunting for better returns, like starving wolves searching for scraps in a frozen wasteland. In Russia, a weaker ruble has nudged locals toward assets like Bitcoin that are priced in dollars. A desperate measure, perhaps, but who are we to judge? 🤔

At the same time, countries such as Kyrgyzstan and Ukraine are exploring crypto in their budgets. Even firms like Cantor Fitzgerald are looking at Bitcoin as a way to shield against market swings. The world, it seems, is slowly but surely succumbing to the allure of the digital ruble… or rather, the digital Bitcoin! 💸

Profit Potential Meets Risk: A Dance with the Devil!

Based on what the Central Bank found, Bitcoin paid off handsomely for investors who held through the drops. A 38% gain over a year can’t be matched by most safe havens. Yet anyone tracking the 19% fall in early 2025 knows it isn’t for the faint of heart. It’s a rollercoaster, a wild ride, a descent into madness! 🎢

Digital coins can zoom higher one month and skid lower the next. That volatility is why many experts still advise limiting how much of your portfolio is in crypto. But w 😔

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-17 11:48