As a seasoned investor with decades of experience navigating the tumultuous waters of media and entertainment, I can’t help but feel a twinge of sympathy for Warner Bros. Discovery amidst their recent financial woes. The $9-billion write-down and staggering net loss is a stark reminder of the challenges faced by traditional television networks in the face of shifting consumer preferences towards streaming platforms.

Warner Bros. Discovery experienced another turbulent quarter, as they had to acknowledge a $9-billion reduction in their valuation due to the declining performance of their television stations.

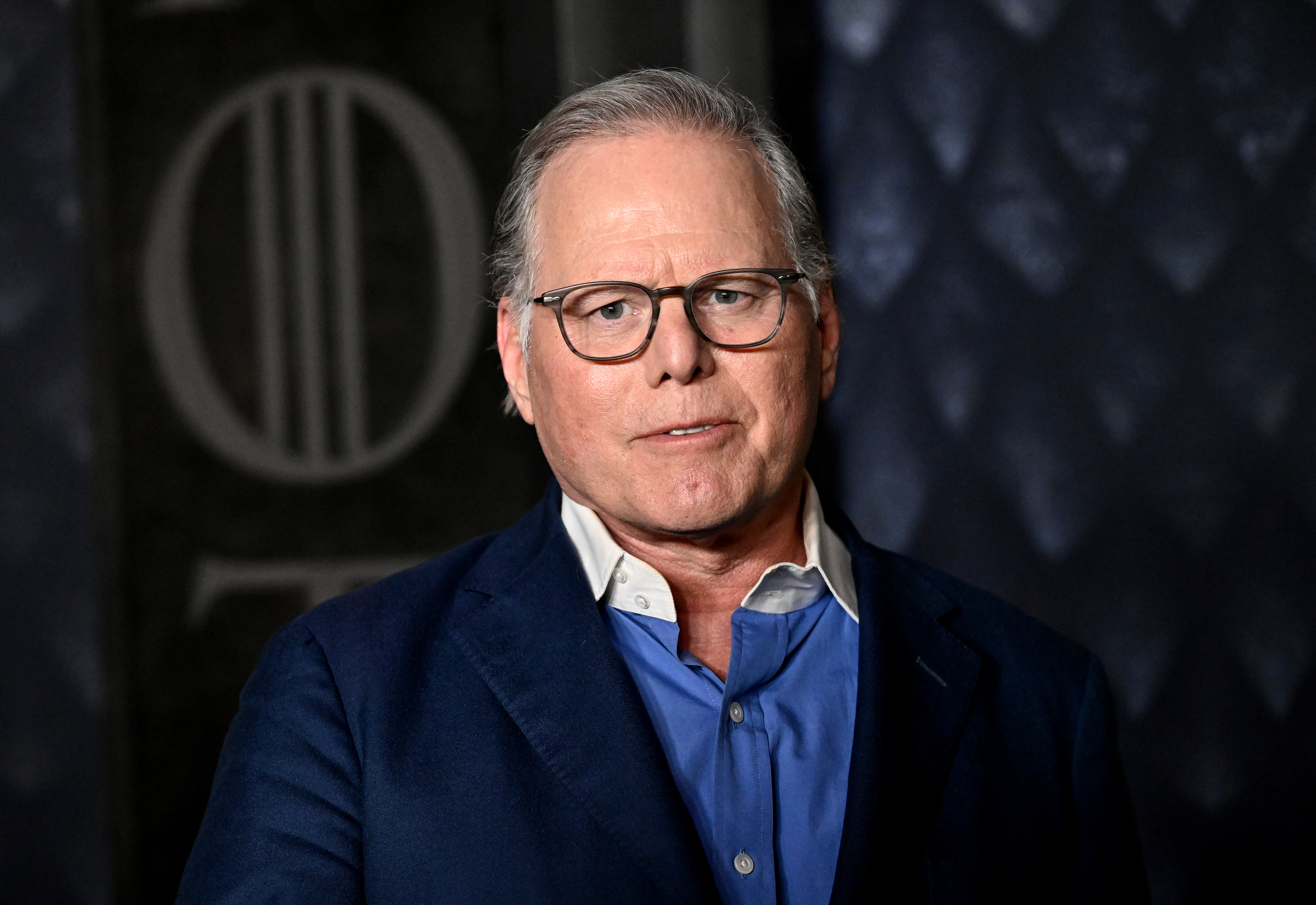

In the second quarter, David Zaslav’s media firm reported earnings below expectations, causing their stock prices to drop by 10% in after-market trading on Wall Street. The company is still struggling to reduce expenses as they attempt to manage their substantial $38 billion debt, a relic from their 2022 acquisition of WarnerMedia, previously owned by AT&T.

On Wednesday, the company’s earnings report, accompanied by a significant reduction in value, underscored the swift deterioration of the cable television industry as audiences and advertisers move towards streaming platforms. This quarter’s financial performance on Wall Street further added to the company’s challenges, as it faces the potential loss of its NBA contract for the TNT cable channel after the upcoming season.

Last year’s equivalent quarter saw a 6% decrease in earnings for the New York-based firm, amounting to approximately $9.7 billion in revenue.

Adjusted earnings before interest, taxes, depreciation and amortization fell 16% to nearly $1.8 billion compared to $2.1 billion in the year-earlier period. Last year, the company spent less on programming because of the Writers Guild of America strike. The company also introduced a popular Harry Potter video game, “Hogwarts Legacy” last year, while this year’s “Suicide Squad” game missed its mark.

However, what stood out initially was the company’s massive net loss amounting to approximately $10 billion. This figure encompassed a $9.1 billion impairment charge from their TV networks division and additional costs totaling $2.1 billion for acquisition-related amortization of intangibles and restructuring expenses.

Warner Bros. Discovery leaders informed analysts that following a thorough evaluation, they determined that the company’s networks are currently valued at $9 billion less than they were two years ago. This media conglomerate owns some of the most recognized traditional channels in the industry, such as CNN, TNT, HGTV, Food Network, Animal Planet, and TLC.

Due to the possibility that TNT might lose their NBA contract, their CFO, Gunnar Wiedenfels, announced they would be evaluating their company’s resources.

According to Wiedenfels, there isn’t a single cause for this issue. Instead, he suggests a comprehensive reassessment is needed.

The firm attributed persistent drops in earnings from traditional TV ads to their broadcasting sector. Additionally, they mentioned uncertainties regarding the renewal of contracts for affiliates and sports events, particularly those involving the NBA.

The earnings come less than two weeks after Warner Bros. Discovery filed a breach of contract lawsuit against the NBA, asking a judge to prohibit the league from awarding a television contract to Amazon Prime Video.

The legal action, initiated on July 26 in New York State Supreme Court, claims that the NBA violated Turner Broadcasting’s existing agreement by allegedly failing to uphold their right to match an offer from Amazon for the contract period starting with the 2025-26 season. In this lawsuit, the company emphasizes the significant impact of losing the sport they have been broadcasting since 1989.

“NBA telecast rights are a unique asset that cannot be replaced,” the company said in its lawsuit.

During an exclusive negotiation window this past spring, Warner Bros. Discovery and the NBA were unable to come to terms on a deal. Recently, the league revealed that it had instead partnered with ESPN (owned by The Walt Disney Company), NBCUniversal, and Amazon, bypassing Turner. In response to this move, Turner has filed a lawsuit, and the NBA is expected to address this legal action later in the month.

The league has said the lawsuit lacks merit.

During the conversation with analysts, Zaslav chose not to delve into the ongoing lawsuit, stating that the legal team is now handling it instead.

“The judge will decide, and off we’ll go,” Zaslav said.

However, the potential loss of the NBA contract for Warner Bros. Discovery is causing unease among investors and experts, as they worry that the company might lack the necessary programming power to keep up with its more financially robust competitors in the media industry.

Analyst Jessica Reif Ehrlich from Bank of America posed an insightful query: Will the expansion of Warner Bros. Discovery’s other sports rights and streaming services be sufficient to compensate for the decreases in their conventional television business?

According to Wiedenfels, our management team is confident that the answer is indeed ‘yes.’ We see significant potential for growth in both our direct-to-consumer business and studio operations. We are backed by a robust strategy designed to support this growth.

However, Wiedenfels mentioned that he wasn’t able to “exactly foresee” when the company’s revitalization initiatives would start showing results.

“He mentioned that there has been discussion about a recovery, but so far, it seems like it hasn’t occurred. In any case, we’re doing our best to handle the situation as it comes.”

Zaslav interjected Wiedenfels to share that high-level company officials gather weekly for a “strategic planning session” – a collective effort. He expressed his belief that the forthcoming content will boost their streaming service and financial gains, based on its quality.

In the final quarter, the global subscriber base for direct-to-consumer services swelled to a staggering 103.3 million, thanks in part to the second season of HBO’s “House of the Dragon.” The company reported that its expansion of streaming service Max across Europe has been thriving, with the platform now accessible in 65 countries and territories around the globe.

JB Perrette, head of global streaming and games at Warner Bros. Discovery, expressed confidence to analysts regarding our content lineup, stating it plays a significant role in driving our success.

During the second quarter, the firm announced that they had paid back a sum of $1.8 billion that was owed as debt. At the end of the three-month span from April to June, they were left with an available cash balance of approximately $3.6 billion.

The company recently announced a significant reduction in its staffing levels, with around 1,000 more jobs being eliminated towards the end of last month.

In simpler terms, Zaslav stated that the standard market environment poses challenges, but they remain optimistic about their current position. The topmost focus is to manage this company efficiently.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

- Sunday City: Life RolePlay redeem codes and how to use them (November 2025)

2024-08-10 01:28