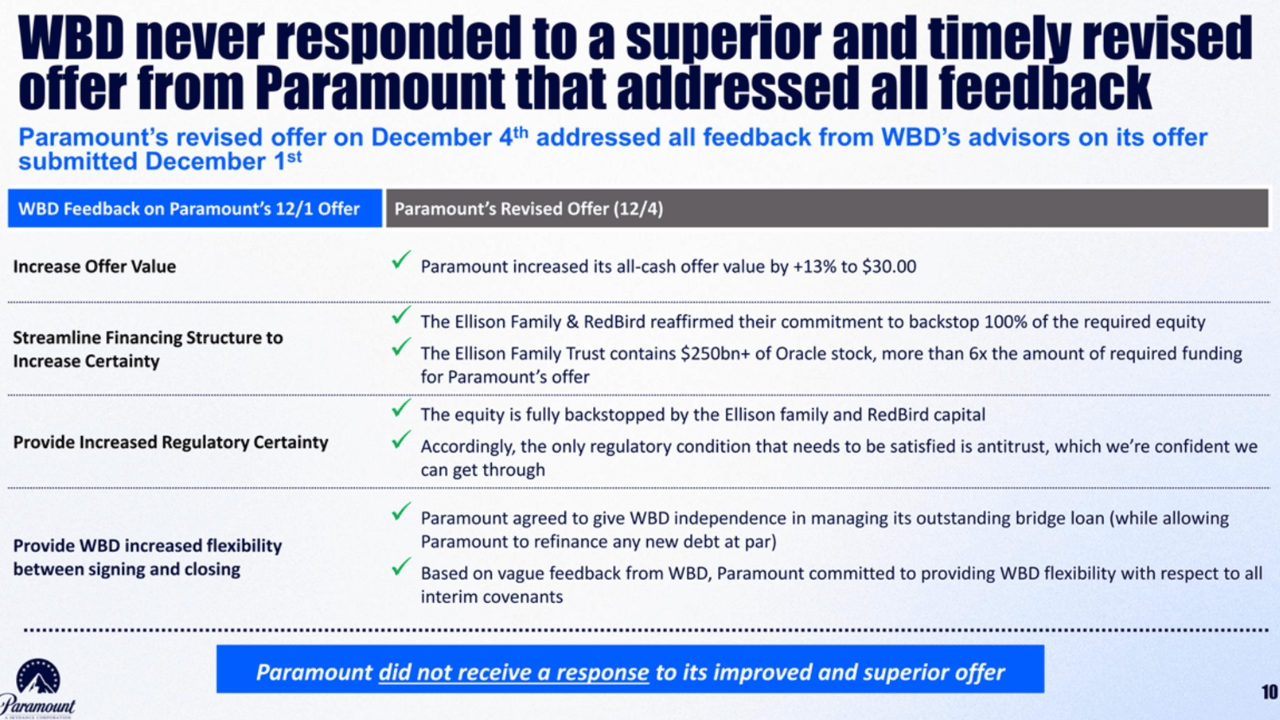

A recent Paramount filing with the Securities and Exchange Commission regarding its attempt to buy Warner Bros. Discovery (WBD) has caused controversy over how WBD handled potential negotiations with Netflix. The filing reveals that Paramount increased its offer to $30 per share in cash on December 4th, specifically addressing all of WBD’s earlier concerns. However, Paramount claims WBD’s board completely ignored the offer – they didn’t respond with a counteroffer, ask any questions, or even send a simple acknowledgment.

Instead, by the very next morning, WBD announced it had reached an agreement with Netflix.

This situation is deeply concerning for investors and raises serious questions about how the company is run. If the board ignores a better offer – one that offers more money, is more secure, and has guaranteed funding – it makes people wonder if the company is being sold fairly and honestly.

A recent document filed with the Securities and Exchange Commission by Paramount raises worrying issues for Warner Bros. Discovery shareholders.

A Timeline That Raises Serious Questions

I was really struck by the detailed timeline on page 10. It clearly shows how things unfolded, and it’s amazing to see that Paramount’s improved offer, delivered on December 4th, directly addressed every concern Warner Bros. Discovery had raised. Not only did it increase the overall value of the deal, but it also made the financing much clearer and gave everyone a lot more confidence that it would actually happen.

And yet, WBD provided no response at all.

The initial lack of interest seems even stranger considering Netflix announced a deal just one day later. This quick turnaround suggests the Warner Bros. Discovery board had already decided, and likely didn’t seriously consider Paramount’s better offer.

If that’s true, shareholders were deprived of a legitimate competitive process.

Fiduciary Duties Aren’t Optional

As a movie lover, I think of it like this: when a studio is potentially sold, the people in charge have to seriously consider all the offers on the table. Even if they really want a certain company to buy them, they can’t just ignore other bids. They need to judge each offer based on what it actually offers – the price, the future plans, everything – and pick the best one, plain and simple. It’s about doing what’s best for everyone involved, not just going with their first choice.

However, a document filed with the Securities and Exchange Commission shows Paramount’s board quickly moved to pursue a deal with Netflix, despite a much better offer being available. Paramount’s updated proposal wasn’t just a higher price; it offered the security of a complete cash payment, had guaranteed funding already in place worth billions, and Paramount believed it had a much lower chance of facing regulatory hurdles.

I couldn’t help but wonder, when the board turned down this offer so quickly and without even talking about it, comparing it to other options, or being open about their reasoning… were they really doing what was best for everyone who owns stock? Or were they just rushing to please whoever they already favored? It just didn’t seem right, and it left me questioning their motives.

Paramount’s Case: Their Offer Was Clearly Better

Throughout the filing, Paramount lays out why it believes its offer was superior:

- $30 per share, all cash—a higher guaranteed payout

- Faster regulatory approval, according to Paramount’s analysis

- Fully committed financing, including major institutional backing

- Clear operational synergies, shown across multiple slides

Unlike Paramount’s clear offer, the value of Netflix’s deal – consisting of $23.25 in cash, $4.50 in Netflix stock, and a potentially valuable but unconfirmed share in a future company – wasn’t certain to be as good or better.

And yet, that’s the deal WBD rushed to accept.

Shareholders Deserve to Know Whether They Were Informed

What really stood out to me in the Paramount SEC filing was the challenge to Warner Bros. Discovery shareholders. It made me wonder if their board truly considered all the possibilities when Paramount made its offer. Did they seriously look at the revised deal? Did they fully analyze how the financing would work, and the potential regulatory hurdles? Did they compare the value of a deal with Paramount to other options? Or did they just shut down any chance of a conversation with us right from the start? It feels like those are important questions WBD shareholders deserve answers to.

As a film buff, I always appreciate a good twist, but this situation feels less like a plot device and more like a real injustice. If the board didn’t even bother to look at the offer, or, even worse, kept it hidden from the people who actually own the company, it’s not just a PR problem. It’s a serious question of whether they’re treating everyone fairly, and that’s a dealbreaker for me.

The Paramount SEC Filing Puts WBD’s Process Under a Harsh Spotlight

This document isn’t a typical bid comparison; it feels like a formal accusation, supported by specific dates, figures, and a clear sequence of events. Paramount claims in its report to the SEC that it made a better, more secure offer, but Warner Bros. Discovery didn’t even consider it.

Now shareholders are left wondering why.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- World Eternal Online promo codes and how to use them (September 2025)

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-12-09 16:57