Insurers Beware! EU’s New Crypto Rule Will Make You 💸💸💸!

Why? To make it so darn expensive that insurers will think twice before investing in digital assets. It’s like telling a kid they can only have ice cream if they eat their veggies first. 🍦🥕

Why? To make it so darn expensive that insurers will think twice before investing in digital assets. It’s like telling a kid they can only have ice cream if they eat their veggies first. 🍦🥕

Oh, the irony! While the Ichimoku Cloud and EMA lines insist the trend remains bearish, they whisper of a potential reversal, a glimmer of hope in this crypto desert.

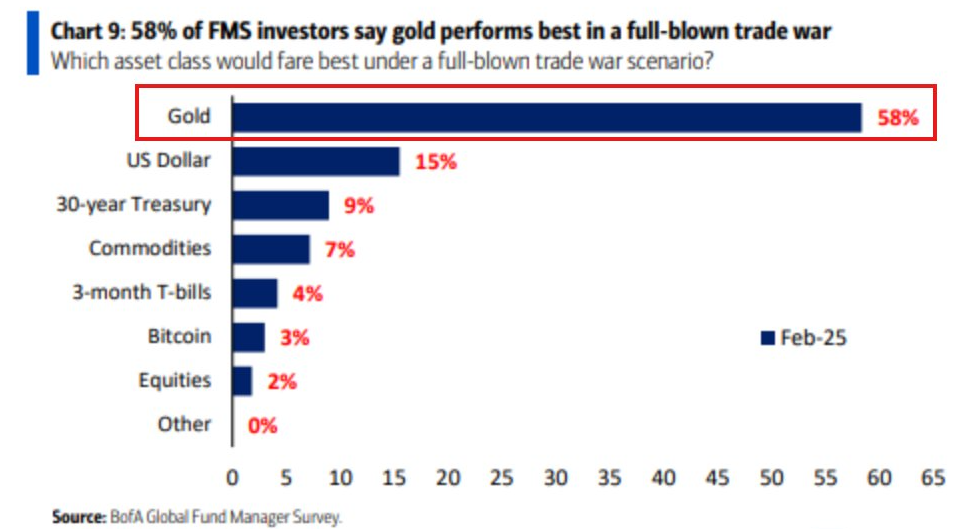

A Bank of America (BofA) survey shows 58% of fund managers backing gold as their trade war BFF, while Bitcoin, bless its little crypto heart, squeaked in with just 3%. Spoiler alert: 3% wouldn’t even get you a participation ribbon.

This address, a relic untouched for nearly a decade, held a treasure chest of $3.7 million worth of Ethereum (ETH) when it finally stirred from its slumber. 🗝️💰

At its zenith, the position glittered with the promise of riches, boasting a value of around $27.4 million, a veritable empire of over378 billion PEPE tokens. Yet, as fate would have it, the market’s capricious nature, akin to a Dostoevskian plot twist, has brought the liquidation price perilously close at $0.020. In a bid to stave off the inevitable, this beleaguered whale has resorted to tactical maneuvers, closing approximately67 million tokens and infusing an additional $3.08 million USDC in a series of desperate deposits, clawing back a meager $490,000.

In today’s thrilling edition of the weekly recap, we are blessed with the opening of Terra’s investor claims portal, President Trump granting a pardon to the BitMEX founders, and Polymarket suffering a little governance hiccup. It’s all happening, folks! Terra opens investor claims portal Terraform Labs, in a rare moment of transparency, has decided to … Read more

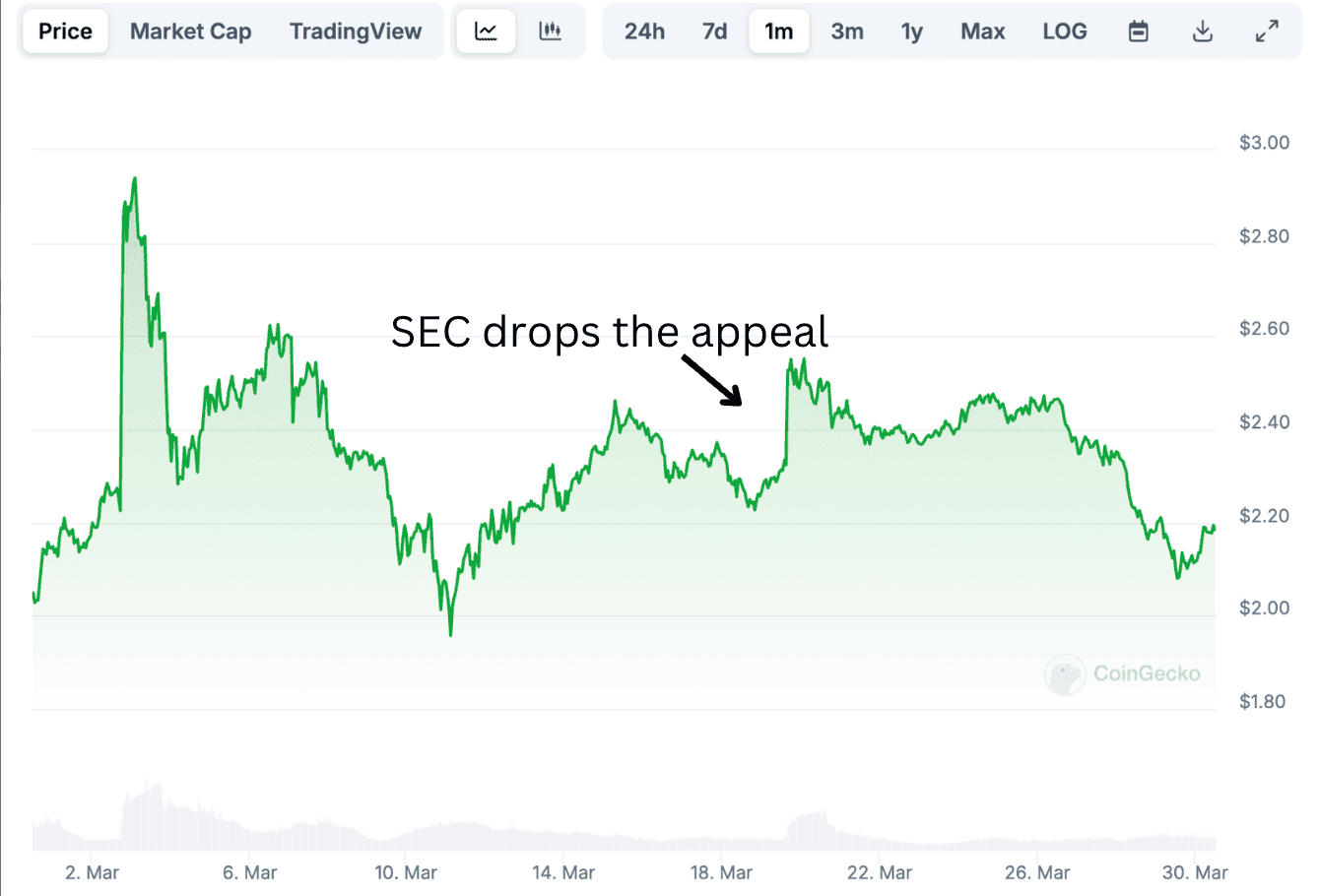

After all, it’s an O.G. cryptocurrency that’s been around for the past few cycles, but its status has been debated at length, especially during Ripple’s legal battle with the US Securities and Exchange Commission. The outcome of this was long touted as a massive catalyst for XRP’s price, and, well, it seems that the dispute has reached a turning point – but not quite the one everyone was expecting.

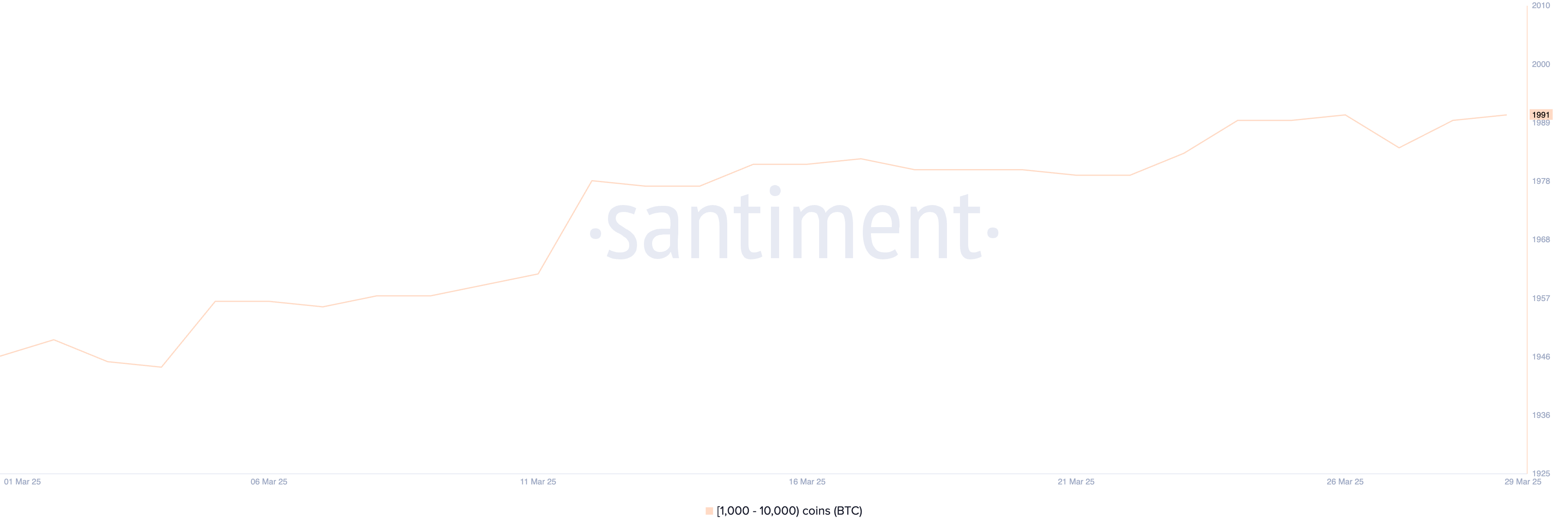

According to Saylor, Bitcoin isn’t just coming for gold; it’s coming for your real estate, your stocks, and quite possibly your grandmother’s secret cookie recipe. He claims it will “demonetize” everything we’ve ever held dear as a store of value. It’s like watching a digital Godzilla stomping through the financial Tokyo, and Saylor is cheering it on.

In a plot twist straight out of a high-stakes thriller, Thailand’s Securities and Exchange Commission (SEC) has thrown down the gauntlet against Aux Cayes FinTech Co. Ltd., the mastermind behind the digital asset exchange OKX. The SEC is accusing this rogue outfit and nine accomplices of running an unlicensed digital asset exchange—yes, you read that right, an unlicensed exchange in the Wild West of cryptocurrencies! 🎲

One might, with a raised eyebrow and a touch of incredulity 🤨, ponder why, after so many years, trust in the so-called decentralized nature of crypto remains, shall we say, elusive. While its most unpredictable system might entice certain gentlemen and ladies of a particularly daring disposition, it does, without a doubt, raise a most concerning flag for those of a more…prudent inclination. In matters of traditional banking, should a difficulty arise, one simply summons the customer service, and after a tiresome, though necessary, verification, a representative deigns to offer assistance.