As a seasoned gamer with years of experience under my belt, I must say that the latest report from Apptica on the Global Mobile Gaming Market in H1 2024 has been nothing short of intriguing. The dynamic changes in downloads and revenues across key markets have kept me on my toes, especially since mobile games are a subject close to my heart.

Discussing the ever-changing landscape of the mobile gaming sector can be incredibly intriguing as it’s always advancing. Numerous analyses provide valuable insights into the current market status, detailing how mobile games are performing and the industry’s ongoing transformations. Let’s explore the latest developments in the Global Mobile Gaming Market for H1 2024, examining trends, triumphs, challenges, and other key aspects.

Global Mobile Gaming Market in H1 2024

As a passionate gamer, diving into the Apptica report for the Global Mobile Gaming Market in H1 2024 offers a comprehensive look at how the mobile gaming landscape has unfolded during the first six months of this exciting year.

As a passionate enthusiast, let me kick things off by providing a brief snapshot for the first half of 2024. The global mobile gaming market has been experiencing an exciting transformation in terms of downloads and revenues across major regions. I’ll be diving deep into the world of mobile games today.

How the downloads fared for Mobile Gaming in H1 2024

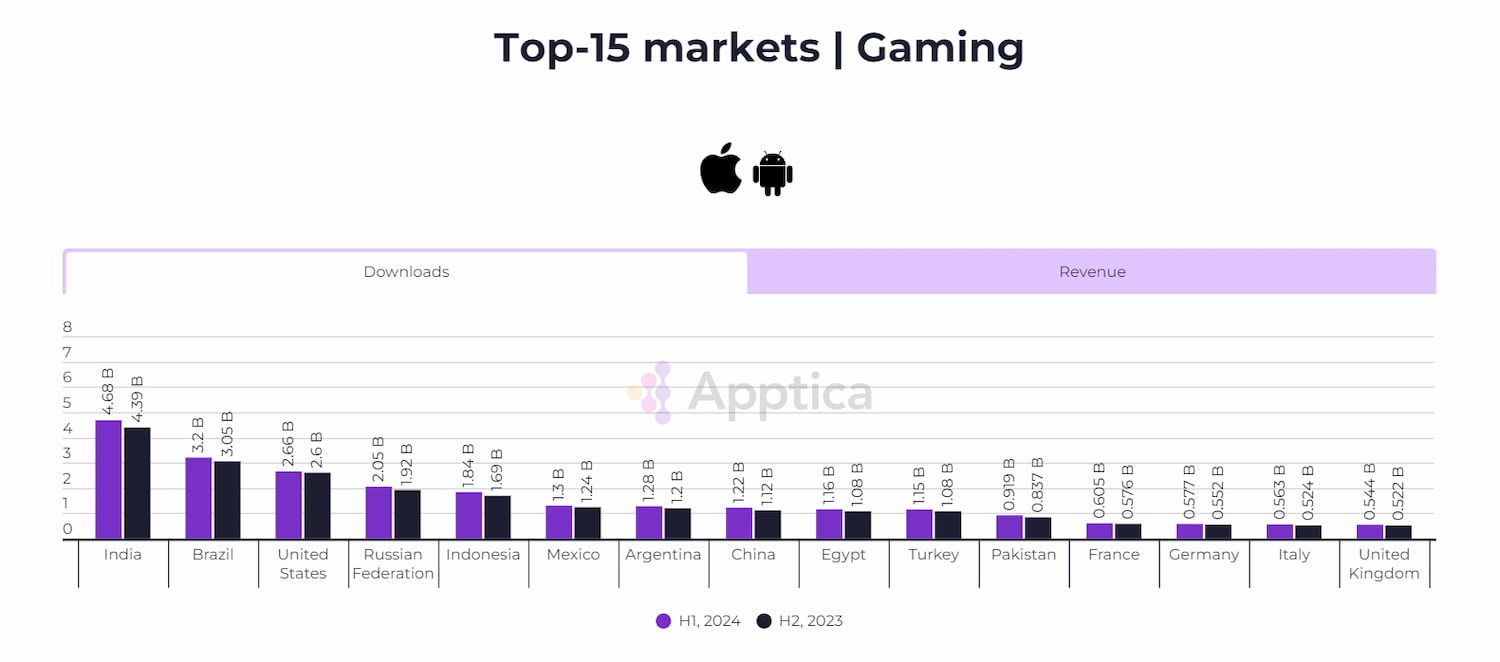

During the first six months of 2024, there was a 5.8% rise in mobile gaming downloads compared to the second half of 2023, exceeding a staggering 30 billion installations worldwide. This upward trend continues, signaling robust growth in download figures. Notably, India, Brazil, and the United States led this expansion, each experiencing consistent growth.

It’s noteworthy that every one of the top 15 regions exhibited growth over their last six months, with Pakistan, Indonesia, and China experiencing the most significant surges, registering increases of 9.8%, 8.9%, and 8.9% respectively. This substantial increase in downloads highlights the burgeoning influence of mobile gaming, particularly within developing markets.

In terms of game downloads categorized by genre, India remained at the forefront. The country reigned supreme in the card game category with a substantial 25.5% share and ranked first for action games with a 14.4% contribution, as well as casual games (16.2%) and simulation games (13.9%). Brazil and Indonesia trailed closely behind India and Indonesia, respectively, as the second and third-highest contributors of downloads.

A slight increase in mobile gaming revenue

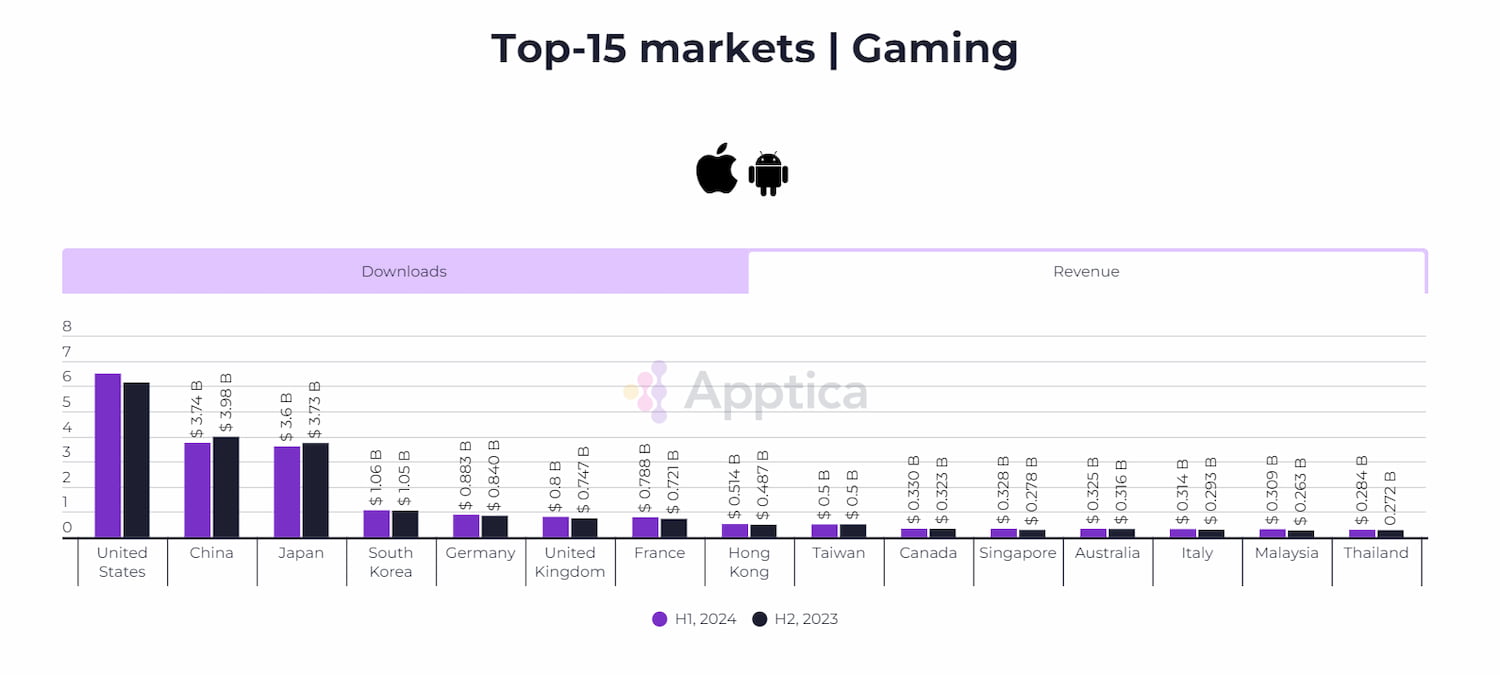

Although there were some ups and downs, the mobile gaming industry raked in more than $24 billion during the period, representing a notable 2.8% rise compared to the second half of 2023. The United States, China, and Japan continued to lead as the most profitable markets, collectively contributing an impressive 58% of the overall revenue.

On the other hand, China and Japan experienced minor decreases, whereas countries such as Malaysia, Singapore, and France showed substantial increases. This data underscores the continuing strength of established markets, although it also hints at the growing influence of emerging regions.

In the categorical comparison, Japan, China, and the U.S. switched positions within each genre. Specifically, Japan took the lead in the Role-Playing Game (RPG) category, earning approximately $1 billion, which represents 22% of the worldwide revenue. China and the United States trailed behind Japan in that order.

In the realm of strategy games, the U.S. dominates with approximately 27.4% of the earnings, while China and Japan trail closely in second and third positions. Conversely, in the action game category, China claims first place with around 27% of the revenues, with the U.S. and Japan following suit. Notably, Japan dominates the music game genre, capturing a staggering 66.64% of the earnings.

The advertising aspect of games

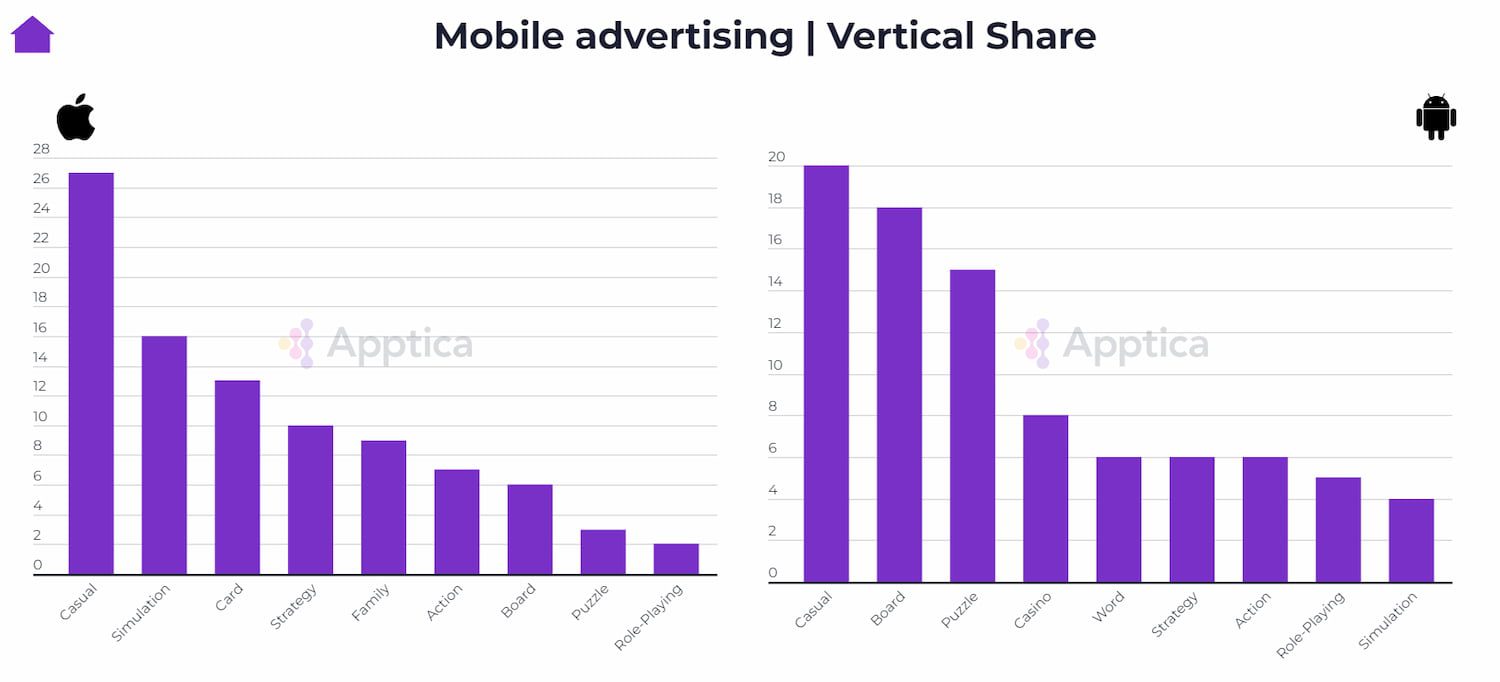

By the first half of 2024, mobile gaming advertisements analysis revealed that video formats accounted for approximately 81.6% of the creative distribution. Banner and interactive ads also held significant positions. Interestingly, a preference for 30-second ads was observed, with 15-second ads being the second most prevalent choice.

In terms of advertising traffic, it was mostly casual games, whether on iOS or Android, that attracted the most attention. Notable gaming advertisers featured popular titles such as “Match-3 Puzzle: Royal Match” and the highly successful casual game “MONOPOLY GO!”, which has recently surpassed $3 Billion in total earnings.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2024-08-11 23:11