David Ellison, head of Paramount Skydance, is considering a major move to acquire Warner Bros. Discovery. Instead of waiting for the company to divide into separate entities as planned, he’s reportedly preparing a bid of $60 to $70 billion to buy the entire company, potentially outbidding other interested parties.

Reports from *Variety* and *The New York Post* indicate that Larry Ellison is considering buying all of Warner Bros. Discovery, including its studios, streaming service HBO Max, and all of its cable channels like CNN, TNT, TBS, Discovery, and The Food Network.

This deal would be a significant change from previous expectations that Paramount Skydance would only be interested in buying Warner Bros.’ movie and streaming businesses after Warner Bros. splits into two separate companies in 2026.

A Preemptive Strike Against Competitors

Experts believe Larry Ellison’s move is strategic. According to a report in *Variety*, analyst Robert Fishman of MoffettNathanson suggests Paramount Skydance is acting now to avoid a competitive auction for Warner Bros.’ properties once the company divides. By making this deal before the split, Ellison could prevent other companies—like Amazon, Apple, Comcast, Sony, and Netflix—from bidding on those assets.

Someone familiar with the deal told That Park Place that the Ellisons are likely trying to buy the whole company immediately to avoid competition from other potential buyers, instead of waiting until Warner Bros. Discovery splits into separate entities.

I’ve been following the potential deal closely, and Fishman pointed out something really interesting. He believes the team led by Ellison could save a lot of money because CBS and CNN both have cable networks that overlap, and they can combine resources. Plus, because of their existing sports partnerships – like how they both cover March Madness – they already share some infrastructure, which could lead to even more savings.

Apollo’s Role and Funding Challenges

According to the *New York Post*, Larry Ellison is discussing potential funding with Apollo Global Management, headed by Marc Rowan, to complete the large acquisition. Apollo tried to buy Paramount Global earlier in 2024 with a $26 billion offer, but was outbid by Skydance. They already have investments in media companies like Cox Media Group and a substantial ownership in Legendary Entertainment, making them a logical partner in this deal.

According to sources at the *Post*, Apollo is currently the leading contender to support Ellison’s bid. Blackstone, which has investments in companies like Candle Media, has considered participating but hasn’t made a firm commitment yet.

Although David Ellison wants to expand, people familiar with the situation believe his father, Larry Ellison – the founder of Oracle and currently the world’s second-wealthiest individual – might be hesitant to make another large investment in media so quickly after the deal with Paramount. With Paramount Skydance holding only $2.75 billion in cash, securing additional funding will be essential.

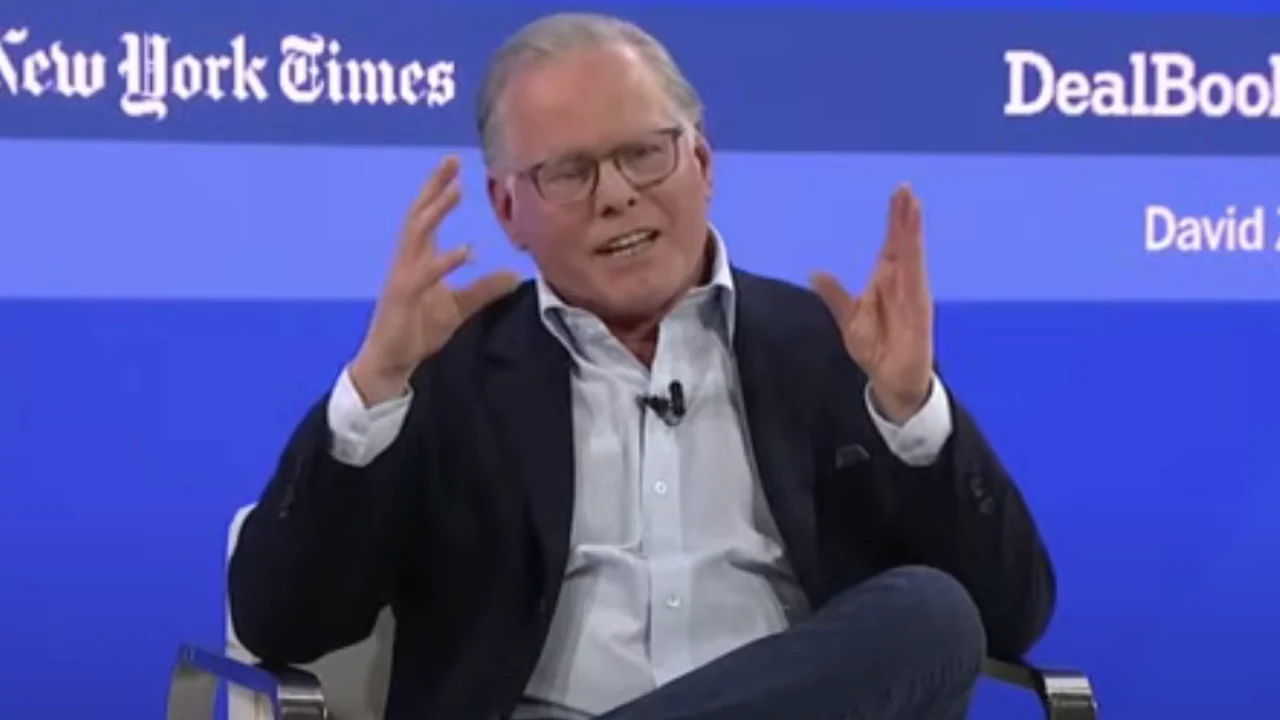

WBD’s Position and Zaslav’s Role

David Zaslav, the CEO of Warner Bros. Discovery, is pushing forward with plans to split the company. He’s brought in Goldman Sachs to look at other potential offers because there are doubts about whether the Ellison family has enough funding. Zaslav is aiming for more than $30 per share just for the studios and streaming services, which is higher than the $22 to $24 per share the Ellison family proposed for the whole company.

I’m hearing from someone in the know that David Zaslav is planning to stay put as CEO, and it sounds like any potential buyer would have to agree to that. Basically, he’s making it clear he’s not going anywhere if Warner Bros. Discovery gets sold.

Political and Regulatory Hurdles

The proposed merger is likely to face tough reviews from regulators. Senator Elizabeth Warren has already spoken out against it, arguing it would give too much power to a single entity. Despite this, the Trump administration has indicated it generally supports companies combining.

According to a recent report in *Variety*, Zaslav predicted that if Trump were reelected in 2024, his administration would significantly benefit the entertainment industry.

According to the Post, Larry Ellison’s recent purchases, such as *The Free Press* for $150 million, show he’s increasingly focused on changing the types of media—including movies, TV shows, and online news—owned by Paramount Skydance.

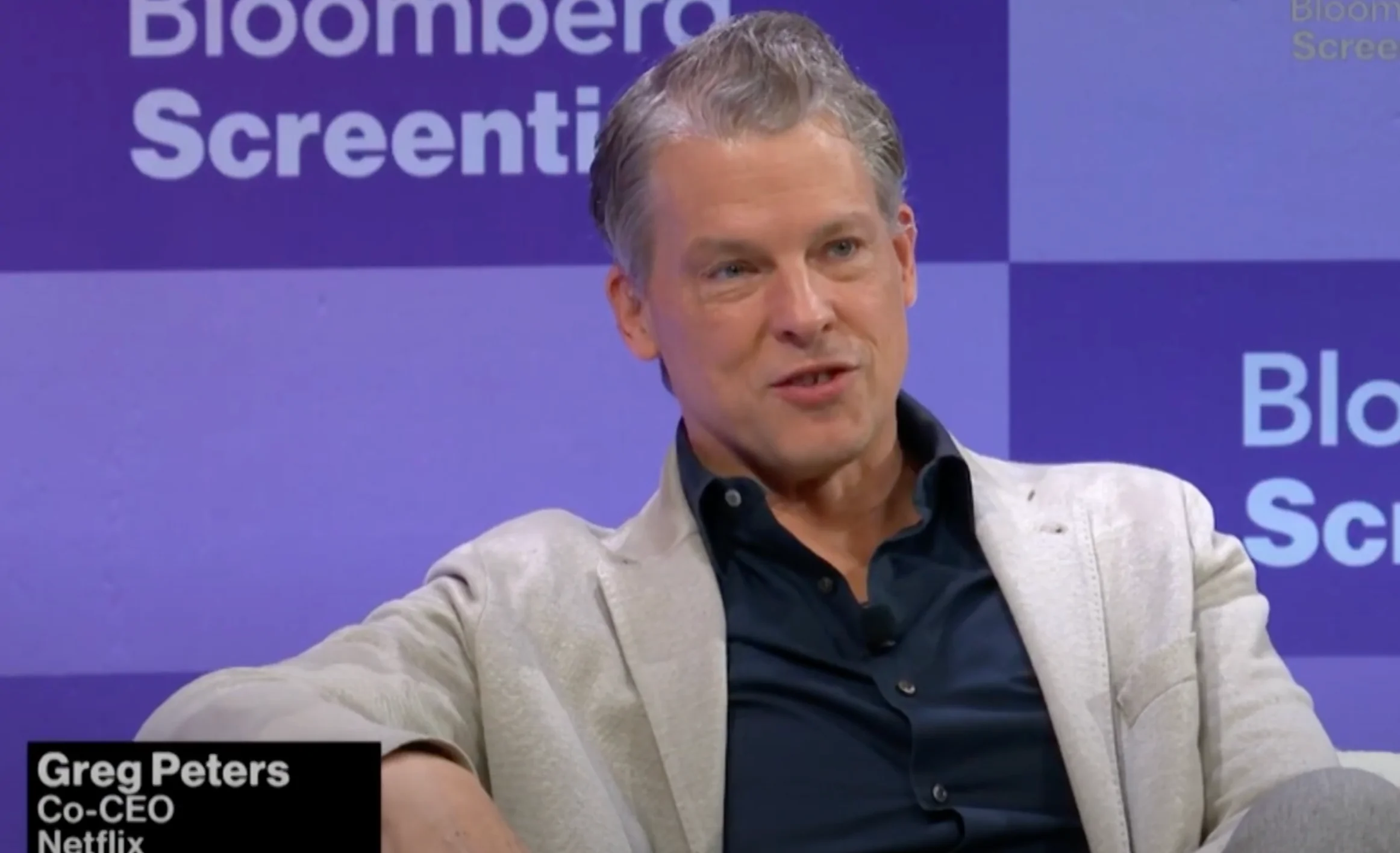

Netflix Dismisses Acquisition Talk

At a recent Bloomberg conference, Netflix co-CEO Greg Peters denied speculation about a potential acquisition of Warner Bros. Discovery (WBD). He pointed out that large media mergers often aren’t successful and reiterated Netflix’s commitment to growing its business naturally, rather than through acquisitions.

His statements seem to eliminate one of the few companies that could seriously compete with Paramount Skydance in a potential bidding situation.

The Road Ahead

While still in the planning stages and facing financial and legal hurdles, Shari Redstone’s proposal to combine Paramount and Warner Bros. Discovery could form a massive entertainment company. If it goes through, it would bring together brands like CBS, HBO, CNN, and Paramount Pictures, significantly changing the power dynamics in Hollywood for the foreseeable future.

That Park Place will continue to monitor the developing story as negotiations progress.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-10-09 21:57